Best Buy Co., Inc (NYSE:BBY) reported better-than-expected second-quarter financial results raised its FY25 earnings guidance on Thursday.

Best Buy reported fiscal second-quarter adjusted EPS of $1.34, beating the street view of $1.16. Quarterly sales of $9.29 billion beat the analyst consensus of $9.24 billion.

CEO Corie Barry: "We delivered strong results in our Domestic tablet and computing categories, which together posted comparable sales growth of 6% versus last year."

Best Buy raised the fiscal 2025 adjusted EPS outlook to $6.10—$6.35 (prior $5.75—$6.20) versus the $6.08 estimate. The company cut the high end of its prior revenue outlook to $41.3 billion—$41.9 billion (prior $41.3 billion—$42.6 billion) versus the $41.81 billion estimate.

Best Buy raised the fiscal 2025 adjusted EPS outlook to $6.10—$6.35 (prior $5.75—$6.20) versus the $6.08 estimate. The company cut the high end of its prior revenue outlook to $41.3 billion—$41.9 billion (prior $41.3 billion—$42.6 billion) versus the $41.81 billion estimate.

For the third quarter of fiscal 2025, the company expects comparable sales to decline by approximately 1.0% and the adjusted operating income rate to be approximately 3.7%.

Best Buy shares gained 14.1% to close at $100.18 on Thursday.

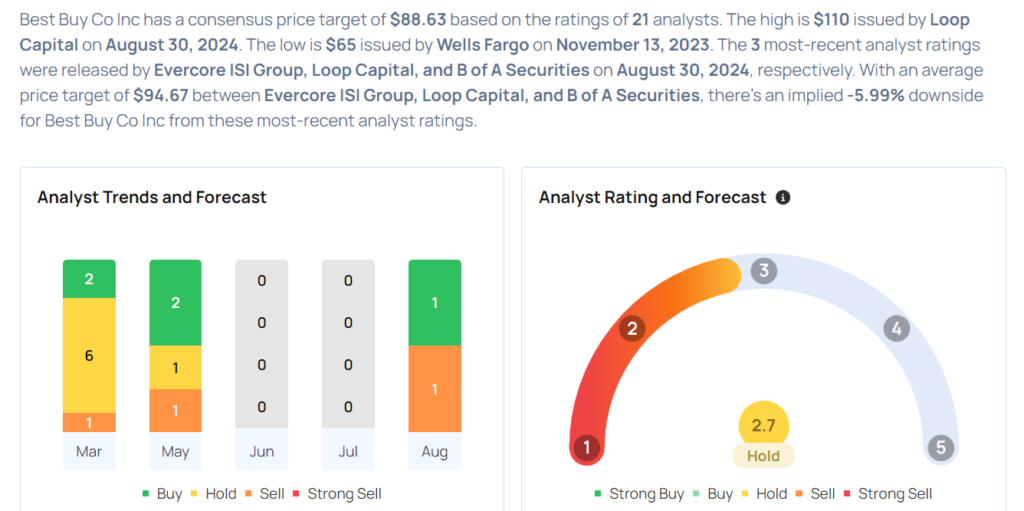

These analysts made changes to their price targets on Best Buy following earnings announcement.

- B of A Securities analyst Elizabeth Suzuki maintained Best Buy with an Underperform and raised the price target from $70 to $80.

- Loop Capital analyst Anthony Chukumba maintained the stock with a Buy and raised the price target from $100 to $110.

- Evercore ISI Group analyst Greg Melich maintained Best Buy with an In-Line and raised the price target from $90 to $94.

Considering buying BBY stock? Here's what analysts think: