①The hog market revival support, new hope liuhe achieved a substantial reduction in losses in the first half of the year, and turned losses into profits in the second quarter; ②The company's fodder business is under pressure, with a 16% year-on-year decline in fodder revenue and a 0.79 percentage point decrease in gross margin; ③Some industry experts pointed out that pig prices are expected to remain high in the second half of the year, and the third and fourth quarters will become the main profit period for pig enterprises.

When facing thousands of listed company announcements every day, which ones should you read? What are the key points to take away from the dozens or hundreds of pages of material announcements? Are the many professional terms in the announcements bullish or bearish? Check out Caixin's "Quick Read Announcement" column, where our reporters across the country will provide you with accurate, fast and professional interpretations on the night of the announcement.

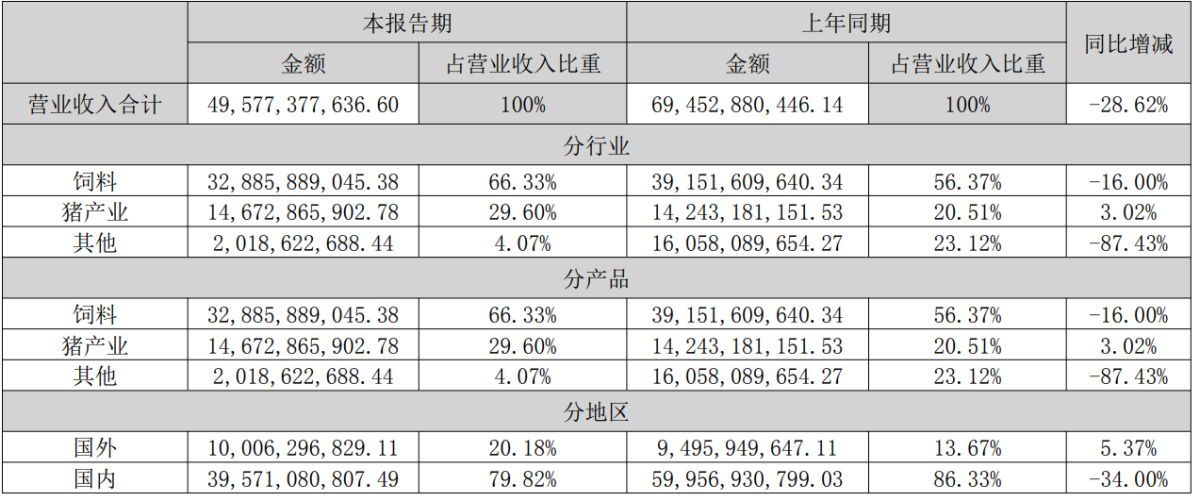

On the evening of today, New Hope released the 2024 semi-annual report, achieving an operating income of 49.577 billion yuan during the reporting period, compared to 69.453 billion yuan in the same period of the previous year, a year-on-year decrease of 19.876 billion yuan, a decrease of 28.62%; net profit attributable to the mother was -1.217 billion yuan, compared to -2.983 billion yuan in the same period of the previous year, a reduction in losses by 59.18%.

The company's Q1 net loss was 1.934 billion yuan, based on which it is estimated that the company achieved a profit of 0.717 billion yuan in the second quarter. In the same period of the previous year, the company's net loss in Q2 was 1.297 billion yuan, while this year the company achieved a turnaround in both a quarter-on-quarter and a year-on-year basis in Q2.

The company's Q1 net loss was 1.934 billion yuan, based on which it is estimated that the company achieved a profit of 0.717 billion yuan in the second quarter. In the same period of the previous year, the company's net loss in Q2 was 1.297 billion yuan, while this year the company achieved a turnaround in both a quarter-on-quarter and a year-on-year basis in Q2.

The rise in hog prices and cost reduction were the main support for the company's performance improvement and achieving profitability in Q2. During the reporting period, the company sold a total of 8.69 million heads, including 1.39 million piglets and 7.3 million hogs, achieving an operating income of 11.801 billion yuan; the company slaughtered a total of 1.21 million hogs, achieving an operating income of 2.872 billion yuan. The overall hog industry achieved an operating income of 14.673 billion yuan, with a gross margin increase of 8.62 percentage points compared to the same period of the previous year.

In fact, according to the sales briefing, the average hog sale price has been increasing for 6 consecutive months this year, rising from 13.30 yuan/KG at the beginning of the year to 18.80 yuan/KG in July. In addition, as of the end of June, the company's pigs per sow per year (PSY) reached 25.2, an increase of 1.7 heads compared to the end of last year; weaning costs dropped to below 280 yuan/head, a decrease of around 60 yuan/head from the end of last year; the fattening pig survival rate reached 91%; feed-to-meat ratio decreased to 2.64; and the fixed cost of sows dropped to below 2300 yuan/head, a reduction of approximately 400 yuan/head compared to the end of last year.

However, despite the recovery trend in the company's net profit, there has been a decline in revenue in the first half of the year. New Hope stated that the decrease in revenue was mainly due to the transfer of controlling interest in the white-feathered broiler and food deep processing sectors at the end of last year.

However, Caixin reporters have noticed that the fodder business being under pressure might also be a factor contributing to the company's decline in revenue. Specifically, during the reporting period, the company's total fodder sales volume reached 12.38 million tons, including 9.91 million tons of exported fodder. Among them, poultry feed sales volume was 7.1 million tons; hog feed sales volume was 4.29 million tons, including 1.96 million tons of exported hog feed; aquaculture feed sales volume was 0.68 million tons; ruminant feed sales volume was 0.22 million tons; achieving operating income of 32.886 billion, a year-on-year decrease of 16%, with the gross margin declining by 0.79 percentage points.

(Company's decline in fodder sales revenue, source: screenshot)

The main factor for the pressure on pig feed is the decline in sales volume. During the same period last year, the company's pig feed sales volume was 5.62 million tons, with 2.98 million tons of exported pig feed. In fact, in the first half of this year, the overall domestic pig feed industry has been relatively sluggish, with the national industrial feed production volume decreasing by 4.1% year-on-year, including a 4.0% decrease in compound feed production, a 10.8% decrease in concentrated feed production, and a 0.7% decrease in additive premix feed production.

Looking ahead to the second half of the year, the company's annual slaughtering plan is around 15 million heads. With the current high pig prices, the company is expected to continue to enjoy the cyclical dividend in the second half of the year. In an interview with reporters, industry experts said, 'The pig prices in the second half of the year will continue to remain high, and there should not be a significant risk of a sharp decline. The main profit period for pig enterprises throughout the year will also be in the third and fourth quarters.'

今日晚间,新希望发布2024年半年度报告,报告期内实现营业收入495.77亿元,上年同期为694.53亿元,同比减少198.76亿元,降幅为28.62%;归母净利润为-12.17亿元,上年同期为-29.83亿元,同比减亏,减亏幅度为59.18%。

今日晚间,新希望发布2024年半年度报告,报告期内实现营业收入495.77亿元,上年同期为694.53亿元,同比减少198.76亿元,降幅为28.62%;归母净利润为-12.17亿元,上年同期为-29.83亿元,同比减亏,减亏幅度为59.18%。