Smart Money Is Betting Big In Morgan Stanley Options

Smart Money Is Betting Big In Morgan Stanley Options

Benzinga's options scanner just detected over 8 options trades for Morgan Stanley (NYSE:MS) summing a total amount of $1,000,530.

Benzinga的期權掃描器剛剛發現了8個摩根士丹利(紐交所:MS)的期權交易,總金額爲$1,000,530。

At the same time, our algo caught 3 for a total amount of 627,633.

同時,我們的量化策略捕捉了3個期權交易,總金額爲627,633。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $97.5 and $120.0 for Morgan Stanley, spanning the last three months.

經評估交易量和未平倉利息後,明顯可見市場主要操盤手正關注摩根士丹利在97.5至120.0美元之間的價格區間,該區間跨越過去三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

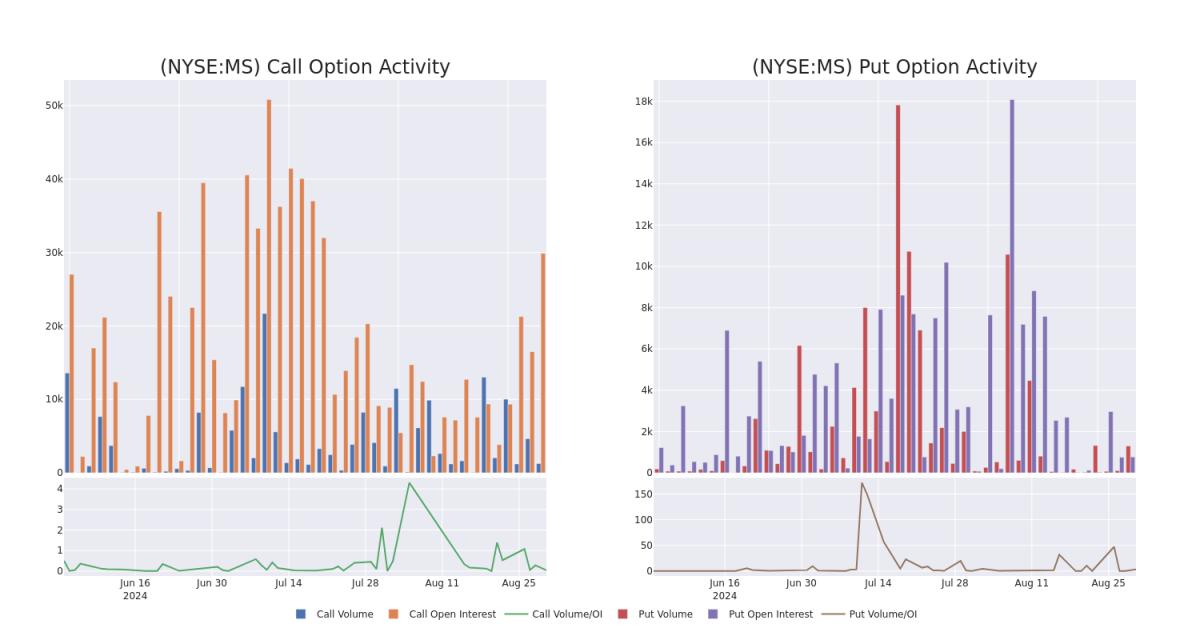

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Morgan Stanley's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Morgan Stanley's substantial trades, within a strike price spectrum from $97.5 to $120.0 over the preceding 30 days.

評估成交量和未平倉利息是期權交易中的戰略步驟。這些指標揭示了摩根士丹利期權在指定執行價格上的流動性和投資者興趣。即將到來的數據可視化了過去30天內摩根士丹利看漲和看跌期權的成交量和未平倉利息的波動,涉及執行價格範圍從97.5美元到120.0美元。

Morgan Stanley Option Volume And Open Interest Over Last 30 Days

摩根士丹利期權在過去30天內的成交量和持倉量。

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | PUT | TRADE | BULLISH | 09/19/25 | $8.65 | $8.45 | $8.5 | $100.00 | $510.0K | 400 | 600 |

| MS | CALL | SWEEP | BULLISH | 01/17/25 | $8.55 | $8.45 | $8.55 | $100.00 | $241.9K | 14.0K | 289 |

| MS | PUT | TRADE | BULLISH | 09/19/25 | $8.7 | $8.4 | $8.5 | $100.00 | $85.0K | 400 | 700 |

| MS | CALL | TRADE | BULLISH | 01/17/25 | $1.23 | $1.18 | $1.22 | $120.00 | $73.2K | 3.0K | 601 |

| MS | PUT | SWEEP | BULLISH | 09/06/24 | $0.42 | $0.4 | $0.41 | $101.00 | $32.6K | 370 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | 看跌 | 交易 | 看好 | 09/19/25 | $ 8.65 | 8.45美元 | $8.5 | $100.00。 | 400 | 600 | |

| MS | 看漲 | SWEEP | 看好 | 01/17/25 | $8.55 | 8.45美元 | $8.55 | $100.00。 | $241.9K | 14.0K | 289 |

| MS | 看跌 | 交易 | 看好 | 09/19/25 | $8.7 | $8.4 | $8.5 | $100.00。 | $85.0K | 400 | 700 |

| MS | 看漲 | 交易 | 看好 | 01/17/25 | $1.23 | $1.18 | $1.22 | $120.00 | $73.2K | 3.0K | 601 |

| MS | 看跌 | SWEEP | 看好 | 09/06/24 | $0.42 | $0.4 | $0.41 | 101.00美元 | $32.6K | 370 | 0 |

About Morgan Stanley

關於摩根士丹利

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

摩根士丹利是一家全球性投資銀行,其歷史可以追溯到1924年的前身公司。該公司擁有機構證券、财富管理和投資管理業務,約45%的淨收入來自其機構證券業務,45%來自财富管理,10%來自投資管理。其總收入約30%來自美洲以外地區。截至2023年底,該公司客戶資產總額超過5萬億美元,員工人數約爲80,000人。

In light of the recent options history for Morgan Stanley, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Morgan Stanley

- With a volume of 771,584, the price of MS is down -0.23% at $102.36.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 47 days.

- RSI指標暗示該股票可能要超買了。

- 下一次的盈利預計將在47天內發佈。

What Analysts Are Saying About Morgan Stanley

1 market experts have recently issued ratings for this stock, with a consensus target price of $95.0.

1位市場專家近期對這隻股票發表了評級,目標價平均爲95.0美元。

- In a cautious move, an analyst from Wells Fargo downgraded its rating to Underweight, setting a price target of $95.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Morgan Stanley's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Morgan Stanley's substantial trades, within a strike price spectrum from $97.5 to $120.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Morgan Stanley's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Morgan Stanley's substantial trades, within a strike price spectrum from $97.5 to $120.0 over the preceding 30 days.