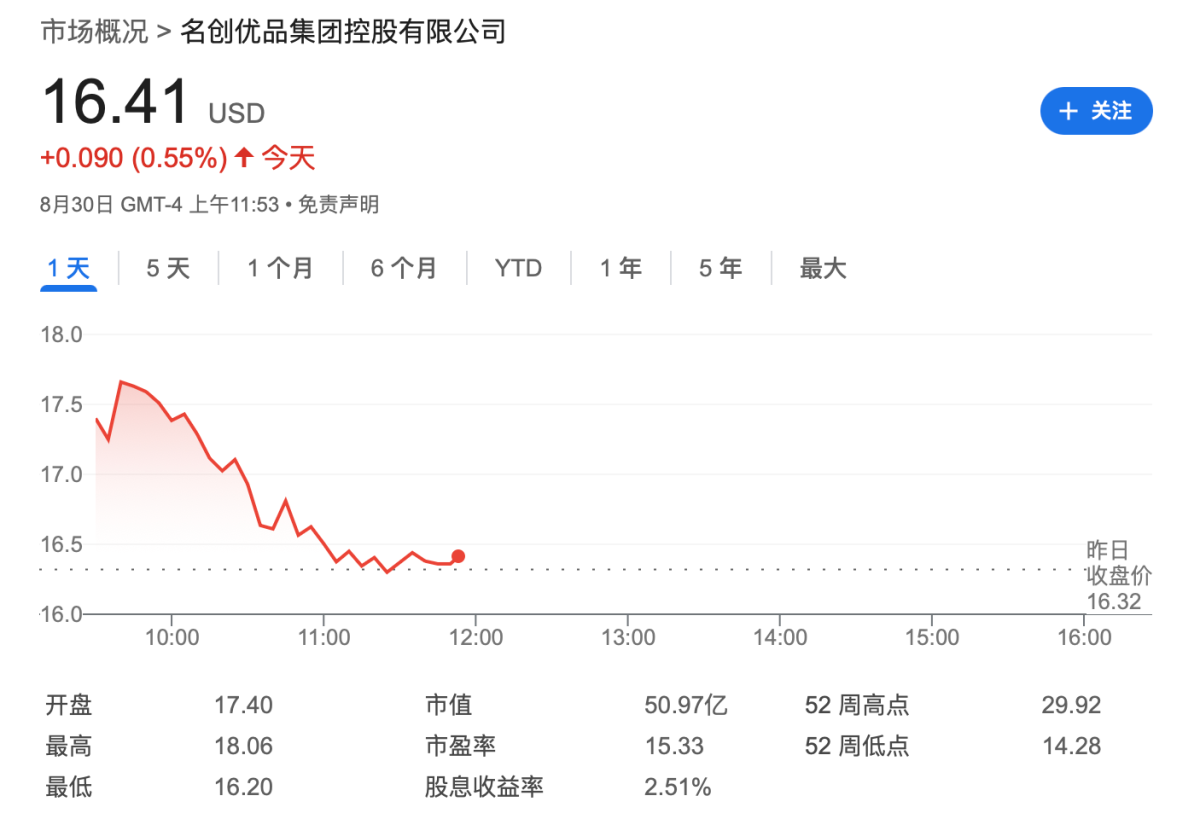

The management of the company is confident in the company's business prospects and believes that the current stock price is below its intrinsic value. Good performance has driven Miniso's US stocks to open with a significant increase of 10%, but the gain was later reversed.

Miniso released its report for the first half of 2024 on Friday, showing strong performance with better-than-expected gross margin, net increase in stores, and other operating indicators. The company also announced plans to repurchase up to 2 billion Hong Kong dollars worth of shares within the next 12 months. Management expressed confidence in the company's business outlook and prospects, and believed that the current stock price is undervalued.

1) Main financial data

Revenue: Increased by 25% YoY to 7.76 billion yuan.

Gross margin: 43.7%, a 4.1% increase compared to the same period last year, reaching a historical high.

Adjusted net income: 1.24 billion yuan, an 18% YoY increase, with a net profit margin of 16.0%.

2) Store Data

Global store count: 6,868 stores, with a net increase of 455 stores, marking the highest number of new store openings in the first half since Miniso entered the overseas market.

Overseas business revenue: surpassing 2.7 billion, achieving a year-on-year growth rate of 43%.

Number of domestic stores: 4,115, with a net increase of 189 new stores.

Domestic revenue: over 5 billion yuan, a 17% year-on-year growth.

USA market stores: exceeding 200, becoming the Asian consumer brand with the most offline stores in the USA, now present in 40 major states in the USA.

Meanwhile, TOP TOY under the Miniso group achieved performance growth beyond expectations by actively expanding into core business districts, launching exclusive new products, and more. Financial report data shows that TOP TOY's first-half revenue reached 0.43 billion yuan, a 38% year-on-year growth, achieving profitable results for three consecutive quarters. In terms of store expansion, as of June 30, 2024, the total number of TOP TOY stores has increased to 195, with a net increase of 47 stores in the first half of the year, including 21 self-operated stores and 174 partner stores.

The company also announced that the board of directors has authorized and approved the '2024 Share Buyback Plan'. According to this plan, the company may repurchase up to a value of 2 billion Hong Kong dollars of the company's outstanding common shares and/or American Depositary Shares representing its common shares on the open market within 12 months from the date of approval. The company is expected to utilize surplus cash from its balance sheet to fund the repurchases under the 2024 Share Buyback Plan.

The company's announcement stated that the board of directors is confident in the company's business outlook and prospects, believing that the current stock price is below its intrinsic value. By adopting the 2024 Share Buyback Plan, the company aims to promote the interests of shareholders, balancing the group's rapid growth with commitments to provide stable and predictable returns to shareholders.

Boosted by strong performance, Miniso's US stock surged more than 10% at Friday's opening, but later retraced gains to a 0.55% increase at midday, trading at $16.41.