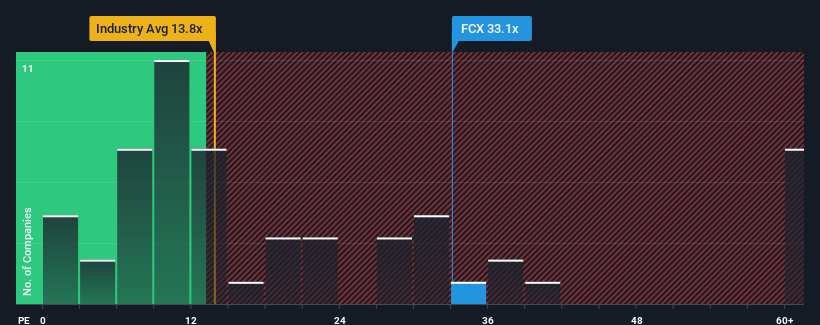

Freeport-McMoRan Inc.'s (NYSE:FCX) price-to-earnings (or "P/E") ratio of 33.1x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 18x and even P/E's below 10x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Freeport-McMoRan has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Does Growth Match The High P/E?

In order to justify its P/E ratio, Freeport-McMoRan would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.4%. This means it has also seen a slide in earnings over the longer-term as EPS is down 31% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 25% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Freeport-McMoRan's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Freeport-McMoRan's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Freeport-McMoRan with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.