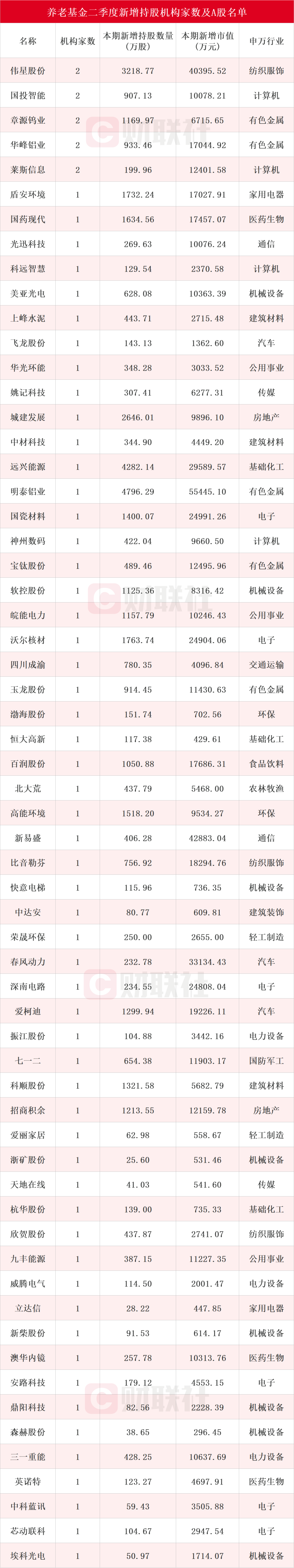

① With the disclosure of the semi-annual reports of listed companies, pension funds intensively appeared on the list of the top ten tradable shareholders with 188 shares in the second quarter; ② Among them, 61 new shares entered the list of the top ten tradable shareholders. 5 individual shares, including Weixing Shares and SDIC, received 2 new pension fund shareholders; ③ Attached are the number of new shareholding institutions and A share list of new pension funds in the second quarter (attached table).

Financial Services Association, September 1 (Editor: Ga Chen) As the disclosure of the 2024 semi-annual reports of listed companies comes to an end, the latest heavy stock holdings of pension funds have also surfaced. According to Choice statistics, pension funds appeared on the list of 188 top ten tradable shareholders in the second quarter.

Judging from the latest position trends, according to Choice data, pension funds entered the list of 61 new top ten tradable shareholders in the second quarter. Among them, Weixing Co., Ltd., SDIC Intelligence, Zhangyuan Tungsten Industry, Huafeng Aluminum, and Laishi Information all received 2 new shareholders from the Pension Fund.

In addition, Dun'an Environmental, Sinopharm Hyundai, Guangxun Technology, Keyuan Intelligence, Meiya Optoelectronics, Shangfeng Cement, Feilong Co., Ltd., Huaguang Huaneng, Yao Ji Technology, Urban Construction Development, Sinoma Technology, Yuanxing Energy, Mingtai Aluminum, China Porcelain Materials, Shenzhou Digital, Baotai Co., Ltd., Soft Holdings, Wanneng Electric, Wall Nuclear Materials, Sichuan Chengyu, Yulong Co., Ltd., Bohai Co., Ltd., Evergrande Hi-Tech, Bairun Co., Ltd., Beidahuang, Gaoneng Environmental Fen, Kuaiyi Elevator, Zhongda An, Rongsheng Environmental Protection, Chunfeng Power, Shennan Circuit, iKodi, Zhenjiang Co., Ltd., 712, Keshun Co., Ltd., Investment Savings, Ellie Home, Zhejiang Mining Co., Ltd., Tiandi Online, Hanghua Co., Ltd., Xinhe, Jiufeng Energy, Weiteng Electric, Rieter, Xinchai Co., Ltd., Aohua Endoscopy, Anlu Technology, Dingyang Technology, Senhe Co., Ltd., Sany Heavy Energy, Innotel, Zhongke Lanxun, Chipcom, and Eco Optoelectronics received 1 additional shareholder in the second quarter. The details are as follows:

In addition, Dun'an Environmental, Sinopharm Hyundai, Guangxun Technology, Keyuan Intelligence, Meiya Optoelectronics, Shangfeng Cement, Feilong Co., Ltd., Huaguang Huaneng, Yao Ji Technology, Urban Construction Development, Sinoma Technology, Yuanxing Energy, Mingtai Aluminum, China Porcelain Materials, Shenzhou Digital, Baotai Co., Ltd., Soft Holdings, Wanneng Electric, Wall Nuclear Materials, Sichuan Chengyu, Yulong Co., Ltd., Bohai Co., Ltd., Evergrande Hi-Tech, Bairun Co., Ltd., Beidahuang, Gaoneng Environmental Fen, Kuaiyi Elevator, Zhongda An, Rongsheng Environmental Protection, Chunfeng Power, Shennan Circuit, iKodi, Zhenjiang Co., Ltd., 712, Keshun Co., Ltd., Investment Savings, Ellie Home, Zhejiang Mining Co., Ltd., Tiandi Online, Hanghua Co., Ltd., Xinhe, Jiufeng Energy, Weiteng Electric, Rieter, Xinchai Co., Ltd., Aohua Endoscopy, Anlu Technology, Dingyang Technology, Senhe Co., Ltd., Sany Heavy Energy, Innotel, Zhongke Lanxun, Chipcom, and Eco Optoelectronics received 1 additional shareholder in the second quarter. The details are as follows:

Weixing Co., Ltd., whose main business is R&D, manufacturing and sales of various high-end clothing and luggage accessories products, received an additional market value of 0.404 billion yuan from the Pension Fund in the second quarter. Judging from the semi-annual reports disclosed by Weixing Co., Ltd., the Basic Pension Insurance Fund 101 Group and the Basic Pension Insurance Fund 805 Group ranked 6th and 9th among the top ten tradable shareholders respectively. Weixing Co., Ltd. announced on August 13 that the half-year of 2024 was announced. During the reporting period, the company achieved operating income of 2.296 billion yuan, an increase of 25.57% over the previous year; net profit attributable to shareholders of listed companies was 0.416 billion yuan, an increase of 37.79% over the previous year. Tang Jun of Dongwu Securities and others said in a research report released on August 18 that Weixing Co., Ltd. is a leading domestic apparel accessories company. 24H1 has benefited from the release of demand from downstream customers to replenish stocks, and Weixing Co., Ltd. continues to expand new customers and increase customer share, and its performance has exceeded expectations. Looking ahead to the second half of the year, as customer demand for inventory replenishment is fully released, the overseas consumption environment is weak, and the 23H2 base rises, analysts expect annual results to show high and low characteristics, but performance is expected to continue to be better than that of peers under the guidance of their own competitive advantage and internationalization strategy.

The main business is electronic data forensics and network information security products and related services. SDIC Smart Pension Fund added 0.1 billion yuan in market value in the second quarter. Judging from the semi-annual report disclosed by SDIC Intelligence, the basic pension insurance fund 1652 portfolio and the basic pension insurance fund 16051 group ranked 6th and 10th in the top ten tradable shareholders respectively. SDIC Smart announced on August 23 that in the first half of the year, the company achieved revenue of 0.549 billion yuan, an increase of 20.54% over the previous year; net loss attributable to the owners of the parent company was 0.128 billion yuan. Miao Xinjun of Tianfeng Securities said in a research report released on August 26 that in the AI field, SDIC Intelligence's “Tianqing Public Safety Big Model Algorithm” passed the China Internet Information Office's in-depth synthesis service algorithm registration, and became the first major model algorithm in the field of public safety to pass the filing in China. In the field of electronic data forensics, SDIC Intelligence continues to promote research and development of domestic chemical products, and it is expected that it will continue to benefit from credit innovation in the future. In the field of big data, SDIC Intelligence continues to iterate the “Qiankun” Big Data Operating System (QKOS), actively explore combined applications with big models, and further enhance the reuse capabilities and intelligence level of big data products. SDIC Intelligence actively lays out the digital business of enterprises, relies on the wholly-owned subsidiary SDIC Cloud Network to fully promote the enterprise digital sector business, clearly states that SDIC Cloud Network is the digital business service platform for the SDIC Group, and undertakes the digital service work of the China Investment Group as a whole.

Tungsten industry manufacturer Zhang Yuan Tungsten received a pension fund with a market value of 67.1565 million yuan in additional positions in the second quarter. Judging from the semi-annual report disclosed by Zhangyuan Tungsten Industry, the 804 basic pension insurance fund package and the 1206 basic pension insurance fund group ranked the fifth and seventh seats in the top ten tradable shareholders respectively. Zhangyuan Tungsten Industry released its 2024 semi-annual report on August 26. During the reporting period, the company achieved operating income of 1.814 billion yuan, an increase of 5.23% over the previous year; net profit attributable to shareholders of listed companies was 0.112 billion yuan, an increase of 29.86% over the previous year. Qiu Zuxue of Minsheng Securities and others said in a research report released on August 28 that as an integrated enterprise in the domestic tungsten industry chain, the mining side benefits from rising tungsten prices, steady growth in demand for hard alloys, broad development prospects for the blade sector, and the future performance of Zhangyuan Tungsten Industry can be expected. Analysts expect Zhangyuan Tungsten's net profit to be 0.218/0.287/0.358 billion yuan in 2024-2026, respectively.

Huafeng Aluminum, whose main business is R&D, production and sales of aluminum sheets and foils, received an additional market value of 0.17 billion yuan in the second quarter from the Pension Fund. Judging from the semi-annual report disclosed by Huafeng Aluminum, the basic pension insurance fund 1204 portfolio and the basic pension insurance fund 1611 group ranked 7th and 9th among the top ten tradable shareholders respectively. Huafeng Aluminum announced on July 30 that it achieved operating income of 4.934 billion yuan in the first half of the year, an increase of 18.37% over the previous year, and net profit of 0.558 billion yuan, an increase of 35.19% over the previous year. Qiu Zuxue of Minsheng Securities and others said in a research report released on August 1 that Huafeng Aluminum currently has two major production bases in Chongqing and Shanghai, with an annual production capacity of 0.35 million tons, and production capacity bottlenecks are mostly concentrated in the front-end hot rolling process, and production capacity can be released by purchasing semi-finished aluminum ingots, etc. Furthermore, Huafeng Aluminum's Chongqing Phase II project with an annual output of 0.15 million tons is progressing steadily. It is expected to be completed and put into operation in 2025, and production capacity expansion is guaranteed.

Rice Information, whose main products are air conditioning automation systems, etc., received an additional market value of 0.124 billion yuan in the second quarter of the Pension Fund's holdings. Judging from the semi-annual report disclosed by Rice, the Basic Pension Insurance Fund 1605 Group and the Basic Pension Insurance Fund 16051 Group ranked fifth and ninth among the top ten tradable shareholders respectively. Rice Information released its 2024 semi-annual report on August 28. The report shows that the company achieved operating income of 0.637 billion yuan in the first half of the year, an increase of 21.02% over the previous year; net profit attributable to shareholders of listed companies was -5.4519 million yuan. Liu Wenshu of Zheshang Securities and others said in a research report released on August 29 that Rice Information is speeding up air traffic control, new airport product development, and localization. In the field of air traffic control, Rice Information is seizing the Air Traffic Control Administration's 8+N district management construction opportunities, speeding up core system upgrades, completing R&D and testing of a number of intelligent applications; completing tests on the new air traffic control automation system innovation platform, and testing the new air traffic control automation system on site for some users in Qingdao and other countries to accelerate the localization process. In the airport sector, Rice Information continues to promote the development of core products such as large-scale airport IIS systems and intelligent airport operation resource allocation systems based on the “Type 4 Airport” smart solution to help improve command and dispatch efficiency.

此外,盾安环境、国药现代、光迅科技、科远智慧、美亚光电、上峰水泥、飞龙股份、华光环能、姚记科技、城建发展、中材科技、远兴能源、明泰铝业、国瓷材料、神州数码、宝钛股份、软控股份、皖能电力、沃尔核材、四川成渝、玉龙股份、渤海股份、恒大高新、百润股份、北大荒、高能环境、新易盛、比音勒芬、快意电梯、中达安、荣晟环保、春风动力、深南电路、爱柯迪、振江股份、七一二、科顺股份、招商积余、爱丽家居、浙矿股份、天地在线、杭华股份、欣贺股份、九丰能源、威腾电气、立达信、新柴股份、澳华内镜、安路科技、鼎阳科技、森赫股份、三一重能、英诺特、中科蓝讯、芯动联科和埃科光电获得养老基金二季度新增持股家数均为1家。具体情况如下:

此外,盾安环境、国药现代、光迅科技、科远智慧、美亚光电、上峰水泥、飞龙股份、华光环能、姚记科技、城建发展、中材科技、远兴能源、明泰铝业、国瓷材料、神州数码、宝钛股份、软控股份、皖能电力、沃尔核材、四川成渝、玉龙股份、渤海股份、恒大高新、百润股份、北大荒、高能环境、新易盛、比音勒芬、快意电梯、中达安、荣晟环保、春风动力、深南电路、爱柯迪、振江股份、七一二、科顺股份、招商积余、爱丽家居、浙矿股份、天地在线、杭华股份、欣贺股份、九丰能源、威腾电气、立达信、新柴股份、澳华内镜、安路科技、鼎阳科技、森赫股份、三一重能、英诺特、中科蓝讯、芯动联科和埃科光电获得养老基金二季度新增持股家数均为1家。具体情况如下: