Yunnan Energy New Material Co., Ltd. (SZSE:002812) Analysts Are Reducing Their Forecasts For This Year

Yunnan Energy New Material Co., Ltd. (SZSE:002812) Analysts Are Reducing Their Forecasts For This Year

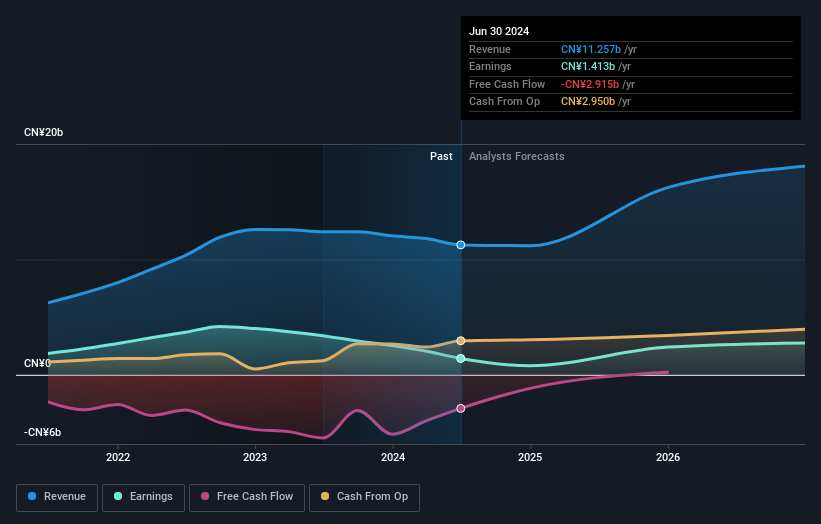

The latest analyst coverage could presage a bad day for Yunnan Energy New Material Co., Ltd. (SZSE:002812), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. Shares are up 6.0% to CN¥26.91 in the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

最新的分析師覆蓋可能預示着恩捷股份將迎來糟糕的一天(SZSE:002812),分析師們大幅削減了他們的財務預估,這可能會讓股東們感到有點震驚。營業收入和每股收益估算均大幅下調,因爲分析師考慮了業務的最新前景,得出結論稱之前的預期過於樂觀。股價在過去一週上漲了6.0%,至人民幣26.91元。看看這一降級是否會激勵投資者開始出售他們的持股,將會很有趣。

Following this downgrade, Yunnan Energy New Material's 16 analysts are forecasting 2024 revenues to be CN¥11b, approximately in line with the last 12 months. Statutory earnings per share are supposed to plummet 45% to CN¥0.81 in the same period. Previously, the analysts had been modelling revenues of CN¥13b and earnings per share (EPS) of CN¥1.81 in 2024. Indeed, we can see that the analysts are a lot more bearish about Yunnan Energy New Material's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

在這次降級之後,恩捷股份的16位分析師預測2024年的營業收入爲110億人民幣,大致與過去12個月的情況相符。法定每股收益預計將在同一時期下降45%,至人民幣0.81元。此前,分析師們曾對2024年的營業收入爲130億人民幣,每股收益(EPS)爲1.81元進行建模。事實上,我們可以看到,分析師們對恩捷股份的前景變得更加看淡,大幅下調營收預估並同時削減EPS預估。

Analysts made no major changes to their price target of CN¥40.50, suggesting the downgrades are not expected to have a long-term impact on Yunnan Energy New Material's valuation.

分析師們對40.50人民幣的目標價沒有做出重大變化,這表明降級不太可能對恩捷股份的估值產生長期影響。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 1.2% by the end of 2024. This indicates a significant reduction from annual growth of 30% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 16% per year. It's pretty clear that Yunnan Energy New Material's revenues are expected to perform substantially worse than the wider industry.

現在來看看更大的畫面,我們理解這些預測的一種方法是比較它們與過往業績和行業增長預期。這些預估暗示銷售預期放緩,到2024年底預計營收年均下降1.2%。這表明與過去五年的年增長率30%相比,銷售預期有顯着下降。將這與我們的數據進行比較,數據顯示同行業其他公司的營收年增長率預計爲16%。很明顯,恩捷股份的營收預期預計將遠遠不如整個行業。

The Bottom Line

最重要的事情是分析師增加了它對下一年每股虧損的估計。令人欣慰的是,營收預測未發生重大變化,業務仍有望比整個行業增長更快。共識價格目標穩定在28.50美元,最新估計不足以對價格目標產生影響。

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Yunnan Energy New Material after the downgrade.

最重要的一點是,分析師們削減了他們的每股收益預測,預計業務狀況將會出現明顯的下滑。遺憾的是,他們還下調了他們的營業收入預測,最新的預測表明該業務的銷售增長速度將會慢於整個市場。我們還驚訝地發現價格目標沒有發生變化。然而,業務狀況惡化(假設預測準確!)可以成爲股價的一個領先指標,所以在降級後,我們不會責怪投資者對恩捷股份更加謹慎。

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Yunnan Energy New Material's business, like its declining profit margins. For more information, you can click here to discover this and the 1 other flag we've identified.

在像這樣的降級之後,明顯可以看出之前的預測過於樂觀。而且,我們發現了恩捷股份業務的一些可能問題,比如其利潤率的下降。欲了解更多信息,您可以點擊這裏發現我們所發現的這一點和另一個問題。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

當然,看到公司管理層投入大量資金投資股票的情況與分析師是否對其評級下調一樣有用。因此,您還可以搜索此處的高內部所有權股票的免費列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 1.2% by the end of 2024. This indicates a significant reduction from annual growth of 30% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 16% per year. It's pretty clear that Yunnan Energy New Material's revenues are expected to perform substantially worse than the wider industry.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 1.2% by the end of 2024. This indicates a significant reduction from annual growth of 30% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 16% per year. It's pretty clear that Yunnan Energy New Material's revenues are expected to perform substantially worse than the wider industry.