上半期の企業収益は65.43億元で、そのうち医療関連ビジネスの収益は38.88億元であり、総収益の割合はさらに59.4%に向上しました。純利益は2.71億元で、総純利益の割合も21%に向上しました。

過去3年間、香港株恒生医療保健指数は大きな調整期間を経験し、市場の波乱が増しています。この背景の中、環球医療を代表とする一連の業績成長が安定し、持続的な高い配当を実現している国有上場企業は、投資家のますます注目を集めています。

2024年8月28日、環球医療は2024年の中間業績を正式に発表しました。上半期の企業収益は65.43億元で、そのうち医療関連ビジネスの収益は38.88億元であり、総収益の割合はさらに59.4%に向上しました。純利益は2.71億元で、総純利益の割合も21%に向上しました。

会社の業績データによると、9月9日から、環球医療は恒生指数の産業分類も医療保健に調整される予定です。環球医療は将来、医療事業の大幅な成長に伴い、収益と利益の割合がさらに上昇すると述べています。

会社の業績データによると、9月9日から、環球医療は恒生指数の産業分類も医療保健に調整される予定です。環球医療は将来、医療事業の大幅な成長に伴い、収益と利益の割合がさらに上昇すると述べています。

環球医療の戦略は「医療サービスを中核に、金融サービスを支え、ヘルステクノロジーをエンジンとして、産融結合の優位性を十分に活用し、共有と共栄の大規模な健康エコシステムを構築する」というものです。次に、智通財政アプリでは総合医療、専門医療およびヘルステクノロジー、金融ビジネスの3つの側面から、会社の中間業績を詳しく説明します。

1. 総合医療: 国有企業による医療事業の展開は、質の高い発展を実現し、着実に進展しています。

2021年6月、国務院の意見「公立医療機関の高品質な発展を促進するための意見」の発行以降、公立医療機関は高品質な発展の新しい段階に入りました。規模の拡大から品質と効率の向上、粗放な管理から精緻化された管理、物質的要素を重視することから人材と技術的要素をより重視する方向に転換し、公立医療機関は「3つの転換」「3つの向上」を目指して、医療サービスの品質と効率の向上に努めています。最近に開催された党の第20回中央委員会の第3回全体会議でも、健康改革について包括的かつ体系的に布陣されました。改革のペースは一度も停止せず、公立医療機関の改革と高品質な発展は引き続き深化し、医療機関のサービスと管理水準により高い要求を出しています。

現在、国営病院の高品質な発展を積極的に探求し、医療機関の高品質な発展を継続的に推進することは、環球医療が適応しなければならない変革の傾向です。

総合医療事業セクターでは、環球医療は核心能力を構築し続け、デジタル化の促進、差別化された展開、協力的な発展を推進し、中心的な技術を持つ、運営が効率的な病院グループを構築し、高品質な国営病院運営の新しいモデルを作り出そうとしています。

2024年上半期において、企業の総合医療事業セクターは品質と効率の向上に力を入れ、医療機関の全体的な経営効果が着実に向上しました:収入は364.5億元で、前年同期比2.0%減少しました;当期純利益は24.3億元で、前年同期比9.9%増加しました。

運営面から見ると、2024年上半期において、環球医療は医療機関の収入構造が大幅に改善され、診療技術の向上、治療プロジェクトの増加、病気の構造の最適化などの施策により、医療機関は全体的な効率的な医療収入の比率が3ポイント向上し、医薬品の調達範囲の拡大や医療保険の支払い方法の改革などの政策調整の影響に効果的に対処しました。

72の医療機関を保有し、医療と健康が主要なビジネスである央企持株上場企業として、環球医療は総合医療事業セクターを医療健康産業のエコシステムを構築するための核心的な支援および戦略的リソースとし、産業単位の基本顧客および産業革新の現場共同創造拠点とすることに力を入れています。

国営病院は中国の公立保健システムにおける「第2のナショナルチーム」として、高品質な医療資源供給の増加、医療保健事業の供給側の構造的改革の深化に重要な役割を果たしています。将来、環球医療も国営病院とグループ化の優位性を存分に発揮し続け、差別化された競争力を構築し、"ヘルスチャイナ"戦略をサポートし、より大きな社会価値を創出すると信じています。

2. 専門医療+健康テクノロジー:内含外延「二輪駆動」により、布陣を加速させます。

現在、専門病院の数が持続的に増加しており、技術、医療保険、投資、市場需要などの要因により、異なるタイプの専門病院が異なる発展を遂げています。この背景の下で、連鎖展開の経営モデルが徐々に業界のトレンドとなっています。

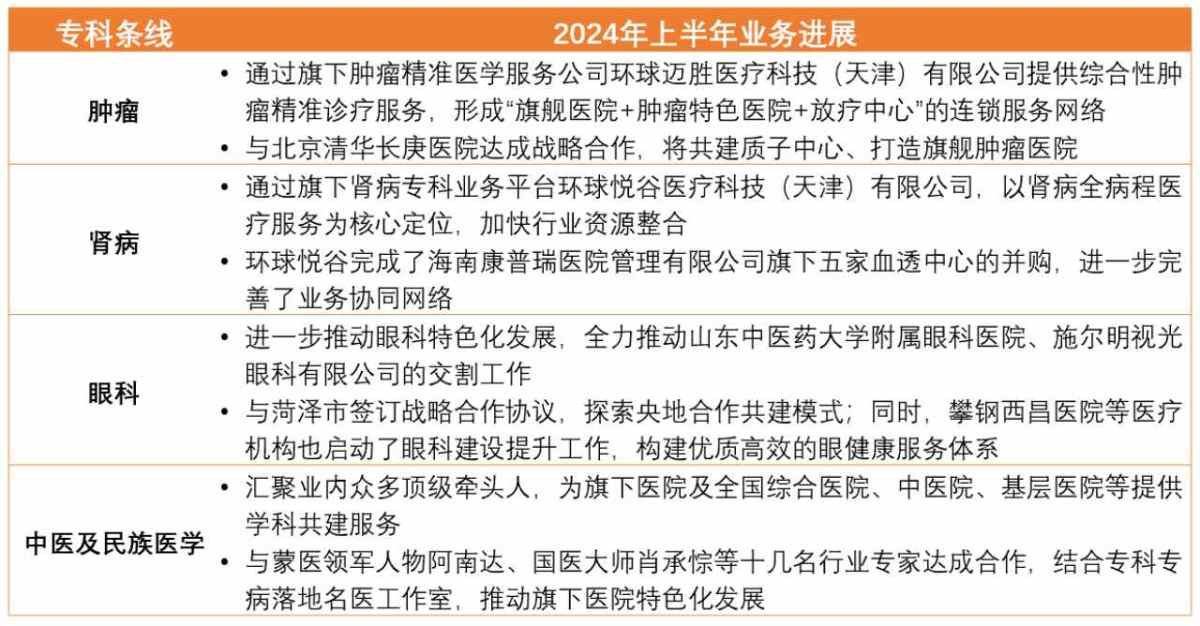

当社の専門医療事業は、国民の需要や痛みを基盤にしたビジネスに重点を置き、特色のある部門、チェーン展開、産業化への発展方向を堅持し、旗艦病院を作り上げることに注力し、腫瘍、腎臓病、眼科、中医学および民族医学などの専門医療分野のビジネス展開を図りました。2024年上半期には、専門医療の展開がさらに強化され、完璧になりました。

次に、ここ数年で急成長している健康テクノロジー分野に注目します。健康テクノロジー事業は、医療機器全生命週期管理、スマートヘルスケアなどの健康テクノロジー分野のビジネス展開を中心に展開し、先端技術とイノベーション手法を取り入れ、特色ある事業とコア能力を育成し、上場企業の第2の成長曲線を築くために努力しています。その中でも、医療機器全生命週期管理は、ビジネス規模の拡大と子会社の増加に伴い、上半期の合併レポート収入は2.64億人民元であり、423.4%の成長、純利益は0.33億人民元であり、208.5%の成長となりました。8月28日の企業業績発表会での経営陣の説明によると、これからもこれは持続的な急成長を遂げる新しいビジネス分野となるでしょう。

先日、智通財経APPは、環球技服が中设协(中国繊維工業機械装置工程技術研究センター)医療部門会において、『医用磁気共鳴撮影装置(MRI)の修理およびメンテナンスのためのサービスガイドライン』企業基準を発表しました。これは、同社の技術力と専門知識が業界から認められたことを示しています。同社はまた、引き続き企業の優位性を発揮し、医療機器管理業界の高品質な発展に標準化を支援すると述べています。

良い企業は「基準を作る」と言います。優れた企業は製品とサービスの卓越性だけでなく、業界の標準を策定し、指導することにも力を注ぎ、革新と品質で市場の基準を築き上げます。

3. 金融事業:「基本盤」を安定させ、新たな変革の方向に進む

金融ビジネスは環球医療の主要事業であり、現在、企業は中国の金融リース業界のリーダー企業に成長しました。

環球医療の業績資料によると、同社は2000以上の顧客にカスタマイズされた金融ソリューションを提供し、累計2000億元を超える資金を投下し、AAA信用格付け企業2社を所有し、金融機関からの信用限度額は累計1000億元を超えています。

企業の金融部門の上半期の収入は266.7億元で、10.7%減少しました。ただし、コスト面や資金管理水準も着実に向上しており、当期純利益は98.1億元に達し、前年同期比2%増となり、安定性と収益性の良好な状況が示されています。

実際、業界全体の不況、競争の激化、規制の強化、収益空間の縮小など、不利な外部要因に直面しています。既存の市場で守りに入るか、それとも高品質な発展と事業の転換を求めて新たな領域を開拓するか、融資リース機関にとっては緊急に検討すべき問題です。

環球医療は後者を選択し、経営陣によると、現在、企業の金融ビジネスは徐々に構造調整と革新の新しい段階に進んでいます。将来、企業は主に責任と主要業務に焦点を当て、実物経済に基づいて新しいサービス体系を着実に創造し、テクノロジーファイナンス、グリーンファイナンス、包摂的金融、老後金融、テクノロジーファイナンスの5つの分野に焦点を当て、製造と金融の統合を新たな利点として打ち出す計画です。

環球医療のこの戦略の選択は、市場変化への鋭い洞察力と将来の発展機会への積極的な把握を体現しています。既存のビジネスに変化をもたらし、変化する市場で機会をつかむことは、環球医療の金融ビジネスの転換とアップグレードが期待されます。

経営陣は決算説明会で、同社の目標は、総合医療を中心とし、金融サービス能力、専門医療特色、およびヘルステクノロジーの優位性を兼ね備えた国際的に先導し、国内で一流の医療・健康テクノロジー企業に育てることです。

風景を眺めるのは長いです。環球医療の「金融+総合医療+専門医療+健康テクノロジー」の事業範囲が着実に充実し続けるにつれ、しっかりした基本、強力な発展弾力性、明確な発展道路によって、高品質の発展成長勢能を着実に蓄積していくでしょう。

現在、hshci(PE)は4倍未満で、PBR(PB)は0.5倍未満です。会社の配当比率は30%を維持しており、配当利回りは8%を超えており、非常に割安な評価、高配当、高配当の標的です。医療保健分野での豊富な蓄積と先見性のある戦略的な布陣を加えると、会社は強力な発展勢いと広大な成長空間を示し、将来の成長が期待できるため、投資家にとって長期間にわたる注目に値します。