Today we're going to take a look at the well-established Adobe Inc. (NASDAQ:ADBE). The company's stock saw a significant share price rise of 31% in the past couple of months on the NASDAQGS. Shareholders may appreciate the recent price jump, but the company still has a way to go before reaching its yearly highs again. With many analysts covering the large-cap stock, we may expect any price-sensitive announcements have already been factored into the stock's share price. But what if there is still an opportunity to buy? Let's examine Adobe's valuation and outlook in more detail to determine if there's still a bargain opportunity.

Is Adobe Still Cheap?

Great news for investors – Adobe is still trading at a fairly cheap price. Our valuation model shows that the intrinsic value for the stock is $736.53, but it is currently trading at US$574 on the share market, meaning that there is still an opportunity to buy now. What's more interesting is that, Adobe's share price is quite volatile, which gives us more chances to buy since the share price could sink lower (or rise higher) in the future. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What kind of growth will Adobe generate?

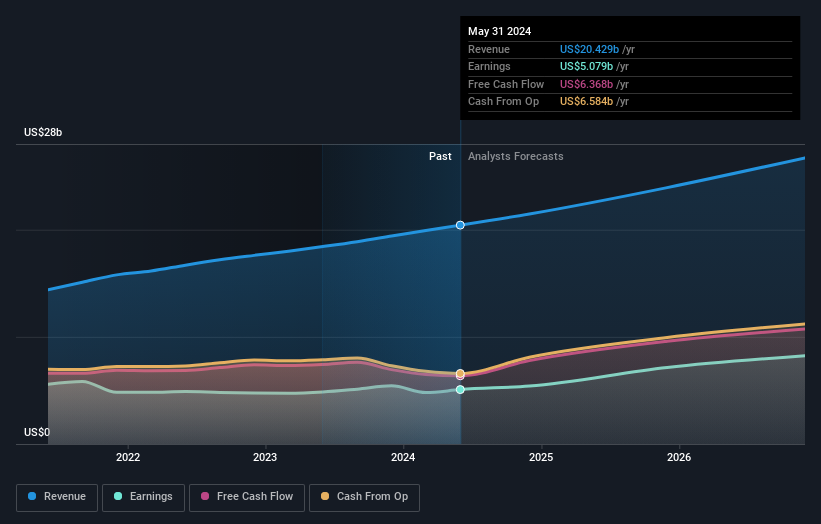

NasdaqGS:ADBE Earnings and Revenue Growth September 2nd 2024

Future outlook is an important aspect when you're looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also take a look at the company's future expectations. Adobe's earnings over the next few years are expected to increase by 71%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

Future outlook is an important aspect when you're looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also take a look at the company's future expectations. Adobe's earnings over the next few years are expected to increase by 71%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What This Means For You

Are you a shareholder? Since ADBE is currently undervalued, it may be a great time to increase your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as capital structure to consider, which could explain the current undervaluation.

Are you a potential investor? If you've been keeping an eye on ADBE for a while, now might be the time to make a leap. Its prosperous future outlook isn't fully reflected in the current share price yet, which means it's not too late to buy ADBE. But before you make any investment decisions, consider other factors such as the strength of its balance sheet, in order to make a well-informed buy.

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example - Adobe has 1 warning sign we think you should be aware of.

If you are no longer interested in Adobe, you can use our free platform to see our list of over 50 other stocks with a high growth potential.