Recently, British consumers have experienced the so-called 'double shrunken inflation', which refers to the phenomenon of shrinking product volumes while prices remain unchanged or rise.

According to the Futubull Finance App, British consumers have recently encountered the phenomenon of 'double shrunken inflation', which refers to the shrinking of product volumes while prices remain unchanged or rise. This is particularly evident in products such as chocolates and potato chips. A survey by Barclays Bank revealed this trend, finding that 80% of shoppers have been affected by shrunken inflation, with over a quarter of them noticing that product sizes have been reduced by more than twice, especially in snack categories such as biscuits and confectioners.

Furthermore, the report also points out that nearly half of consumers purchase cosmetic and sweet luxury goods, such as makeup and sweets, to boost their mood during periods of tightening budgets. This phenomenon is known as the 'lipstick effect'. Barclays credit card data also shows a 7.3% year-on-year growth in expenditure for health and beauty retailers, the fastest rate since early 2023.

Despite the impact of the cost of living crisis still being felt by British consumers and businesses, this impact has somewhat eased. Although the rate of real wage growth has reached its fastest level in nearly three years, it still remains far below its peak.

It is understood that the shrunken inflation has affected many best-selling products in the UK, including Bisto chicken gravy granules, Colgate-Palmolive Triple Action toothpaste, and Lurpak butter, where the prices have remained unchanged or increased while the volume has decreased. However, with the easing of cost pressures, companies may reduce the use of this strategy. Last year, the UK food inflation rate dropped from double digits to 1.4%, and central banks around the world have been lowering interest rates.

Karen Johnson, head of retail banking at Barclays, pointed out that consumers are increasingly turning to retail therapy to boost their mood, which is a direct reflection of their willingness to allocate budgets for unforgettable experiences, such as buying tickets for next year's Oasis band tour.

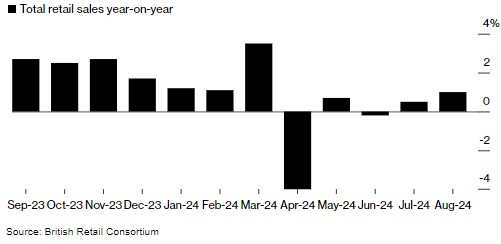

In addition, data from Barclays Bank and the British Retail Consortium (BRC) shows that retail sales in August were driven by barbecues and 'picnic weather'. Barclays Bank states that credit card spending increased by 1% year-on-year in August, ending a two-month decline. Meanwhile, the BRC indicates that total retail sales increased by 1% due to consumers purchasing more food in the sunny weather, making it the strongest performance since March.

BRC Chief Executive Helen Dickinson commented: "Sales growth accelerated in August, especially in food sales, as people gathered together for barbecues and picnics with family and friends. At the same time, sales of summer clothing, health, and beauty products also increased as people prepared for travel and summer social activities."