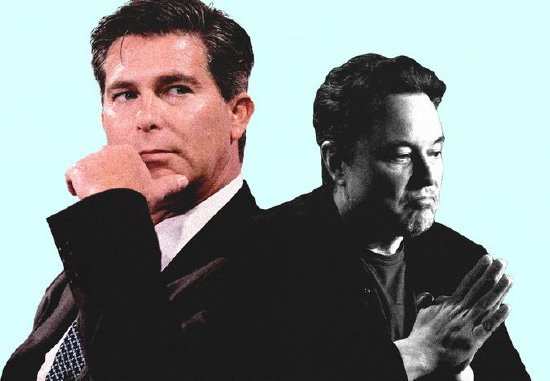

Prominent Tesla investor and CEO of Gebor Kawasaki Wealth and Investment Management Company, Ross Gebor, has transformed from a staunch supporter of Elon Musk to a outspoken critic. Gebor was an early investor in Tesla. However, since November last year, his fund has significantly reduced its shareholding in Tesla stocks.

In an interview on Sunday, Gebor stated that Musk's erratic behavior on social media, controversial reforms on Twitter (now known as 'X'), and political controversies were the reasons for his change of heart. Gebor said that he receives calls from clients daily requesting to sell their Tesla stocks, expressing a desire to distance themselves from Musk.

Since November 2023, Gebor's fund has held approximately half of its shares in Tesla, with an investment of only about $60 million remaining.

Gebor stated that Tesla has six months to improve its performance, otherwise his company will completely divest from the stock.

When asked if he would completely liquidate his Tesla holdings, Gebor replied, 'Absolutely.' 'If you're not making money, and you're not doing what you need to do to make or help the company make more money or do better, I have to leave. That's just the way it is.'

Gebor's initial enthusiasm for Tesla began in 2013 when he test drove a Model S. However, over time, his concerns about Musk's behavior grew, especially after Musk's $44 billion acquisition of Twitter in 2021.

Gebor's criticisms include Musk's tumultuous presence on social media and legal disputes, which he believes have damaged Tesla's brand image. He also attempted to address these issues by running for a seat on Tesla's board of directors in 2023, but his proposals were largely ignored.

He said, "I think the stock is indeed overvalued because I don't think they have achieved any of their target expectations." He added that he believes there is weak demand for Tesla and he cannot sell his two Teslas at a reasonable price.

"Based on the current strategy, I don't see how they can sell more cars," Gerber said.

Given that Tesla's stock price has fallen by 15% in 2024, Gerber remains skeptical about its future performance. He believes Tesla's stock price may fall by another 15% and points out that he thinks the fair value of the stock is about $180 per share.

Gerber also stated that if other electric car companies like Rivian are able to expand production scale and lower prices, they could become the "next Tesla".

Gerber said that before he becomes bullish on Tesla again, either the company needs to make clearer commitments on advertising and boosting car sales, or Musk needs to clean up his image.

"I mean, I would be excited if he wanted to change his image. But that's not possible. So I don't think that's an option."