スイスの8月のインフレ率の緩和は予想を上回り、この国の中央銀行が再び利下げすることを支持しています。

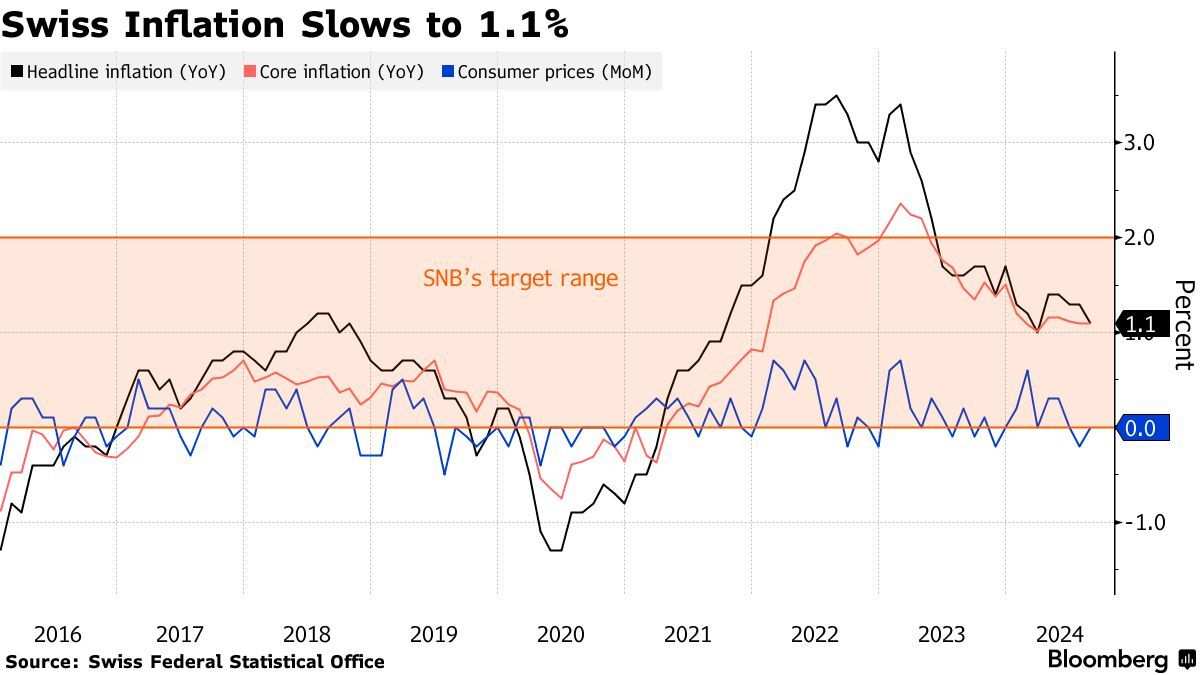

智通财经APPによると、火曜日に発表されたデータによると、スイスの8月の消費者物価指数(CPI)は前年比で1.1%上昇し、前月の1.3%および市場の予想の1.3%を下回りました。スイスの8月のインフレ率の緩和は予想を上回り、この国の中央銀行が再び利下げすることを支持しています。

データによると、交通、暖房用オイル、および国際旅行パッケージの費用が下がり、家賃や衣装と履物の価格の上昇の影響を相殺しました。さらに、コアCPI(生鮮食品や季節商品、エネルギーを除いた指数)は1.1%の年間上昇率を維持しています。

今年3月にスイス中央銀行は予想外にも25ベーシスポイントの利下げを選択し、グローバルマーケットの他の主要な中央銀行よりも早く緩和サイクルを開始し、6月に再び25ベーシスポイントの利下げを行いました。経済学者は現在、スイス中央銀行は今月末の政策会議で再び25ベーシスポイントの利下げを行い、基準金利を1%に引き下げる可能性があると予測しています。

今年3月にスイス中央銀行は予想外にも25ベーシスポイントの利下げを選択し、グローバルマーケットの他の主要な中央銀行よりも早く緩和サイクルを開始し、6月に再び25ベーシスポイントの利下げを行いました。経済学者は現在、スイス中央銀行は今月末の政策会議で再び25ベーシスポイントの利下げを行い、基準金利を1%に引き下げる可能性があると予測しています。

スイスのインフレ率の緩和と強いスイスフランは、スイス中央銀行の利下げの可能性を支えています。特にアナリストたちは懸念しており、ヨーロッパ中央銀行がスイス中央銀行に追いついて利下げを行った場合(ヨーロッパ中央銀行の政策会議の頻度はスイス中央銀行の2倍です)、スイスフランが刺激を受ける可能性があります。

さらに、スイス中央銀行の役員は、国内のサービス業の推進により、第3四半期の消費者物価指数は平均1.5%成長すると予測しており、その後は緩やかに減少し、2026年までに1%になると予想しています。

瑞士央行在今年3月出人意料地选择降息25个基点,比全球其他主要央行更早启动了宽松周期,并在6月再度降息25个基点。经济学家目前预计,瑞士央行可能会在本月底的政策会议上再次降息25个基点,使基准利率降至1%。

瑞士央行在今年3月出人意料地选择降息25个基点,比全球其他主要央行更早启动了宽松周期,并在6月再度降息25个基点。经济学家目前预计,瑞士央行可能会在本月底的政策会议上再次降息25个基点,使基准利率降至1%。