Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio This Month

Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio This Month

The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

通訊服務板塊中目前最超賣的股票爲買入被低估企業提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

comScore Inc (NASDAQ:SCOR)

康姆斯克公司(納斯達克:SCOR)

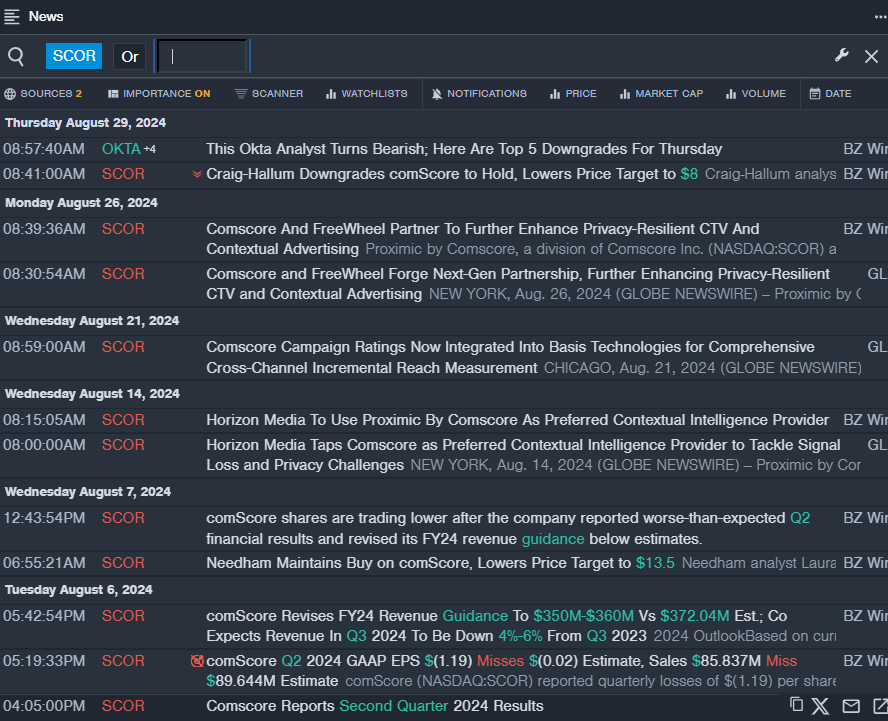

- On Aug. 6, comScore reported worse-than-expected second-quarter financial results and revised its FY24 revenue guidance below estimates. "While the second quarter fell short of our expectations, we remain confident that the direction we're taking the company – one that is focused on delivering omnichannel measurement solutions to address the growing gaps in today's measurement offerings – is the right one," said Jon Carpenter, CEO of Comscore. The company's stock fell around 45% over the past month and has a 52-week low of $6.41.

- RSI Value: 28.03

- SCOR Price Action: Shares of comScore gained 2.3% to close at $7.17 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest SCOR news.

- 8月6日,康姆斯克公司公佈了比預期還差的第二季度財務結果,並將FY24營收指導下調至預期以下。「雖然第二季度未達到我們的預期,但我們仍然相信我們正在推行的公司發展方向——專注提供全渠道測量解決方案,以解決當今測量需求中不斷增長的差距——是正確的。」康姆斯克公司CEO喬恩·卡本特說道。該公司股價在過去一個月下跌了約45%,52周最低價爲6.41美元。

- RSI值:28.03

- 康姆斯克公司股票價格變動情況:週五,康姆斯克公司股票上漲2.3%,收盤價爲7.17美元。

- Benzinga Pro的實時新聞提醒了最新的康姆斯克公司新聞。

SPAR Group Inc (NASDAQ:SGRP)

spar group股票(NASDAQ:SGRP)

- On Aug. 14, SPAR Group posted better-than-expected quarterly sales. Mike Matacunas, the Company's President and Chief Executive Officer, commented, "Our second quarter results reflect a focus on simplification and driving growth in the Americas, specifically the U.S. and Canada. Our revenues in the second quarter were up 37% in the ongoing U.S. business and 14% in Canada. In addition, we continued to divest in underperforming assets in the second quarter resulting in a one-time $4.9 million capital gain and increasing our cash to $22 million. Our financials are stronger than they have ever been in the history of the company and demand for our services is growing." The company's stock fell around 20% over the past month. It has a 52-week low of $0.70.

- RSI Value: 25.61

- SGRP Price Action: Shares of SPAR Group closed at $1.45 on Friday.

- Benzinga Pro's charting tool helped identify the trend in SGRP stock.

- 8月14日,spar group發佈了超出市場預期的季度銷售報告。公司總裁兼首席執行官Mike Matacunas評論稱:「我們第二季度的業績反映出我們在美洲特別是美國和加拿大的簡化和推動增長方面的重點。我們第二季度的營業收入在持續的美國業務中增長了37%,在加拿大增長了14%。此外,我們在第二季度繼續剝離不佳的資產,實現一次性490萬美元的資本收益,並將現金增加到2200萬美元。我們的財務狀況比公司歷史上任何時候都要強大,對我們服務的需求也在增長。」該公司的股價在過去一個月下跌了約20%。股價的52周最低價爲0.70美元。

- RSI值:25.61

- spar group的股票收盤價週五爲1.45美元。

- Benzinga Pro的圖表工具幫助識別出SGRP股票的趨勢。

IQIYI Inc – ADR (NASDAQ:IQ)

愛奇藝公司(NASDAQ:IQ)

- On Aug. 27, Goldman Sachs analyst Lincoln Kong downgraded iQIYI from Buy to Neutral and announced a $2.8 price target.. The company's shares fell around 31% over the past month and has a 52-week low of $2.08

- RSI Value: 26.24

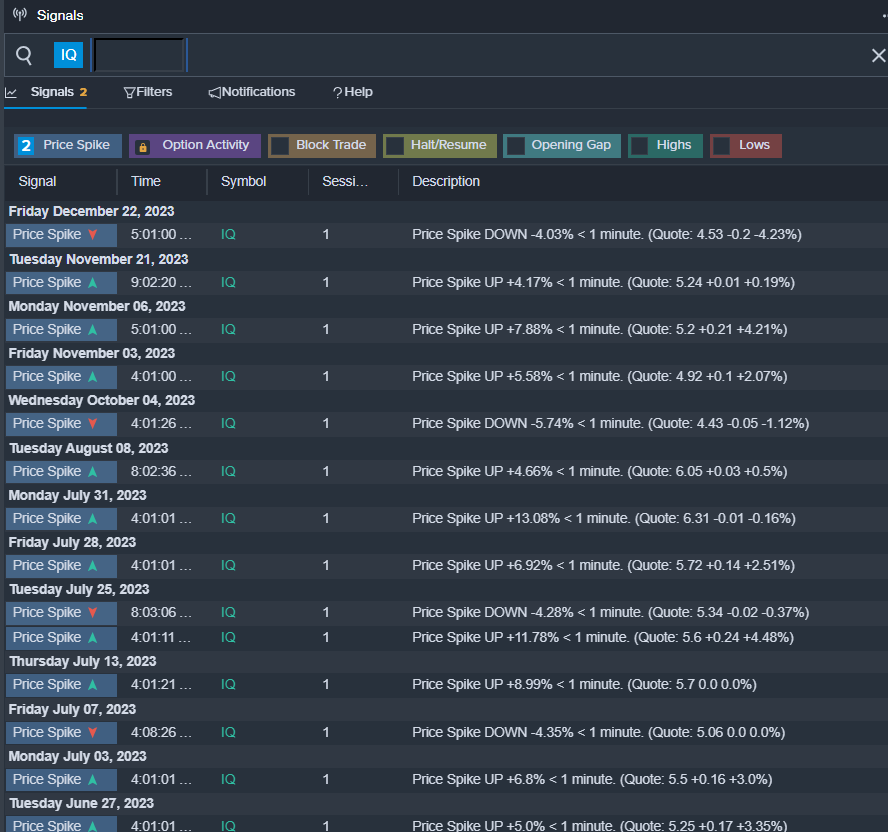

- IQ Price Action: Shares of IQIYI fell 4% to close at $2.15 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in IQ shares.

- 高盛分析師林肯·康將愛奇藝的買入評級下調爲中立,並宣佈2.8美元的目標價格。該公司的股價在過去一個月下跌了約31%,52周最低價爲2.08美元。

- RSI值:26.24

- 愛奇藝股票的價格走勢:週五收盤時,愛奇藝股票下跌了4%,收於2.15美元。

- Benzinga Pro的信號功能通知了IQ股票的潛在突破。

Read More:

閱讀更多:

- This Analyst With 87% Accuracy Rate Sees Over 24% Upside In Nvidia – Here Are 5 Stock Picks For Last Week From Wall Street's Most Accurate Analysts

- 這位準確率爲87%的分析師認爲英偉達的上漲空間超過24% - 以下是華爾街最準確分析師上週的5個股票推薦