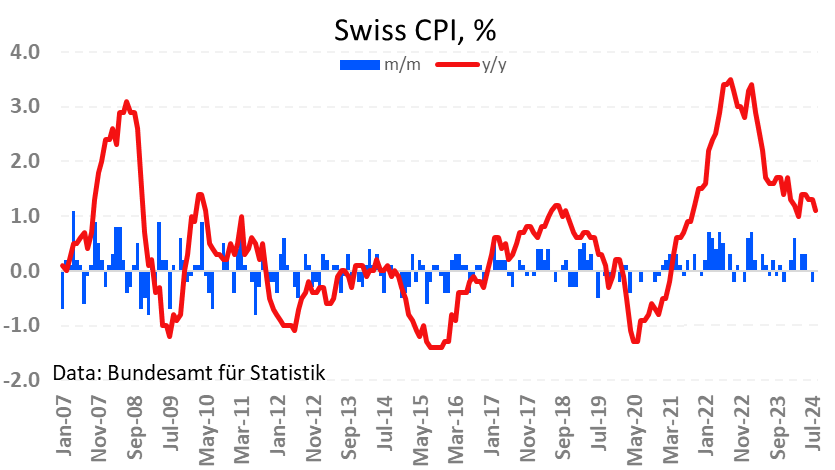

Switzerland's inflation rate in August fell to 1.1% year-on-year from 1.3% in the previous month, lower than the forecast of 1.2%. Prices rose to 1.4% year over year in April and May, but then began to fall again, falling 0.2% over the past three months.

(Swiss CPI chart)

The Swiss National Bank (Swiss National Bank) cut the benchmark interest rate twice in March and June. However, a further slowdown in price growth and the appreciation of the Swiss franc opened the door for further monetary easing.

USD/CHF has returned to a low of around 0.8500 at the beginning of this year. Against the backdrop of rising expectations of the Federal Reserve's interest rate cuts, the pair fell to this region at the time as it is now. Meanwhile, Switzerland's earlier easing policy did not significantly weaken the Swiss franc.

USD/CHF has returned to a low of around 0.8500 at the beginning of this year. Against the backdrop of rising expectations of the Federal Reserve's interest rate cuts, the pair fell to this region at the time as it is now. Meanwhile, Switzerland's earlier easing policy did not significantly weaken the Swiss franc.

(USD/CHF weekly chart)

The strength of the Swiss franc may encourage monetary authorities to take more active measures to curb the appreciation of the Swiss franc, including issuing warnings or actual exchange rate intervention. The Swiss franc only fell below current levels in 2011.

An overly strong Swiss franc will reduce export competitiveness, thereby harming the Swiss economy, which may be a problem for Switzerland's open economy.

At 04:30 Beijing time, USD/CHF reported 0.8505, a decrease of 0.06%.

美元兑瑞郎回到了今年年初低点0.8500附近。在美联储降息预期上升的背景下,该货币对当时和现在一样跌至该区域。与此同时,瑞士早些时候的宽松政策并没有显著削弱瑞郎。

美元兑瑞郎回到了今年年初低点0.8500附近。在美联储降息预期上升的背景下,该货币对当时和现在一样跌至该区域。与此同时,瑞士早些时候的宽松政策并没有显著削弱瑞郎。