①奥瑞金が中粮包装を買収する主な動機は何ですか? ②奥瑞金の買収プロセスで、主なチャレンジは何でしたか?

財界社9月4日(編集 胡家荣)中粮包装(00906.HK)は昨日、市場の注目を集めるニュースを発表しました。その中で奥瑞金(002701.SZ)は昨日、公告を発表し、中粮包装の発行済株式すべてを要約買収することを計画しており、取引価格の上限は5524百万元です。

注:公告

具体的には、奥瑞金は関連子会社の华瑞凤泉有限公司の海外関連会社である华瑞凤泉发展有限公司を通じて、香港証券取引所上場企業である中粮包装の全株主に対し、自発的で条件付きの全面的な要約買収を行い、現金で中粮包装の発行済株式を買収する計画です。要約価格は1株当たり7.21香港ドルで、総取引価格の上限は6066百万元です。

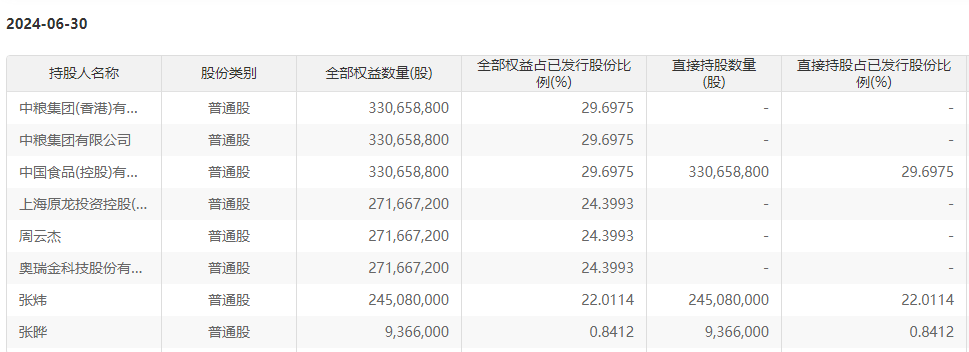

2024年6月6日、張煒(報告書の署名日時点で中粮包装2.45億株を所有し、中粮包装の発行済株式の約22.01%を占める)は要約人との不可撤回の承諾書に署名し、張煒は条件なしかつ不可撤回で本要約の最終受け入れ日までに、所有するすべての中粮包装株式を本要約に受け入れることを同意し、この受け入れを撤回しないことを約束しました。

2024年6月6日、張煒(報告書の署名日時点で中粮包装2.45億株を所有し、中粮包装の発行済株式の約22.01%を占める)は要約人との不可撤回の承諾書に署名し、張煒は条件なしかつ不可撤回で本要約の最終受け入れ日までに、所有するすべての中粮包装株式を本要約に受け入れることを同意し、この受け入れを撤回しないことを約束しました。

要約価格は1株当たり7.21香港ドルであり、総取引価格の上限は6066百万元、約5524億元です。

報告書の署名日までに、奥瑞金は子会社の奥瑞金開発と湖北奥瑞金を通じて中国粮食包装の24.40%の株式を保有しています。この買収要請は、自発的で条件付きの公開買付けであり、最大で8.41億株を取得する予定であり、総株式の75.56%を占めます。取引が完了すると、奥瑞金は中国粮食包装の統制権を持つことになります。

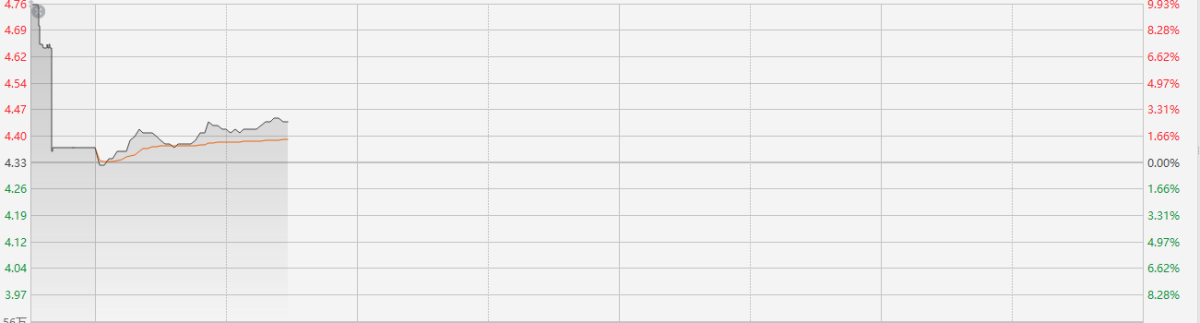

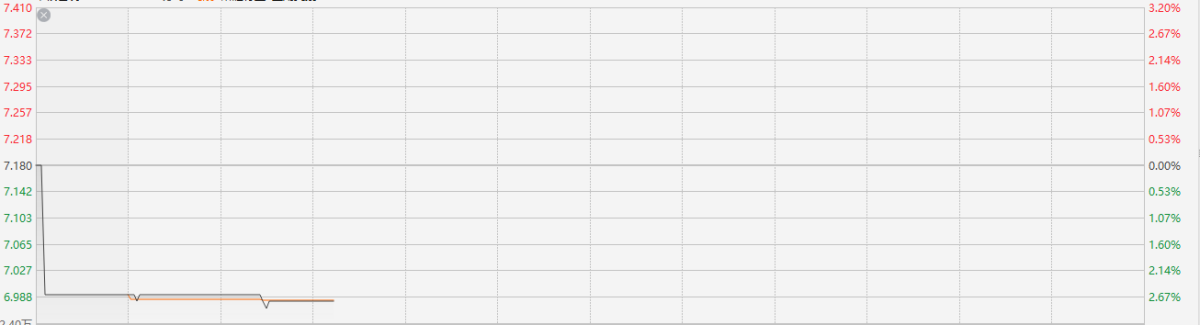

記事が執筆された時点で、奥瑞金の株価は1.62%上昇し、4.40元になりました。中国粮食包装の株価は2.79%下落し、6.98香港ドルになりました。

注:中国粮食包装のパフォーマンス

今日のパフォーマンスから判断すると、この買収のニュースは中国粮食包装の株価を刺激することはありませんでした。しかし、同社の株価は昨年6月末から累計で80%上昇しています。

注:中国粮食包装の過去1年間のパフォーマンス

奥瑞金が中国粮食包装を買収する道は順調ではありませんでした。

実際には、これはorg technology の中糧包装を買収するための2回目の発表です。今年6月に、この会社は中糧包装の全ての発行済み株式を現金による買収で買収することを発表しました。買収価格は7.21香港ドルで、交渉価格の上限は60.6億香港ドル(約55.2億元)です。

一方、org technology の買収計画には強力な競争相手が存在します。7月30日の発表によると、中糧包装は中国宝武から正式な買収要件書を受け取りました。今回の買収要件の価格は、現金による6.87香港ドルです。買収要件に関連する株の総数は11.13億株であり、すべての買収要件が受け入れられる場合、最大の買収現金は76.49億香港ドルに達します。

公開データによれば、org technology と中糧包装はいずれも中国の金属包装業界のトップ企業です。2023年の売上高に基づいて計算すると、org technologyは業界1位で、中糧包装は業界2位です。中国宝武の子会社である宝武包装は業界3位です。前瞻産業研究院のデータによると、缶タイプの容器市場でのorg technology、宝武包装、中糧包装のシェアはそれぞれ20%、18%、17%です。

具体来看,奥瑞金拟通过下属华瑞凤泉有限公司的境外下属公司华瑞凤泉发展有限公司,以每股要约股份7.21港元的要约价,向香港联交所上市公司中粮包装全体股东发起自愿有条件全面要约,以现金方式收购中粮包装的全部已发行股份。

具体来看,奥瑞金拟通过下属华瑞凤泉有限公司的境外下属公司华瑞凤泉发展有限公司,以每股要约股份7.21港元的要约价,向香港联交所上市公司中粮包装全体股东发起自愿有条件全面要约,以现金方式收购中粮包装的全部已发行股份。