Recently, Global New Materials International (6616.HK) disclosed financial results for the first half of 2024 ending June 30. The Group achieved significant growth in revenue and net profit in the first half of the year, and submitted satisfactory responses at the performance level.

Looking back at the first half of 2024, the Group achieved many achievements under the development strategy of “putting equal emphasis on endogenous development and epitaxial expansion”. Internally, the company's investment in production capacity construction has achieved phased results, laying a solid foundation for the company's future development; externally, the results of the merger and acquisition of CQV were reflected during this performance period, and the Group's acquisition plan for Merck's surface solutions business in Germany has also accelerated the company's internationalization process, which is conducive to enhancing the company's competitiveness in the global market.

1. Revenue and net profit both increased, and high-end products led to an improvement in gross profit

Judging from financial data, Global New Materials International's business performance in the first half of 2024 is excellent. In the first half of the year, the company achieved revenue of 0.775 billion yuan, an increase of about 66.8% over the first half of 2023; realized gross profit of 0.388 billion yuan, an increase of 72.8% over the same period last year, gross margin was 50.1%, up 1.7 percentage points from the same period last year; profit during the realized period was 0.145 billion yuan, an increase of about 52.7% over the same period last year, and the operating profit margin was 18.7%. EBITDA revenue was $0.267 billion, up 63.1% year over year.

Judging from financial data, Global New Materials International's business performance in the first half of 2024 is excellent. In the first half of the year, the company achieved revenue of 0.775 billion yuan, an increase of about 66.8% over the first half of 2023; realized gross profit of 0.388 billion yuan, an increase of 72.8% over the same period last year, gross margin was 50.1%, up 1.7 percentage points from the same period last year; profit during the realized period was 0.145 billion yuan, an increase of about 52.7% over the same period last year, and the operating profit margin was 18.7%. EBITDA revenue was $0.267 billion, up 63.1% year over year.

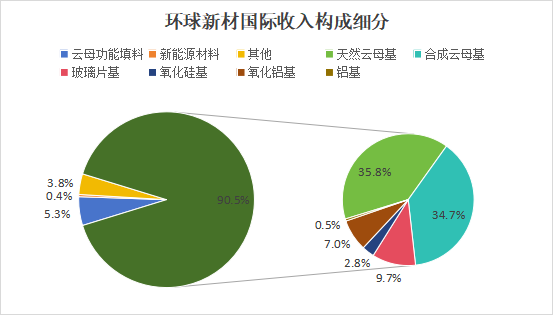

By business, pearlescent pigments are still the main source of the company's revenue, accounting for 90.5% of revenue, but their product range is significantly richer than in the same period last year. During the reporting period, the company's pearlescent pigment revenue reached 0.701 billion yuan, an increase of about 66.2% over the same period last year. Among them, the revenue of synthetic mica-based pearlescent pigments reached 0.269 billion yuan, accounting for 38.3% of pearlescent pigment revenue, which has an important position.

In addition to mica products, the company's pearlescent pigment products also include products such as glass-based, silicon oxide-based, alumina-based, and aluminum-based pearlescent pigments. Among them, revenue from glass-based and silicon oxide-based pearlescent pigments increased by 130% and 716% respectively over the same period last year, which is a significant increase over the same period last year; alumina-based and aluminum-based pearlescent pigment products achieved revenue of 54.5 million yuan and 3.62 million yuan respectively, but there was no such segment for the same period last year. Overall, the company's mid-to-high-end product matrix has been further enriched. Although the current share is limited, the total contribution to revenue has increased significantly.

According to the company's management, thanks to the company's continuous investment in R&D and the addition of high-end products brought by CQV, the proportion of high-end products in the company's pearlescent pigment products is constantly increasing. As of the first half of 2024, Global New Materials International has a total of 154 patents and 73 registered trademarks. At present, the total number of pearlescent pigment products that the company can provide exceeds 2,100, accounting for more than 50% of high-end products.

In terms of expenses, the company has increased its R&D investment, and sales expenses have also increased. In the first half of 2024, the company's R&D expenses increased 40% year on year, and sales expenses increased by more than 107% year on year. However, judging from the overall cost ratio, the company's sales and administrative expenses ratio in the first half of the year was 20.3%, which remained stable overall.

2. Overseas mergers and acquisitions have achieved remarkable results, and future planning benefits can be expected

Judging from the Group's performance report and financial reporting structure, the acquisition of CQV has had a significant boost effect on Global New Materials International. The company officially completed the acquisition of CQV in August 2023. The latter is a well-known pearlescent pigment company in Korea and the only company in the world that can mass-produce pearlescent pigment products based on automotive-grade alumina. After the CQV merger, the company's revenue sources tend to diversify, and the business model is closer to the nature of a multinational group.

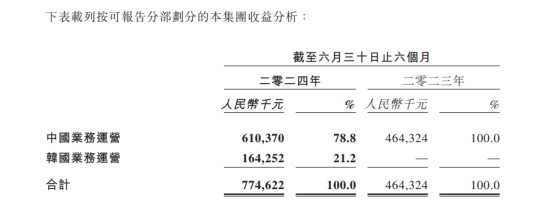

Specifically, in the financial reporting structure for interim results, the company's business is divided into two major modules: China business and South Korea business. Although the main business of both is the production/sale of pearlescent pigments, the two follow different marketing strategies in terms of operation and are also managed independently. In the first half of 2024, the company's Korean operations provided the company with 0.164 billion yuan in revenue, accounting for 21.2% of revenue.

Judging from the benefits of resource integration brought about by mergers and acquisitions, CQV has significantly benefited from Global New Materials International's supply chain, and its financial performance has improved significantly. According to CQV's 2024 semi-annual report, CQV's revenue for the first half of the year reached 30.68 billion won, up 30.16% year on year, and gross margin increased by nearly 10 percentage points from 29.25% in the same period last year to 39.72%, achieving net profit of 5.1 billion won, an increase of 490% over the same period last year. As subsequent CQV performance continues to improve, its revenue contribution to Global New Materials International may further increase.

The merger of CQV also complements the company's technology research and development and product range, transforming the company's revenue structure to a high-end product line. In terms of products, CQV mainly focuses on automotive-grade and cosmetic grade products, while Global New Materials International has comprehensive coverage, and the two sides have complementary relationships in terms of product structure. CQV and Global New Materials International have now cooperated to develop 32 pearlescent pigment products, and will continue to cooperate to develop new products in the future.

Management revealed that CQV will support the intelligent upgrading and transformation of the Seven Color Pearl Phase II factory. The cooperation between the two sides is also expected to become a model for Chinese enterprises to go overseas, and an example of mutual benefit and mutual progress and development for Chinese and foreign enterprises.

As for the follow-up layout, Global New Materials International announced an agreement with Merck of Germany in July this year to acquire its global surface solutions business. If the acquisition is successfully implemented, the company's business layout in Europe and America will be complemented, its global marketing channels are expected to be improved, and the company is expected to transform from a material manufacturer to a global innovation leader.

3. When capacity is released, R&D results are commercialized

On the production capacity side, Global New Materials International ushered in the first quarter of 2024 when production capacity was released. The second phase of the Pearlescent Materials Smart Factory in Luzhai, Guangxi, was officially put into operation in February 2024. It mainly produces high-end automotive weather-resistant, cosmetic grade, and special functional pearlescent materials. By the end of June 2024, the plant had added 3,000 tons to Global New Materials International.

In the past 2023, Global New Materials International continued to be in a state of full production and sales. The first phase of the plant already has a pearlescent pigment production capacity of 18,741 tons and a production capacity of 12,474 tons of synthetic mica powder, and the capacity utilization rate of both types of products is overloaded. However, the Phase II plant, which was launched at the beginning of this year, is an important foundation for the company to achieve a decline in production capacity, break sales bottlenecks, and contribute to increasing the company's sales volume and high-end production capacity.

In addition to pearlescent pigment products, Global New Materials International is also exploring the application of synthetic mica in the fields of new energy and cosmetics. In the first half of 2024, the company achieved revenue in the fields of cosmetic functional fillers and new energy battery insulation materials, which only accounted for a small share of the company's revenue. As the scale of the company's R&D investment increases, the company will continue to consolidate and deepen its product advantages in the automotive and cosmetics fields, and actively explore new application areas and directions.

Overall, the results of the company's “equal emphasis on endogenous development and epitaxial expansion” strategy over the past two years will gradually be reflected through performance in 2024. Internally, the company's bottlenecks on the production capacity side are gradually opening up, and the results on the scientific research side are gradually being commercialized, and are reflected in the variety of product sales revenue; in the epitaxial sector, mergers and acquisitions of CQV have successfully improved profit levels, ushered in changes in various fields such as business structure, market channels, product technology, etc., and there is still a large market space to be explored.

Looking ahead to the second half of 2024 to the 2025 performance period, the merger and acquisition of Merck's surface solutions business in Germany will become the company's core catalyst. Under the expectation that the merger progresses smoothly, the company is expected to experience a gradual increase in revenue and profit sides in the future, and its valuation is also expected to be reshaped as the market recovers.

从财务数据来看,环球新材国际在2024年上半年的业务表现称得上优秀。上半年公司实现收入7.75亿人民币,较2023年上半年增长约66.8%;实现毛利为3.88亿元,较去年同期增长72.8%,毛利率为50.1%,较去年同期提升1.7个百分点;实现期内利润为1.45亿元,较去年同期提升约52.7%,营业利润率为18.7%。EBITDA收益为2.67亿元,同比增长达到63.1%。

从财务数据来看,环球新材国际在2024年上半年的业务表现称得上优秀。上半年公司实现收入7.75亿人民币,较2023年上半年增长约66.8%;实现毛利为3.88亿元,较去年同期增长72.8%,毛利率为50.1%,较去年同期提升1.7个百分点;实现期内利润为1.45亿元,较去年同期提升约52.7%,营业利润率为18.7%。EBITDA收益为2.67亿元,同比增长达到63.1%。