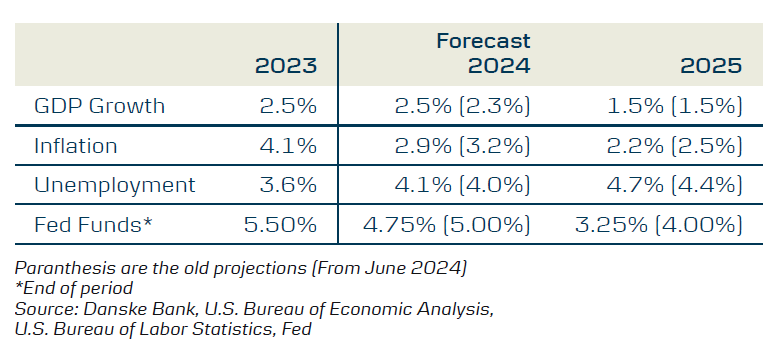

Danske Bank's report states that the slowdown in the growth of the USA economy is basically in line with expectations, and the risk of economic recession is still low. We have made only minor adjustments to our forecasts, with GDP growth expected to be 2.5% in 2024 (up from 2.3%) and 1.5% in 2025 (unchanged). With the increase in labor supply, steady growth in productivity, and support from manufacturing investment demand driven by fiscal policies, potential output continues to grow rapidly.

The report states that the risks to the economic outlook still lean towards downward to some extent. The current low savings rate indicates that consumers' ability to buffer is still weak. The slow transmission of monetary policy and the high share of fixed-rate mortgages indicate that if the outlook deteriorates faster than our expectations, interest rate cuts will not be able to quickly spur economic growth. Inflation forecasts have been slightly lowered. We expect the average overall inflation rate in 2024 to be 2.9% (previously 3.2%) and 2.2% in 2025 (previously 2.5%). The core inflation rate for 2024 is expected to be 3.3% (previously 3.4%) and 2.4% in 2025 (previously 2.6%).

The report predicts that the Federal Reserve will lower interest rates by 25 basis points at each meeting from September to June 2025. Starting from September, every other meeting is expected to have a rate cut, and the nominal end policy rate is expected to be 3.00-3.25% by the end of 2025.

(Adjusted US economic forecast by Danske Bank)

(Adjusted US economic forecast by Danske Bank)

The main contents of the report are as follows:

In the first half of 2024, the USA economy grew slower, partly due to the negative contribution of net exports, but also included a slowdown in private consumption and investment growth. The cooling rate of the labor market conditions was also faster than expected, but mainly due to the rapid growth of the labor force, as the number of layoffs is still low. Overall, we believe that the USA economy is stable and a soft landing is still expected.

In contrast to some European economies, the savings rate of American consumers has remained at a low level throughout the post-pandemic period. The steady labor market and relatively optimistic consumer confidence have supported the continuous growth of actual expenditure. However, if wage growth slows down and concerns about rising unemployment arise, consumers' savings buffers remain weak. The latest retail sales and sentiment indicators indicate that, as of now, nominal expenditure growth remains active, with an increase in optimism about future prospects, but consumers' concerns about the current economic situation are also growing.

Investment growth has also slowed down due to the impact of a tight monetary policy on corporate expansion plans. The uncertainty of the fiscal policy outlook, especially the future of IRA subsidies, may have also delayed some investment plans. However, regardless of the election results, we expect the overall fiscal policy stance to remain expansionary in the coming years. Kamala Harris may follow in the footsteps of the Biden administration, retaining the IRA policy while choosing to increase corporate taxes to fund the growing deficit. On the other hand, although Trump's plans to abolish the IRA policy and significantly increase import tariffs will have a disruptive impact on economic growth in the short term, he will also provide support for economic growth by extending the tax reduction policies of the TCJA from his first term and further reducing corporate taxes. We expect that neither candidate will significantly reduce the public budget deficit in the short term, but if Trump wins, there will be a higher risk of unsustainable debt dynamics.

Inflation has slowed down this summer, and since June, especially the wider service price pressures have significantly eased. In addition to alleviating labor shortages, strong growth in labor productivity has also continued to alleviate cost pressures for businesses. Rising productivity and labor supply mean that the potential growth rate of the U.S. economy remains high. We believe that the risk of a full recession is still low, but we expect growth rates to remain below potential levels in the next few quarters.

(Expected pace of interest rate cuts in the USA before June 2025, 25 basis points per cut)

As the labor market overheating period has prolonged, both realized and expected inflation have cooled down. We now expect the Federal Reserve to cut interest rates by 25 basis points at each meeting from September to June 2025, followed by two final cuts of 25 basis points in the second half of 2025. Therefore, we expect the nominal end policy rate to be 3.00-3.25% by the end of 2025.

Expectations of rapid interest rate cuts have eased the financial conditions in the market. On the other hand, the slow transmission of monetary policy means that the boost to economic growth will have a long delay. 95% of mortgages in the United States are fixed-rate, and although mortgage rates have started to decline, demand for new loans remains low. In our view, the risk of an economic recession is still low, and FOMC participants have expressed a preference for a gradual easing cycle. We disagree with market speculation about a 50 basis point interest rate cut. Nevertheless, we now believe that the Federal Reserve's pace of interest rate cuts will be significantly faster than that of the European Central Bank, reflecting expectations of sustained growth in the U.S. economic capacity. In our view, the Eurozone does not have a similar downturn, and the European Central Bank will not cut interest rates as quickly as the Federal Reserve.

(丹麦银行调整后的美国经济预测)

(丹麦银行调整后的美国经济预测)