Nvidia's market cap was wiped out by a record $279 billion on Tuesday, prompting traders to search for clues on when the pain might end on technical charts.

According to Jay Woods, Chief Global Strategist at Freedom Capital Markets, $100 - not far from the stock's lowest closing price last month - is an important level to watch. Nvidia's stock fell about 2% to around $106 in pre-market trading on Wednesday.

"I don't want to see the stock fall below the August low and set a new closing low, as it would mean that the situation has changed, at least technically," Woods said. "I think it will find support around $100, then trade sideways for a while."

The latest sell-off has caused Nvidia's stock to fall 14% in three trading days, as the chipmaker's performance failed to meet the market's previously high expectations. Two research reports released on Tuesday expressed caution about the company's spending on artificial intelligence, exacerbating investor anxiety. And more bad news emerged after the market closed, as Nvidia received a subpoena as part of the U.S. Department of Justice's antitrust investigation.

Nvidia's stock faces a lack of positive catalysts on its calendar, according to Michael Kirkbride, Portfolio Manager at Evercore Wealth Management.

"We are currently in a period of lull. Earnings have been announced, and there are many economic data releases this month. There is a strong sense of caution in the market before that," he said. "When you are in a trading vacuum, it becomes a market that is essentially very short-term action-oriented."

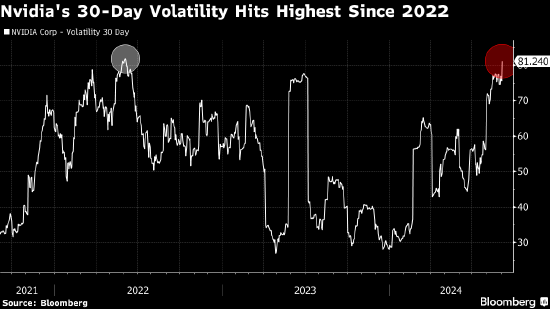

Nvidia's sharp drop dragged down the stock prices of global chipmakers and risk assets. The stock has been volatile in recent months, and Tuesday's decline was the seventh time in two months that the stock fell 6% or more. Data compiled by Bloomberg shows that Nvidia's 30-day volatility indicator also reached its highest level since mid-2022.

Investors will also review last month's data to understand at what price Nvidia's stock price may have hit bottom. In August, Nvidia's stock price experienced a pullback, ultimately dropping 27% from its June high and then rebounding to a level less than 5% away from its record high. At that time, the stock's steep decline was due to a combination of macroeconomic factors and concerns about the sustainability of AI spending, and now those concerns have resurfaced in the market again.

In research reports released by Morgan Asset Management and BlackRock's think tank on Tuesday, the relatively low returns from Nvidia's AI investments, which amount to billions of dollars, have become a focal point of attention.

Michael Cembalest, Head of Market and Investment Strategy at Morgan Asset Management, wrote that in the next 12 to 18 months, there needs to be a broader demand from corporate clients, not just customers like OpenAI that train new AI models, to prove that massive spending on AI technology is justified.

At the same time, Jean Boivin, Head of BlackRock's think tank, stated that investors need to be patient because the expansion of data centers and the improvement of processing power usually take years, not just a few quarters, to complete.

However, Boivin suggested that investors should continue to overweight AI stocks, as the recent decline in technology stocks has provided an opportunity to rebuild positions.

Looking ahead, Woods from Freedom Capital and Kirkbride from Evercore WM remain bullish on Nvidia.

Woods believes there is no reason to panic about this week's decline, while Kirkbride states that the company or its earnings report does not have any fundamental issues.

"We are still long-term holders, and we haven't heard any news that could change the situation, whether it's about Nvidia, or their customers and their spending plans," Kirkbride said.

"We will be buyers now."