Unpacking the Latest Options Trading Trends in Lam Research

Unpacking the Latest Options Trading Trends in Lam Research

Investors with a lot of money to spend have taken a bullish stance on Lam Research (NASDAQ:LRCX).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LRCX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 28 uncommon options trades for Lam Research.

This isn't normal.

The overall sentiment of these big-money traders is split between 42% bullish and 32%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $375,780, and 19 are calls, for a total amount of $844,472.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $600.0 to $1040.0 for Lam Research over the last 3 months.

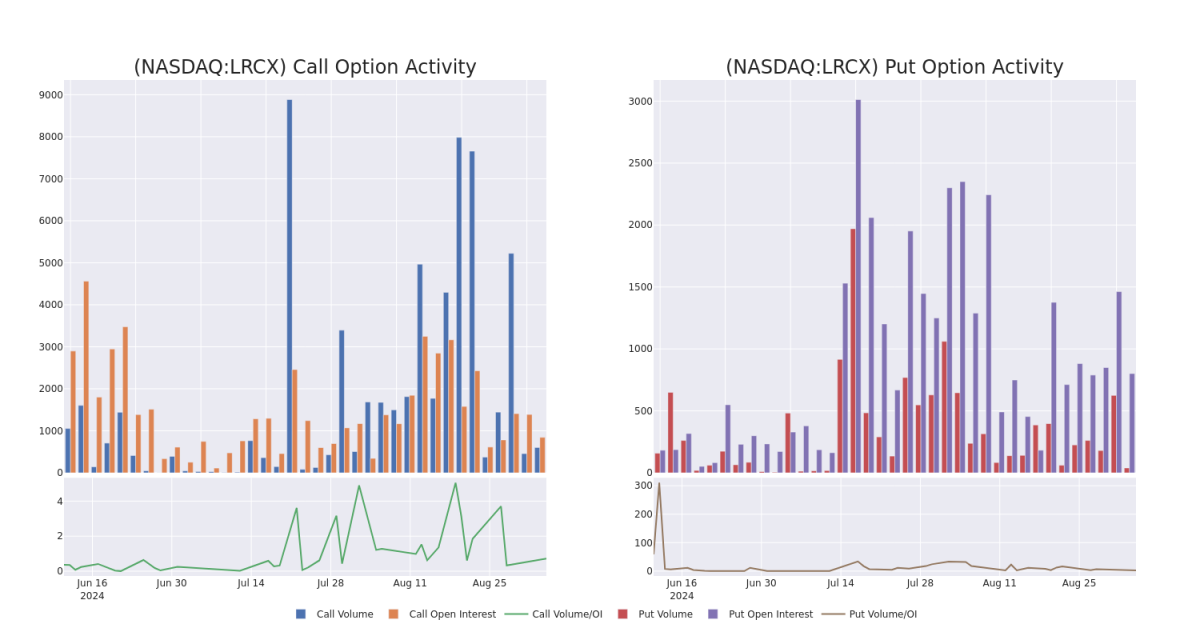

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Lam Research's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Lam Research's significant trades, within a strike price range of $600.0 to $1040.0, over the past month.

Lam Research 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | CALL | SWEEP | BULLISH | 02/21/25 | $64.5 | $60.25 | $64.5 | $840.00 | $90.3K | 10 | 48 |

| LRCX | PUT | TRADE | NEUTRAL | 01/16/26 | $216.05 | $206.15 | $211.35 | $900.00 | $84.5K | 13 | 4 |

| LRCX | CALL | TRADE | BULLISH | 01/17/25 | $82.25 | $79.15 | $81.26 | $780.00 | $81.2K | 157 | 13 |

| LRCX | PUT | SWEEP | BEARISH | 09/06/24 | $71.75 | $63.0 | $68.83 | $820.00 | $68.6K | 30 | 0 |

| LRCX | CALL | TRADE | BEARISH | 06/20/25 | $227.15 | $216.4 | $220.17 | $600.00 | $66.0K | 5 | 3 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Having examined the options trading patterns of Lam Research, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Lam Research

- Currently trading with a volume of 327,962, the LRCX's price is up by 0.27%, now at $767.83.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lam Research with Benzinga Pro for real-time alerts.