Deep-pocketed investors have adopted a bearish approach towards KLA (NASDAQ:KLAC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in KLAC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for KLA. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 55% bearish. Among these notable options, 2 are puts, totaling $74,130, and 7 are calls, amounting to $680,490.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $1220.0 for KLA over the last 3 months.

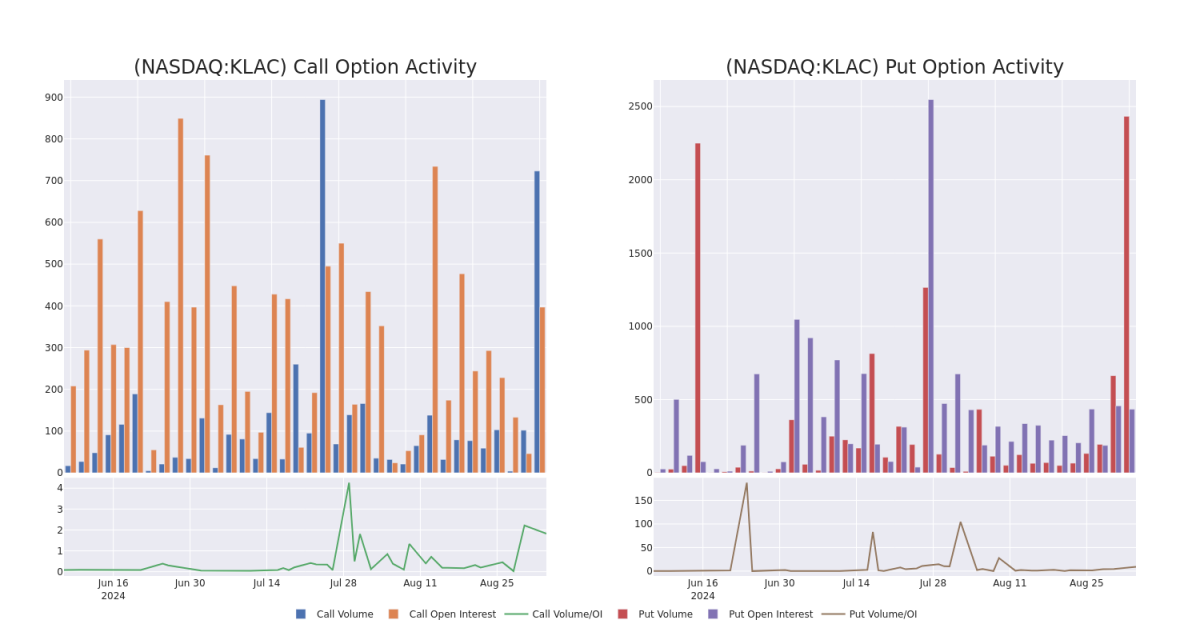

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for KLA's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of KLA's whale activity within a strike price range from $400.0 to $1220.0 in the last 30 days.

KLA Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KLAC | CALL | TRADE | BEARISH | 01/17/25 | $54.4 | $51.3 | $51.7 | $820.00 | $284.3K | 178 | 60 |

| KLAC | CALL | TRADE | BEARISH | 01/16/26 | $371.9 | $368.0 | $368.0 | $400.00 | $184.0K | 10 | 0 |

| KLAC | CALL | TRADE | BEARISH | 01/17/25 | $94.5 | $87.4 | $88.65 | $720.00 | $70.9K | 74 | 9 |

| KLAC | PUT | TRADE | BEARISH | 12/20/24 | $490.8 | $482.5 | $490.8 | $1220.00 | $49.0K | 0 | 1 |

| KLAC | CALL | TRADE | BULLISH | 01/17/25 | $91.4 | $91.4 | $91.4 | $720.00 | $45.7K | 74 | 14 |

About KLA

KLA is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segment of semiconductor process control, wherein machines inspect semiconductor wafers during research and development and manufacturing for defects and verify precise measurements. In this section of the market, KLA holds a majority share. It also has a small exposure to the etch and deposition segments of the WFE market. It counts as top customers the largest chipmakers in the world, including TSMC and Samsung.

In light of the recent options history for KLA, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is KLA Standing Right Now?

- Currently trading with a volume of 347,001, the KLAC's price is up by 0.42%, now at $744.51.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.