For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Teledyne Technologies (NYSE:TDY). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Teledyne Technologies' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Teledyne Technologies has managed to grow EPS by 24% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It seems Teledyne Technologies is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not a major concern but nor does it point to the long term growth we like to see.

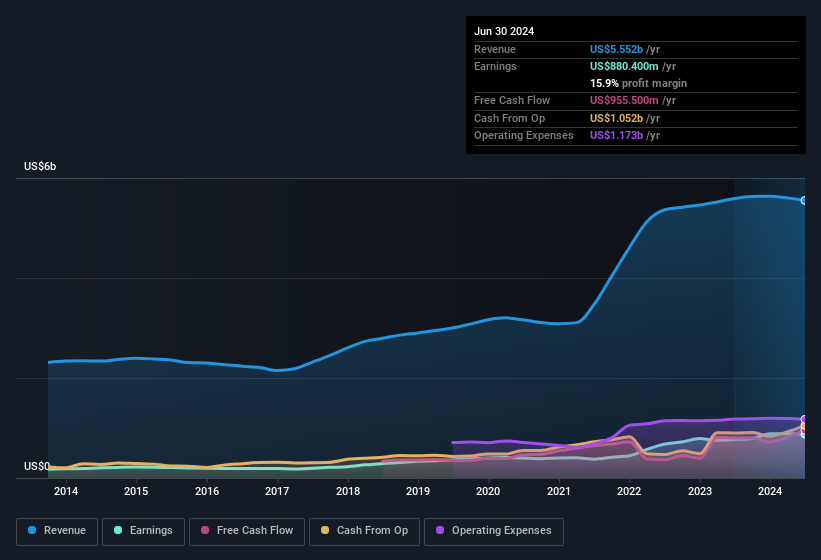

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Teledyne Technologies' forecast profits?

Are Teledyne Technologies Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$20b company like Teledyne Technologies. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Notably, they have an enviable stake in the company, worth US$229m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Teledyne Technologies, with market caps over US$8.0b, is about US$13m.

Teledyne Technologies' CEO took home a total compensation package of US$1.7m in the year prior to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Teledyne Technologies Deserve A Spot On Your Watchlist?

For growth investors, Teledyne Technologies' raw rate of earnings growth is a beacon in the night. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. This may only be a fast rundown, but the key takeaway is that Teledyne Technologies is worth keeping an eye on. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Teledyne Technologies is trading on a high P/E or a low P/E, relative to its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.