Carvana Unusual Options Activity For September 04

Carvana Unusual Options Activity For September 04

Investors with a lot of money to spend have taken a bearish stance on Carvana (NYSE:CVNA).

投資者看淡Carvana(紐交所:CVNA),他們有很多錢可供使用。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with CVNA, it often means somebody knows something is about to happen.

無論這是一個機構還是一個富有的個人,我們並不知道。但是當CVNA發生這樣大的變化時,通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 12 options trades for Carvana.

今天,Benzinga的期權掃描器發現了12個關於Carvana的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 41% bullish and 58%, bearish.

這些大手交易者的總體情緒在41%看好和58%看淡之間分歧。

Out of all of the options we uncovered, 11 are puts, for a total amount of $494,375, and there was 1 call, for a total amount of $25,571.

在我們發現的所有期權中,有11個看跌期權,總額爲$494,375,還有1個看漲期權,總額爲$25,571。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $170.0 for Carvana during the past quarter.

通過分析這些合同的成交量和未平倉合約,似乎大戶在過去一個季度一直在關注 Carvana 的價格區間,從$55.0到$170.0。

Volume & Open Interest Trends

成交量和未平倉量趨勢

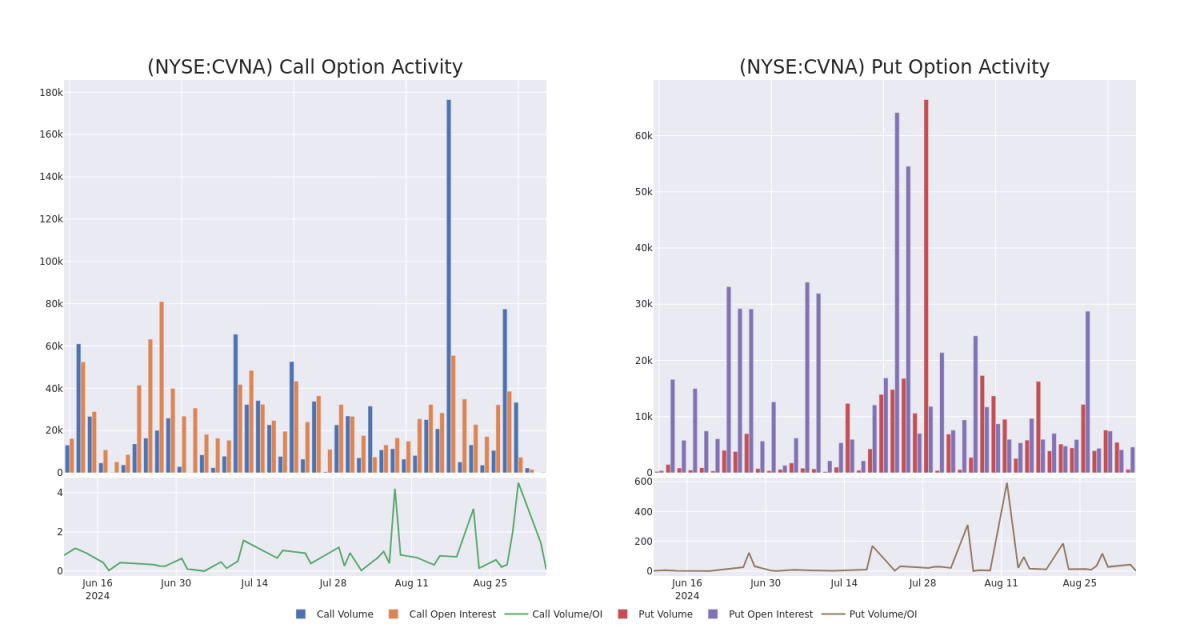

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Carvana's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Carvana's significant trades, within a strike price range of $55.0 to $170.0, over the past month.

檢查成交量和未平倉合約可以爲股票研究提供關鍵的見解。這些信息對於衡量 Carvana 特定行權價格期權的流動性和興趣水平至關重要。以下是過去一個月內 Carvana 交易的看漲期權和看跌期權在$55.0到$170.0行權價格區間內成交量和未平倉合約趨勢的快照。

Carvana Option Volume And Open Interest Over Last 30 Days

Carvana過去30天期權成交量和持倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | PUT | SWEEP | BEARISH | 10/18/24 | $27.1 | $26.65 | $27.1 | $170.00 | $81.3K | 94 | 38 |

| CVNA | PUT | TRADE | BULLISH | 02/21/25 | $36.2 | $35.2 | $35.2 | $160.00 | $59.8K | 67 | 17 |

| CVNA | PUT | SWEEP | BULLISH | 02/21/25 | $28.55 | $28.45 | $28.55 | $150.00 | $51.3K | 80 | 21 |

| CVNA | PUT | TRADE | BULLISH | 11/15/24 | $20.65 | $20.55 | $20.55 | $150.00 | $49.3K | 396 | 27 |

| CVNA | PUT | TRADE | BULLISH | 06/20/25 | $4.05 | $2.91 | $2.91 | $55.00 | $43.6K | 333 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| carvana | 看跌 | SWEEP | 看淡 | 10/18/24 | $27.1 | $26.65 | $27.1 | $170.00 | $81.3K | 94 | 38 |

| carvana | 看跌 | 交易 | 看好 | 02/21/25 | $36.2 | $35.2 | $35.2 | $160.00 | $59.8K | 67 | 17 |

| carvana | 看跌 | SWEEP | 看好 | 02/21/25 | $28.55 | $28.45 | $28.55 | $150.00 | $51.3千 | 80 | 21 |

| carvana | 看跌 | 交易 | 看好 | 11/15/24 | 20.65美元 | $20.55 | $20.55 | $150.00 | $49.3K | 396 | 27 |

| carvana | 看跌 | 交易 | 看好 | 06/20/25 | $4.05 | $2.91 | $2.91 | $55.00 | $43.6K | 333 | 0 |

About Carvana

關於Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Carvana Co是一家用於購買和銷售二手車的電子商務平台。公司的營業收入來自二手車銷售、批發車輛銷售和其他銷售和收入。其他銷售和收入包括在證券化交易中發起並出售的貸款銷售以及向融資合作伙伴的銷售、收到的VSC佣金以及GAP豁免保險的銷售。業務的基石是零售車輛銷售。這推動了大部分收入,並允許公司捕獲與融資、VSC、汽車保險、GAP豁免保險以及以舊車換新車的相關收入流相關的額外收入。

After a thorough review of the options trading surrounding Carvana, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在徹底審查了圍繞Carvana的期權交易之後,我們轉而更詳細地審查這家公司。這包括對其當前市場地位和業績的評估。

Present Market Standing of Carvana

Carvana 的現行市場狀況

- With a volume of 1,114,655, the price of CVNA is up 0.64% at $145.44.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 57 days.

- 成交量爲1,114,655股,CVNA的價格上漲0.64%,報145.44美元。

- RSI指標暗示該股票可能要超買了。

- 下一次業績公佈還有57天。

Expert Opinions on Carvana

關於Carvana的專家意見

In the last month, 1 experts released ratings on this stock with an average target price of $142.0.

上個月有1位專家對該股發佈了評級,平均目標價爲142.0美元。

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Carvana, targeting a price of $142.

- evercore ISI集團的分析師繼續保持立場,對carvana維持⼀個⼀致評級,目標價爲142美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with CVNA, it often means somebody knows something is about to happen.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with CVNA, it often means somebody knows something is about to happen.