Financial giants have made a conspicuous bullish move on Arista Networks. Our analysis of options history for Arista Networks (NYSE:ANET) revealed 9 unusual trades.

Delving into the details, we found 22% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $131,430, and 6 were calls, valued at $650,160.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $300.0 to $370.0 for Arista Networks over the recent three months.

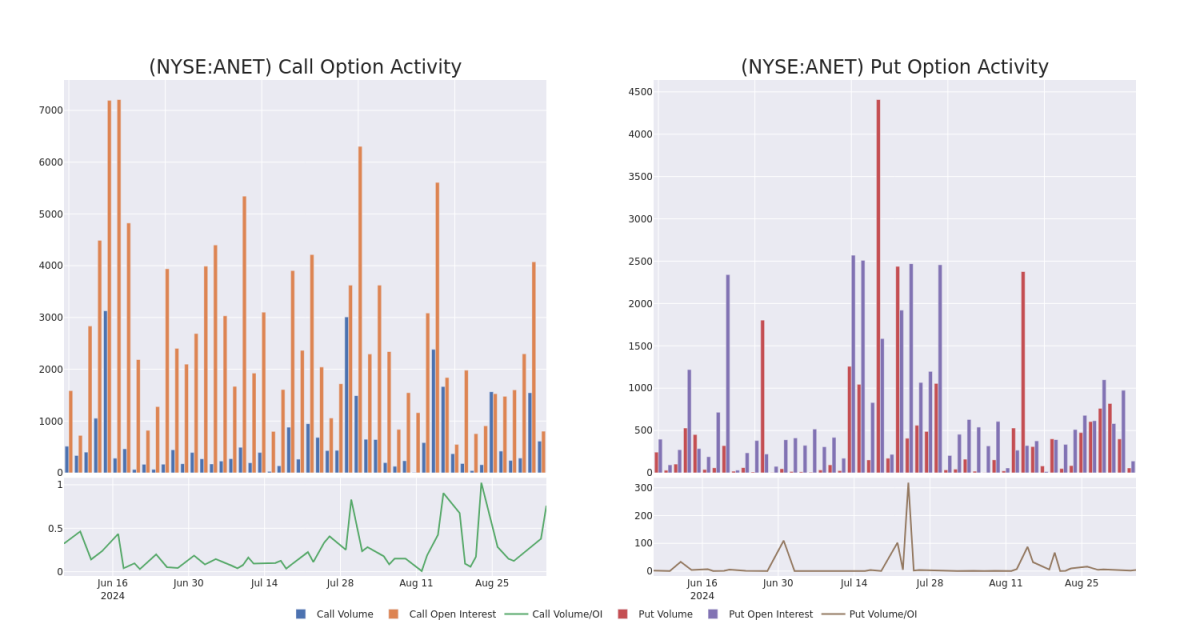

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Arista Networks's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Arista Networks's significant trades, within a strike price range of $300.0 to $370.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Arista Networks's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Arista Networks's significant trades, within a strike price range of $300.0 to $370.0, over the past month.

Arista Networks 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | CALL | SWEEP | NEUTRAL | 09/06/24 | $27.3 | $25.6 | $26.8 | $300.00 | $198.3K | 300 | 74 |

| ANET | CALL | TRADE | BULLISH | 06/20/25 | $60.4 | $57.2 | $59.7 | $320.00 | $119.4K | 396 | 20 |

| ANET | CALL | SWEEP | NEUTRAL | 09/06/24 | $28.3 | $26.1 | $27.2 | $300.00 | $111.5K | 300 | 224 |

| ANET | CALL | TRADE | NEUTRAL | 06/20/25 | $68.5 | $65.3 | $67.2 | $300.00 | $107.5K | 108 | 16 |

| ANET | CALL | SWEEP | BEARISH | 09/06/24 | $28.1 | $25.6 | $27.0 | $300.00 | $72.9K | 300 | 113 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

In light of the recent options history for Arista Networks, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Arista Networks's Current Market Status

- Currently trading with a volume of 851,143, the ANET's price is down by -0.13%, now at $326.28.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 54 days.

What Analysts Are Saying About Arista Networks

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $369.0.

- Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Arista Networks, targeting a price of $369.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.