Deep-pocketed investors have adopted a bullish approach towards Booking Holdings (NASDAQ:BKNG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BKNG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 28 extraordinary options activities for Booking Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 32% bearish. Among these notable options, 11 are puts, totaling $692,294, and 17 are calls, amounting to $1,605,838.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $2000.0 to $4300.0 for Booking Holdings over the last 3 months.

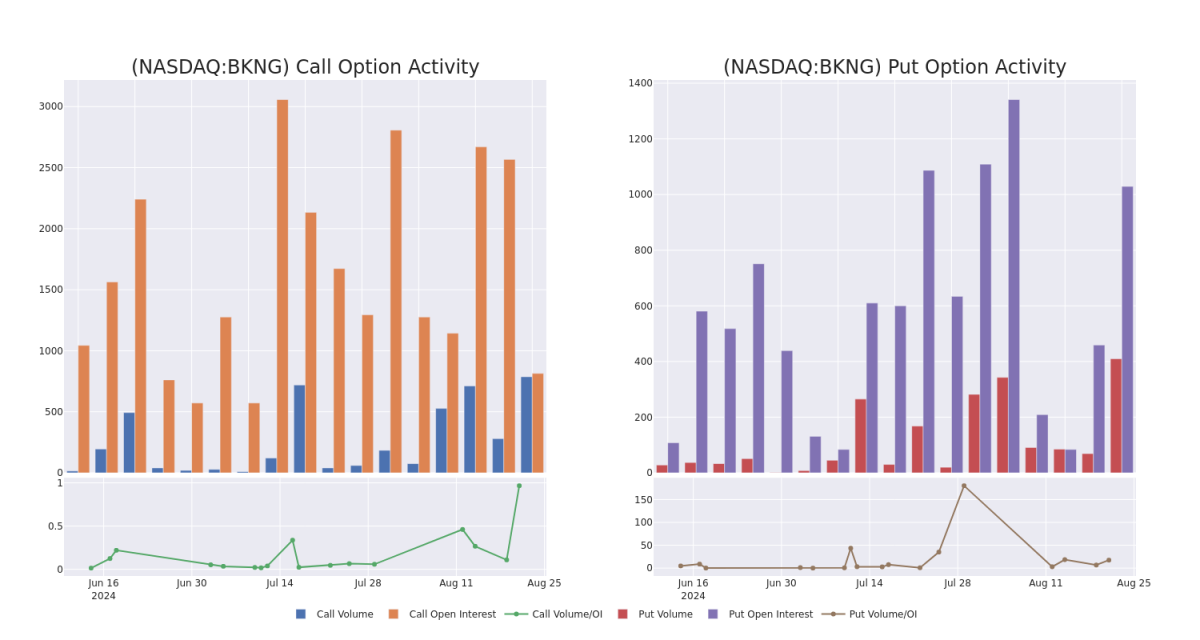

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Booking Holdings options trades today is 105.89 with a total volume of 344.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Booking Holdings's big money trades within a strike price range of $2000.0 to $4300.0 over the last 30 days.

Booking Holdings Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | SWEEP | BEARISH | 11/15/24 | $217.7 | $204.4 | $213.3 | $3800.00 | $257.7K | 4 | 12 |

| BKNG | PUT | SWEEP | BEARISH | 10/18/24 | $124.4 | $119.1 | $124.4 | $3800.00 | $239.5K | 94 | 0 |

| BKNG | CALL | SWEEP | BULLISH | 11/15/24 | $210.4 | $206.7 | $210.4 | $3800.00 | $231.4K | 4 | 27 |

| BKNG | CALL | TRADE | BEARISH | 01/17/25 | $1834.2 | $1823.4 | $1825.0 | $2000.00 | $182.5K | 310 | 14 |

| BKNG | CALL | TRADE | NEUTRAL | 01/17/25 | $1820.9 | $1809.3 | $1815.6 | $2000.00 | $181.5K | 310 | 4 |

About Booking Holdings

Booking is the world's largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

Having examined the options trading patterns of Booking Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Booking Holdings

- With a trading volume of 103,924, the price of BKNG is down by -0.52%, reaching $3793.96.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 57 days from now.

Expert Opinions on Booking Holdings

In the last month, 1 experts released ratings on this stock with an average target price of $4200.0.

- In a cautious move, an analyst from Jefferies downgraded its rating to Hold, setting a price target of $4200.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Booking Holdings with Benzinga Pro for real-time alerts.