Market Whales and Their Recent Bets on SNAP Options

Market Whales and Their Recent Bets on SNAP Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Snap.

资本雄厚的鲸鱼们对Snap采取了明显看好的立场。

Looking at options history for Snap (NYSE:SNAP) we detected 20 trades.

查看Snap(纽交所: SNAP)的期权历史,我们发现了20次交易。

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 30% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,60%的投资者看涨,30%看跌。

From the overall spotted trades, 14 are puts, for a total amount of $1,020,115 and 6, calls, for a total amount of $526,551.

从总体上看,我们发现了14个看跌期权,总金额为$1,020,115,和6个看涨期权,总金额为$526,551。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $5.0 and $15.0 for Snap, spanning the last three months.

经过评估交易量和持仓量,可以明显看出主要的市场参与者正在关注Snap的价格区间,该区间为$5.0至$15.0,涵盖了过去三个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

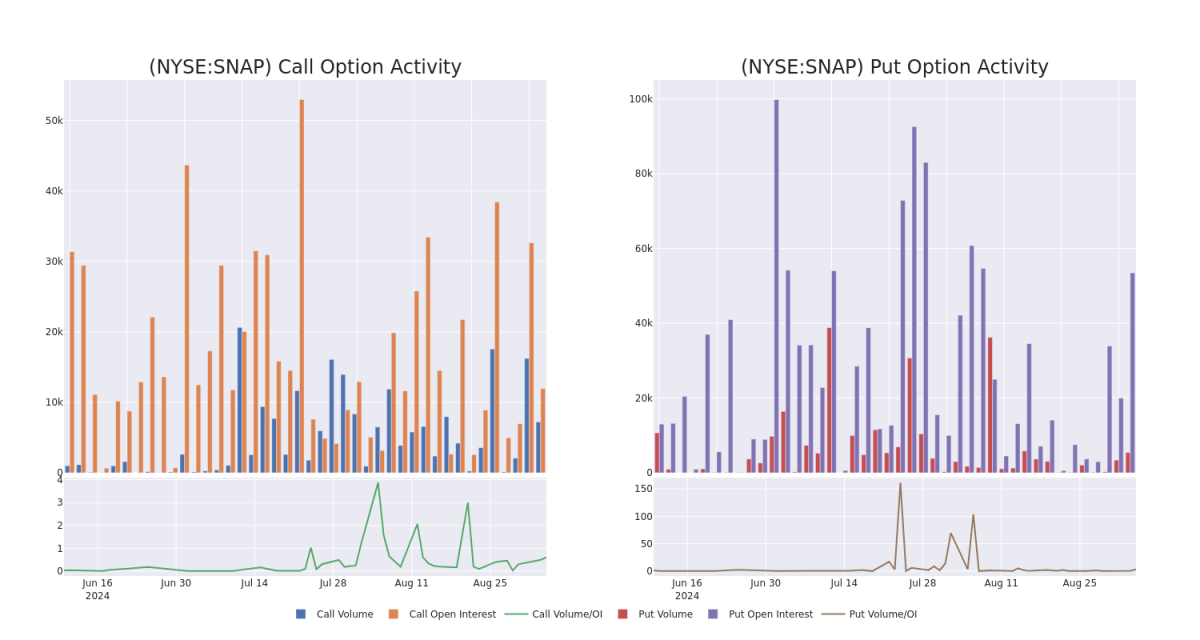

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Snap's options for a given strike price.

这些数据可以帮助您跟踪Snap期权在特定行权价格上的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Snap's whale activity within a strike price range from $5.0 to $15.0 in the last 30 days.

在下面,我们可以观察Snap所有区间在5.0美元到15.0美元行权价格范围内的期权成交量和持仓量的变化,分别为认购期权和认沽期权,时间跨度为过去30天。

Snap Option Activity Analysis: Last 30 Days

Snap期权活动分析:近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | TRADE | BULLISH | 01/17/25 | $0.76 | $0.73 | $0.75 | $11.00 | $375.0K | 4.1K | 5.0K |

| SNAP | PUT | SWEEP | BEARISH | 12/20/24 | $3.5 | $3.4 | $3.5 | $12.00 | $175.0K | 1.5K | 500 |

| SNAP | PUT | SWEEP | BEARISH | 01/16/26 | $4.4 | $4.3 | $4.4 | $12.00 | $109.9K | 7.6K | 563 |

| SNAP | PUT | SWEEP | BEARISH | 01/16/26 | $4.4 | $4.3 | $4.36 | $12.00 | $109.0K | 7.6K | 450 |

| SNAP | PUT | SWEEP | BULLISH | 11/15/24 | $1.13 | $1.12 | $1.12 | $9.00 | $67.2K | 4.3K | 690 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | 看涨 | 交易 | 看好 | 01/17/25 | $0.76 | 0.73美元 | 0.75美元 | 11.00美元 | $375.0K | 4.1K | 5.0K |

| SNAP | 看跌 | SWEEP | 看淡 | 12/20/24 | $3.5 | $3.4 | $3.5 | 12.00美元 | $175.0千 | 1.5K | 500 |

| SNAP | 看跌 | SWEEP | 看淡 | 01/16/26 | $4.4 | $4.3 | $4.4 | 12.00美元 | $109.9千 | 7.6K | 563 |

| SNAP | 看跌 | SWEEP | 看淡 | 01/16/26 | $4.4 | $4.3 | $4.36 | 12.00美元 | $109.0K | 7.6K | 450 |

| SNAP | 看跌 | SWEEP | 看好 | 11/15/24 | $1.13 | $1.12 | $1.12 | 。该公司的股票上周五收盘价为$4.19。 | $67.2K | 4.3千 | 690 |

About Snap

关于Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Snap拥有颇受欢迎的社交网络应用程序Snapchat,截至2023年底,每天活跃用户数超过4亿。Snap几乎全部收入来自广告。虽然仅约四分之一的用户位于北美地区,但该地区占销售额的约65%。

After a thorough review of the options trading surrounding Snap, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对Snap周边期权交易进行彻底审查后,我们会更详细地审查公司的情况,包括其当前的市场地位和表现。

Present Market Standing of Snap

- Trading volume stands at 17,394,641, with SNAP's price down by -0.69%, positioned at $8.8.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 48 days.

- RSI指标显示该股票可能接近超买。

- 预计在48天内公布盈利。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。