① IC futures indicate that the main contract reduced short positions by more than 3,000 lots, and the number of losses was significantly greater than that of long positions. ② Volkswagen Transportation, a popular online car-hailing stock, was purchased nearly 100 million yuan by Ningbo Sangtian Road by Guosheng Securities.

The total turnover of Shanghai and Shenzhen Stock Connect today was 83.084 billion. Among them, Kweichow Moutai and Midea Group ranked first among individual stocks by turnover between Shanghai Stock Connect and Shenzhen Stock Connect. In terms of the main capital of the sector, the computer sector had the highest net inflow. In terms of ETF transactions, the Shanghai and Shenzhen 300ETF (510310) E-side achieved a 453% month-on-month increase in turnover. In terms of futures positions, the number of short positions reduced by IF, IC, and IM contracts is greater than that of long positions. On the Dragon Tiger List, Shenzhen Huaqiang was bought over 40 million by institutions; Kaisheng Technology sold over 90 million; Nandu Power was sold by institutions for over 50 million; Jinlong Auto and Tianyuan Dike were both bought by two first-tier tourist seats; and Yitong Century was bought by a quantitative seat of over 20 million.

1. The top ten transactions of the Shanghai and Shenzhen Stock Exchange

Today, the total turnover of Shanghai Stock Connect was 42.731 billion, and the total turnover of Shenzhen Stock Connect was 40.353 billion.

Today, the total turnover of Shanghai Stock Connect was 42.731 billion, and the total turnover of Shenzhen Stock Connect was 40.353 billion.

Judging from the top ten traded individual stocks on Shanghai Stock Connect, Kweichow Moutai ranked first, while financial stocks such as Ping An of China and China Merchants Bank all ranked in the top ten.

Judging from the top ten traded individual stocks on Shanghai Stock Connect, Kweichow Moutai ranked first, while financial stocks such as Ping An of China and China Merchants Bank all ranked in the top ten.Judging from the top ten traded individual stocks on Shenzhen Stock Connect, Midea Group ranked first, while Ningde Era and BYD ranked second and third.

2. The main capital of individual stocks in the sector

Judging from sector performance, sectors such as e-commerce, mobile payment, pharmaceutical commerce, and online car-hailing registered the highest gains, while sectors such as batteries, coal, dyes, and folding screens registered the highest declines.

Judging from the capital monitoring data of the main sector, the computer sector has the highest net inflow of main capital.

Judging from the capital monitoring data of the main sector, the computer sector has the highest net inflow of main capital.In terms of capital outflows from the sector, the telecommunications sector has the highest net outflow of main capital.

Judging from monitoring data on the main capital of individual stocks, the net inflow of main capital into the top ten individual stock sectors is quite chaotic, with the net inflow of mass transportation leading the way.

Judging from monitoring data on the main capital of individual stocks, the net inflow of main capital into the top ten individual stock sectors is quite chaotic, with the net inflow of mass transportation leading the way.The main capital outflow to the top ten individual stock sectors is quite chaotic, with Nandu Power's net outflow leading.

3. ETF Transactions

Looking at the top ten ETFs by turnover, the top two are both the Shanghai and Shenzhen 300 ETFs. Among them, the Shanghai and Shenzhen 300 ETF (510300) ranked first in terms of turnover increase of 135% month-on-month.

Looking at the top ten ETFs by turnover, the top two are both the Shanghai and Shenzhen 300 ETFs. Among them, the Shanghai and Shenzhen 300 ETF (510300) ranked first in terms of turnover increase of 135% month-on-month. Looking at the top ten ETFs with a month-on-month increase in turnover, the four Shanghai and Shenzhen 300 ETFs are on the list. Among them, the Shanghai and Shenzhen 300 ETF (510310) has achieved a 453% month-on-month increase in turnover and the gaming ETF (159869) ranked third with a 155% month-on-month increase in turnover.

Looking at the top ten ETFs with a month-on-month increase in turnover, the four Shanghai and Shenzhen 300 ETFs are on the list. Among them, the Shanghai and Shenzhen 300 ETF (510310) has achieved a 453% month-on-month increase in turnover and the gaming ETF (159869) ranked third with a 155% month-on-month increase in turnover.4. Futures Index Positions

The four major futures indicate that both long and short main contracts reduced their positions. The number of short positions reduced on IF, IC, and IM contracts. Among them, IC contracts reduced their short positions by more than 3,000 lots, which was clearly greater than that of long ones; IH contracts reduced their positions slightly more.

The four major futures indicate that both long and short main contracts reduced their positions. The number of short positions reduced on IF, IC, and IM contracts. Among them, IC contracts reduced their short positions by more than 3,000 lots, which was clearly greater than that of long ones; IH contracts reduced their positions slightly more.5. Dragon Tiger List

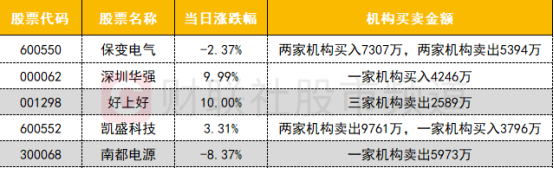

1. Agency

The institutional activity of the Dragon Tiger List is average. In terms of purchases, Baobian Electric, whose controlling shareholder changed, was bought over 70 million by the agency and sold by the agency at the same time over 50 million; Shenzhen Huaqiang was bought by the agency over 40 million.

The institutional activity of the Dragon Tiger List is average. In terms of purchases, Baobian Electric, whose controlling shareholder changed, was bought over 70 million by the agency and sold by the agency at the same time over 50 million; Shenzhen Huaqiang was bought by the agency over 40 million.In terms of sales, Kaisheng Technology, a folding screen concept stock, was sold over 90 million by institutions, and Nandu Power, a solid-state battery concept stock, was sold by institutions for over 50 million. Both stocks were sold continuously by institutions.

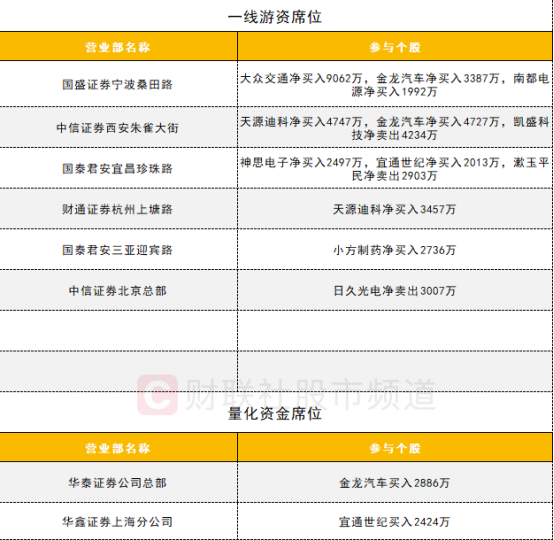

2. Tourist capital

First-tier tourism activity has increased. Volkswagen has been purchased by Guosheng Securities over 90 million from Ningbo Sangtian Road; Jinlong Auto and Tianyuan Dike have both been purchased for first-tier tourist seats.

First-tier tourism activity has increased. Volkswagen has been purchased by Guosheng Securities over 90 million from Ningbo Sangtian Road; Jinlong Auto and Tianyuan Dike have both been purchased for first-tier tourist seats.Quantitative capital activity is average. Yitong Century received a quantitative seat purchase of over 20 million.

今日沪股通总成交金额为427.31亿,深股通总成交金额为403.53亿。

今日沪股通总成交金额为427.31亿,深股通总成交金额为403.53亿。