It is not surprising that there are also targets similar to Accelerated Energy Group in the face of the temptation of high returns and the existence of hot money that dares to push up the stock against the trend.

On September 5th, the top gainers list in the Hong Kong stock market was dominated by a number of old "flash crash stocks".

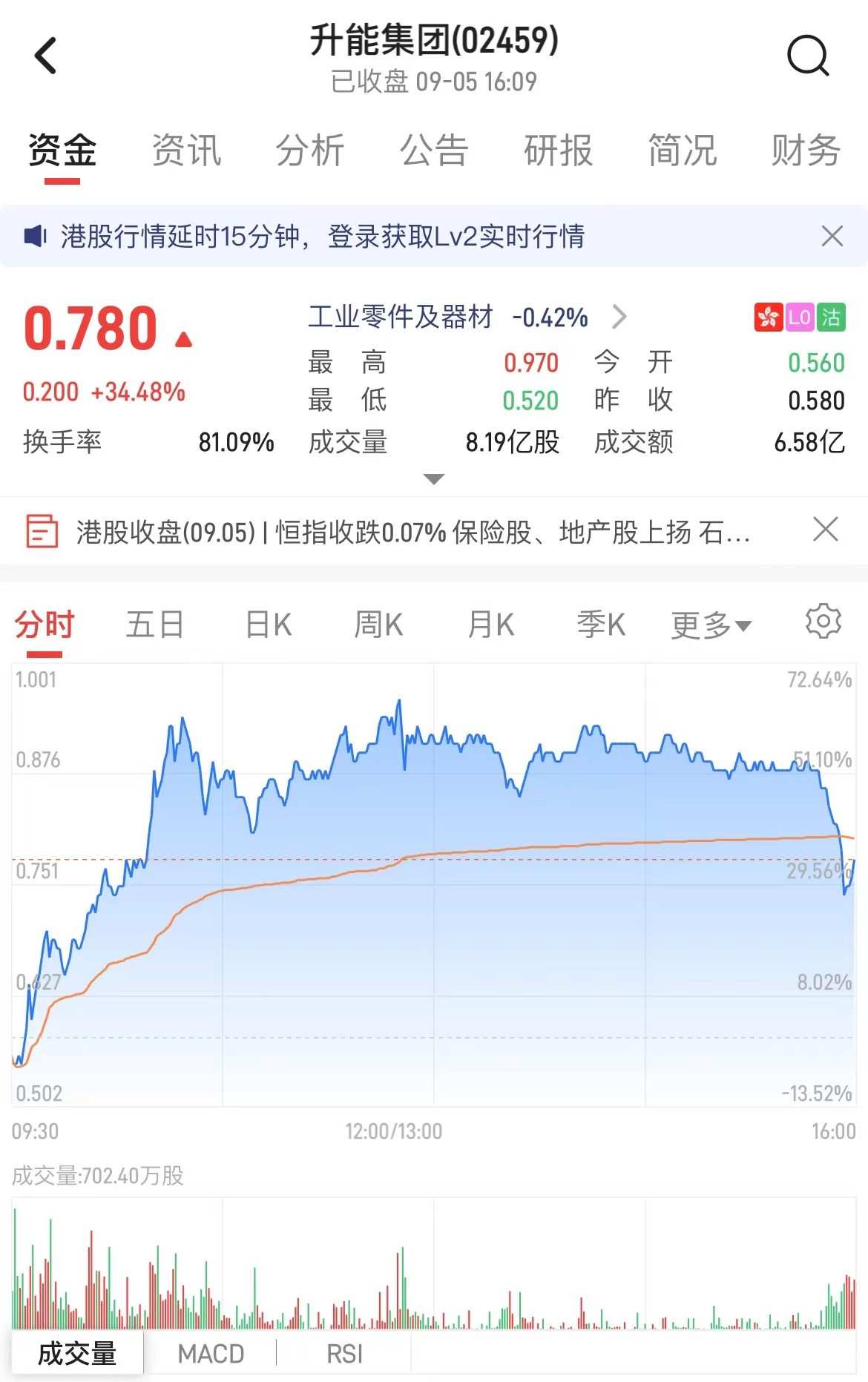

The Smart Finance app noticed that Ascletin Group (02459), which occupied the C position due to a flash crash on Tuesday, continued its strong rebound today. In the morning, Ascletin Group opened lower but quickly rose, and the maximum increase during the session reached nearly 70%. At the close, the stock rose 34.48% to HK$0.78, with the increase falling significantly from the intraday high, but still ranking high on the list of gainers. On the previous trading day, the closing gain of Ascletin Group was 78.46%.

Perhaps influenced by the continuous violent rebound of Ascletin Group, the market hot money seems to be speculating on "flash crash stocks". On September 5th, Longhui International Holdings (01007) suddenly surged, with the stock price rising more than 30% near the midday close. In the afternoon, the stock continued to rise strongly, closing at HK$0.25, with an increase of as much as 60.26%.

Perhaps influenced by the continuous violent rebound of Ascletin Group, the market hot money seems to be speculating on "flash crash stocks". On September 5th, Longhui International Holdings (01007) suddenly surged, with the stock price rising more than 30% near the midday close. In the afternoon, the stock continued to rise strongly, closing at HK$0.25, with an increase of as much as 60.26%.

In addition, today's top gainers list also includes Newlink Tech (09600), which has continued to rise after opening today, with a maximum increase of more than 70% during the session, but closing at 28.77%, at HK$0.47.

It is worth mentioning that, looking at the historical trends of these stocks, the common characteristic is that the stock prices of all three have experienced single-day steep declines in the recent past.

Take Shenneng Group as an example, which has a relatively large market capitalization and high market attention. From May to August this year, the stock showed a sharp upward trend, with a maximum increase of more than 4 times. For companies with a deteriorating fundamental situation, a large short-term increase can be regarded as a 'original sin', not to mention that on September 2nd, Shenneng Group also received a warning of 'highly concentrated equity' from the Hong Kong Securities and Futures Commission. Sure enough, on September 3rd, panic spread rapidly after the market opened, and the stock price of Shenneng Group plummeted by 98.4% in market value that day, even causing a forced liquidation of the 0.37 billion shares held by the controlling shareholder.

However, in the unpredictable stock market, the panic-induced sell-off often brings about temporary oversold rebound opportunities. Taking Shenneng Group as an example, based on today's closing price, the company's stock price has rebounded by 457.1% from the low point on September 3rd. When combined with the investors whose fortunes plummeted due to the crash two trading days ago, it is truly a sigh of the stock market's fickleness.

On the one hand, it is not surprising that hot money is willing to drive up Shenneng Group against the trend, and it is also not surprising that there are similar situations where targets are speculated under the temptation of high returns.

Take Longhui Holdings, which topped the list of top gainers on the Hong Kong Stock Exchange's main board on September 5th, as an example. Although the company's market capitalization is only over 40 million Hong Kong dollars, its trend this year can also be described as ups and downs. First, from the end of March to July, the company experienced a unilateral upward trend, with the stock price rising from HKD 0.59 to HKD 4.74 per share, an accumulated increase of more than 7 times in 4 months. Then, the situation changed suddenly. Starting from July 29th, Longhui Holdings turned downward, and after a continuous decline, it reached the 'climax' on August 7th: on that day's opening, Longhui Holdings experienced a sharp plunge, with a decline of 80% within half an hour. After that, it fluctuated searching for a bottom. By the end of that day's close, the stock fell by 90.2% with a turnover ratio exceeding 40%, and the stock price retreated to HKD 0.345, even lower than the start of the trend.

For the remaining days of August, Longhui Holdings continued to decline with shrinking trading volume, and touched HKD 0.15 during intraday trading on September 3rd, setting a new low in stock price history. However, today, Longhui Holdings' stock price has witnessed a dramatic scene: even with no apparent positive news, the stock price surged on high trading volume.

Considering the company's recent interim report, Longhui Holdings does not have many bright spots in terms of fundamentals.

According to publicly available information, Longhui Holdings was listed on the Hong Kong Stock Exchange through a backdoor listing in 2018. The company mainly operates 'Hui Brother Hot Pot' and 'Xiao Hui Brother Hot Pot' restaurants in mainland China. Although it successfully realized its 'capital dream', the operating conditions of Longhui Holdings have deteriorated after going public. In the first half of this year, the company's revenue decreased by 34.7% to 29.403 million yuan. At the same time, the company suffered further losses, with a net income of -5.617 million yuan during the period, expanding the loss compared to the same period last year, which was -2.325 million yuan.

As of the end of June, the number of restaurants under Longhui Holdings has dropped to single digits, with only 9 remaining. Considering that the factors that restrict the recovery of the service industry economy still exist and the residents' consumption capacity needs to be further improved, it can be seen that it is not easy for Longhui Holdings, which mainly targets the middle and high-income groups, to overcome the operating difficulties.

The lackluster results and lack of growth expectations in the past, Longhui Holdings' stock price movement today can only be attributed to the speculative trading of active funds.

The situation of Newlink Tech is also very similar. According to the company's previous interim report, the company's revenue for the first half of the year was 0.123 billion yuan, a slight increase of 4.2% year-on-year, but the net profit for the same period expanded significantly to 55.418 million yuan. Although the performance is mediocre, the stock price trend of Newlink Tech is quite "exciting": the company's stock price rose by 506.06% within a month in May, and then began to decline in mid-June, and plunged by 80% in the last trading session on August 28, eventually giving back all the gains since May.

Considering the above three symbols, since the performance of each company is in a declining trend and there are no substantial bullish factors in the short term, it is difficult for the author as an observer not to define today's trend of these stocks as active funds grabbing rebounds after overselling.

Indeed, in the short term, due to factors such as excessive pessimism among shareholders and technical overselling, symbols after overselling often have certain speculative value. However, the time window for this speculation is obviously not something that ordinary investors can grasp. Looking at the big picture, the market is ultimately a weighing machine, and the upward movement of stock prices still needs to be supported by performance.

或受升能集团的连续暴力反弹影响,市场热钱似乎正在跟风炒作“闪崩股”。9月5日,龙辉国际控股(01007)股价突然飙涨,临近午盘收盘时股价涨幅已逾三成。午后,该股继续强势拉升,收盘报0.25港元,涨幅高达60.26%。

或受升能集团的连续暴力反弹影响,市场热钱似乎正在跟风炒作“闪崩股”。9月5日,龙辉国际控股(01007)股价突然飙涨,临近午盘收盘时股价涨幅已逾三成。午后,该股继续强势拉升,收盘报0.25港元,涨幅高达60.26%。