Deep-pocketed investors have adopted a bullish approach towards Advanced Micro Devices (NASDAQ:AMD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Advanced Micro Devices. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 57% leaning bullish and 35% bearish. Among these notable options, 4 are puts, totaling $271,644, and 10 are calls, amounting to $387,070.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $220.0 for Advanced Micro Devices over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $220.0 for Advanced Micro Devices over the recent three months.

Volume & Open Interest Trends

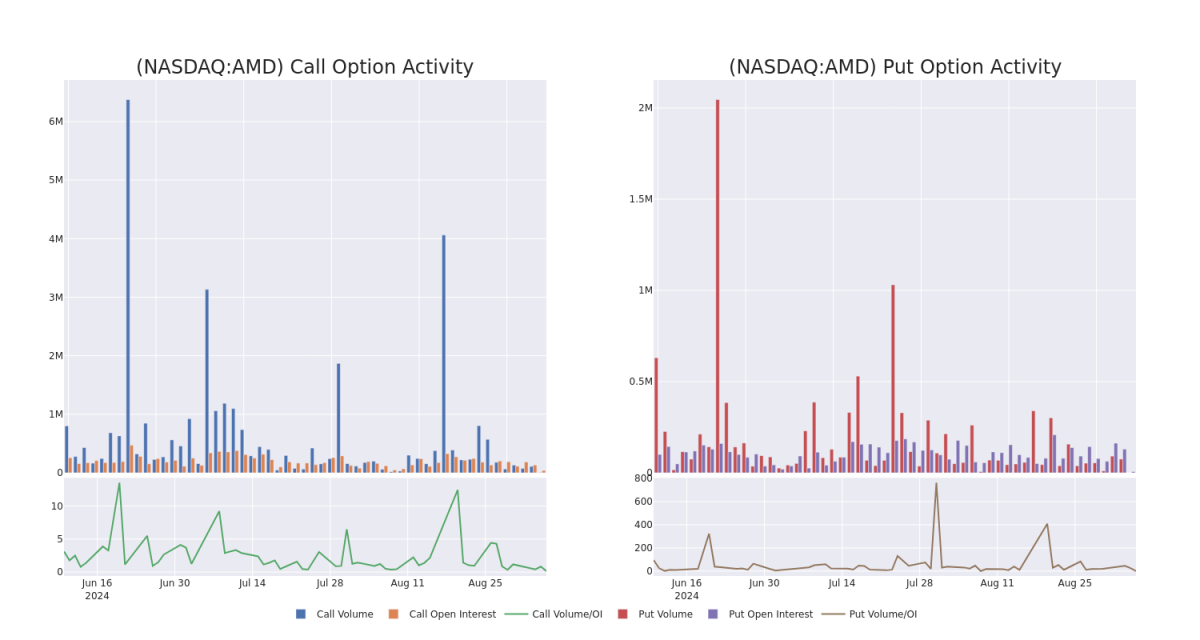

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Advanced Micro Devices's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Advanced Micro Devices's substantial trades, within a strike price spectrum from $130.0 to $220.0 over the preceding 30 days.

Advanced Micro Devices Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| AMD | PUT | SWEEP | BULLISH | 11/15/24 | $18.65 | $18.45 | $18.45 | $150.00 | $184.5K | 4.7K | 0 |

| AMD | CALL | TRADE | BULLISH | 09/20/24 | $4.55 | $4.45 | $4.51 | $144.00 | $90.2K | 2.2K | 233 |

| AMD | CALL | SWEEP | BULLISH | 09/06/24 | $2.77 | $2.71 | $2.77 | $140.00 | $44.3K | 5.1K | 1.9K |

| AMD | CALL | SWEEP | BULLISH | 09/06/24 | $2.86 | $2.76 | $2.86 | $138.00 | $38.6K | 618 | 34 |

| AMD | CALL | SWEEP | NEUTRAL | 11/15/24 | $19.0 | $18.9 | $18.9 | $130.00 | $34.0K | 2.3K | 23 |

About Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

Following our analysis of the options activities associated with Advanced Micro Devices, we pivot to a closer look at the company's own performance.

Advanced Micro Devices's Current Market Status

- With a volume of 4,546,952, the price of AMD is up 0.36% at $141.38.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 54 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Advanced Micro Devices with Benzinga Pro for real-time alerts.

ディープポケットを持つ投資家は、Advanced Micro Devices(NASDAQ: AMD)に対して強気の姿勢を取り、市場参加者が無視すべきではありません。Benzingaの公開オプション記録を追跡することで、私たちは今日この重要な動きを明らかにしました。これらの投資家の正体は不明ですが、AMDでこのような大きな動きがある場合、何か大きなことが起ころうとしていることを示唆しています。

今日の観察結果から得た情報によると、BenzingaのオプションスキャナーはAdvanced Micro Devicesの14の非凡なオプション活動をハイライトしました。この活発さは通常とは異なります。

これらの重要な投資家の中では、57%が強気で、35%が弱気と意見が分かれています。これらの注目すべきオプションの中で、4つはプットで総額271,644ドルであり、10つはコールで387,070ドルです。

目標株価は何ですか?

取引活動に基づくと、最近の3か月間にわたり、重要な投資家はAdvanced Micro Devicesの価格範囲を130.0ドルから220.0ドルに設定することを目指しています。

取引活動に基づくと、最近の3か月間にわたり、重要な投資家はAdvanced Micro Devicesの価格範囲を130.0ドルから220.0ドルに設定することを目指しています。

出来高と建玉のトレンド

出来高と建玉の評価はオプション取引における戦略的なステップです。これらの指標は、Advanced Micro Devicesのオプションにおける流動性と投資家の関心を特定の権利行使価格で明らかにします。今後のデータは、最近の30日間における$130.0から$220.0の範囲の権利行使価格に関連するコールとプットの出来高と建玉の変動を可視化します。

最大のオプションのスポット:

注目すべきオプション活動:

| シンボル | プット/コール | 取引タイプ | センチメント | 権利行使日 | 売気配 | 買気配 | 価格 | 権利行使価格 | トータル取引価格 | 建玉 | 出来高 |

|---|

| AMD | プット | スイープ | 強気 | 24年11月15日 | $18.65 | $18.45 | $18.45 | $150.00 | $184.5K | 4.7K | 0 |

| AMD | コール | 取引 | 強気 | 09/20/24 | $4.55 | $4.45 | $4.51 | $144.00 | $90.2K | 2.2K | 233 |

| AMD | コール | スイープ | 強気 | 09/06/24 | $2.77 | $2.71 | $2.77 | $140.00 | $44.3K | 5.1K | 1.9千 |

| AMD | コール | スイープ | 強気 | 09/06/24 | $2.86 | データソース:ホームデポ

過去10年間、ホームデポは配当金をほかのダウ構成銘柄よりも急速に増やしました。ホームデポのような、あるいはそれに近い規模の企業で、10年間で配当金を4倍近く増やしたところを見つけるのはかなり難しいでしょう。また、ホームデポは市場を上回る銘柄でもあり、S&P 500に対する約500%の総収益に対して、230%という数字を残しています。

表で確認できるように、ホームデポの最近の7.7%の増加率は、過去10年間で最も低い増加率でした。ただし、名目額としては、過去5年間で1株あたり70セント程度の配当上昇が標準であったことも事実です。

最高の配当支払い企業ですら、そこまで大幅に配当を増やすことはめったにありません。たとえば、コカ・コーラは5.4%の増加幅で配当を引き上げたのが5年ぶりの最大の増加幅でした。

全体的に、ホームデポの配当は投資テーゼの欠かせない部分です。ホームデポの成長が停滞していることを考慮すると、配当をあまりに大幅に上げることは責任を持って行動することではありません。しかし、ホームデポの成長が戻った時には、配当金の増加率は2桁の割合になることが期待できます。その時に、配当を株主に還元する主要な方法として、配当成長を継続することになるでしょう。

ホームデポのもう一つの重要な属性である自社株買いを見落とすのは誤りです。以下のチャートには、Home Depotの最近の配当上昇は反映されていませんが、過去10年間のホームデポの配当上昇と自社株買いの総額が示されています。

ホームデポは成長が鈍化してきている中でも成長する配当金と自社株買いを賄うことができる余力があります。複数の方法で株主に報いることができる企業(資本利得、自社株買い、配当金を含む)は、景気減速期に優位に立つことができます。ホームデポが買い戻す株を増やせば増やすほど、発行済み株式数は減り、1株当たりの利益は増加します。これがアップルが何年も前からやっていたことであり、アップルが良い価値を持つ銘柄になっている理由の一つです。

ホームデポで長期的に考えましょう

ホームデポの2023会計年度の結果と2024会計年度の見通しが悪かったことは、糖衣漬けにするわけにはいきません。しかし、株の過剰評価はされていないし、今後の配当利回りは2.5%となっています。これはかなり良い数字ですが、高配当銘柄とは言い切れません。

ホームデポは、投資家が長期間所有しても問題ない銘柄です。評価と配当の質を考慮すれば、今すぐ購入する価値のある銘柄の一つですが、近い将来に大きく上昇する理由はありません。ホームデポをウォッチリストに追加するだけでも問題ありません。

ホームデポに1000ドル投資するべきですか?

Home Depotの株式を買う前に、以下の点を考慮してください:

The Motley Fool Stock Advisorの | $2.86 | 138.00ドル | $38.6K | 618 | 34 |

| AMD | コール | スイープ | ニュートラル | 24年11月15日 | $19.0 | $18.9 | $18.9 | $130.00 | $34.0K | 2.3K | 23 |

アドバンストマイクロデバイスについて

アドバンストマイクロデバイスは、PC、ゲーム機、データセンター、産業、自動車などの市場向けに様々なデジタル半導体を設計しています。AMDの伝統的な強みは、PCやデータセンターで使われる中央処理装置(CPU)やグラフィックス処理装置(GPU)などです。また、同社は、ソニーのプレイステーションやマイクロソフトのXboxなどの有名なゲーム機に搭載されているチップを供給しています。2022年、同社はFPGAのリーダーであるXilinxを買収し、ビジネスを多様化し、データセンターや自動車などの主要なエンドマーケットでの機会を増やしました。

Advanced Micro Devicesに関連するオプション取引の分析に続き、同社のパフォーマンスについて詳しく見ていきます。

アドバンストマイクロデバイスの現在の市場状況

- AMDの出来高は4,546,952で、価格は0.36%上昇して$141.38です。

- RSIの指標が、株価が買われすぎに近づいていることを示唆しています。

- 次の決算発表予定は54日後です。

オプション取引には大きなリスクが伴いますが、高い利益を得る可能性もあります。賢明なトレーダーは、継続的な教育、戦略的な取引調整、様々な指標の利用、市場の動向に注意を払うことで、これらのリスクを軽減しています。リアルタイムアラートを提供するBenzinga Proを使用して、アドバンストマイクロデバイスの最新のオプション取引について追跡しましょう。

取引活動に基づくと、最近の3か月間にわたり、重要な投資家はAdvanced Micro Devicesの価格範囲を130.0ドルから220.0ドルに設定することを目指しています。

取引活動に基づくと、最近の3か月間にわたり、重要な投資家はAdvanced Micro Devicesの価格範囲を130.0ドルから220.0ドルに設定することを目指しています。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $220.0 for Advanced Micro Devices over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $220.0 for Advanced Micro Devices over the recent three months.