Spotlight on Thermo Fisher Scientific: Analyzing the Surge in Options Activity

Spotlight on Thermo Fisher Scientific: Analyzing the Surge in Options Activity

Deep-pocketed investors have adopted a bearish approach towards Thermo Fisher Scientific (NYSE:TMO), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TMO usually suggests something big is about to happen.

深口袋的投资者对赛默飞世尔采取了看淡的态度,市场参与者不应忽视这一点。Benzinga跟踪的公开期权记录揭示了今天的重大举动。这些投资者的身份还不清楚,但通常这样重大的举动意味着将要发生一些重大的事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Thermo Fisher Scientific. This level of activity is out of the ordinary.

今天我们从Benzinga的期权扫描仪中获得了这个信息,那里突出了赛默飞世尔的8个非同寻常的期权活动。这种活动水平是不同寻常的。

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 62% bearish. Among these notable options, 2 are puts, totaling $62,734, and 6 are calls, amounting to $487,222.

这些重要投资者中的普遍情绪存在分歧,37%倾向于看好,62%倾向于看淡。在这些引人注目的期权中,有2个看跌期权,总额为62,734美元,有6个看涨期权,总额为487,222美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $710.0 for Thermo Fisher Scientific during the past quarter.

分析这些合同的成交量和持仓量,似乎这些大玩家在过去一个季度一直关注着赛默飞世尔的价格区间为530.0到710.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

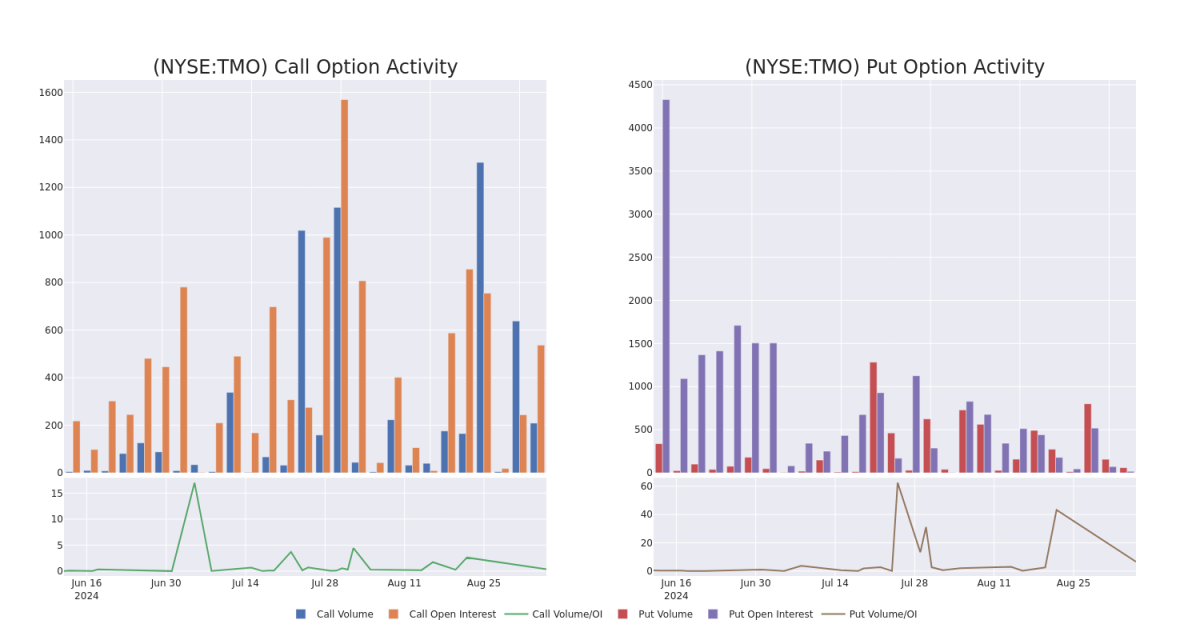

In today's trading context, the average open interest for options of Thermo Fisher Scientific stands at 69.25, with a total volume reaching 268.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Thermo Fisher Scientific, situated within the strike price corridor from $530.0 to $710.0, throughout the last 30 days.

在今天的交易背景下,赛默飞世尔的期权的平均持仓量为69.25,总成交量达到268.00。随附的图表描述了在赛默飞世尔的530.0至710.0美元行权价格走廊内,过去30天内高价值交易的看涨和看跌期权的成交量和持仓量的变化。

Thermo Fisher Scientific Option Activity Analysis: Last 30 Days

赛默飞世尔期权活动分析:最近30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | CALL | TRADE | BEARISH | 01/17/25 | $96.6 | $90.8 | $93.0 | $530.00 | $167.4K | 172 | 18 |

| TMO | CALL | TRADE | BEARISH | 03/21/25 | $83.5 | $82.0 | $82.0 | $550.00 | $147.6K | 2 | 18 |

| TMO | CALL | TRADE | BULLISH | 12/20/24 | $43.4 | $41.6 | $43.2 | $590.00 | $69.1K | 59 | 37 |

| TMO | CALL | SWEEP | BULLISH | 10/18/24 | $4.1 | $4.0 | $4.1 | $650.00 | $37.7K | 73 | 112 |

| TMO | CALL | SWEEP | BULLISH | 01/16/26 | $37.5 | $34.8 | $36.39 | $710.00 | $36.5K | 54 | 32 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | 看涨 | 交易 | 看淡 | 01/17/25 | $96.6 | $90.8 | 93.0美元 | $530.00 | $167.4K | 172 | 18 |

| TMO | 看涨 | 交易 | 看淡 | 03/21/25 | $83.5 | $82.0 | $82.0 | $550.00 | $147.6K | 2 | 18 |

| TMO | 看涨 | 交易 | 看好 | 12/20/24 | $43.4 | $41.6 | $43.2 | 590.00美元 | $69.1K | 59 | 37 |

| TMO | 看涨 | SWEEP | 看好 | 10/18/24 | $4.1 | $4.0 | $4.1 | $650.00 | $37.7千美元 | 73 | 112 |

| TMO | 看涨 | SWEEP | 看好 | 01/16/26 | $37.5 | 34.8美元 | $36.39 | $710.00 | $36.5K | 54 | 32 |

About Thermo Fisher Scientific

关于赛默飞世尔科技(Thermo Fisher Scientific)

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of end-2023 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (10%); life science solutions (23%); and lab products and services, which includes CRO services (54%).

Thermo Fisher Scientific出售科学仪器和实验室设备、诊断消耗品和生命科学试剂。截至2023年底,该公司通过四个板块(营业收入包括某些跨板块营业收入)运营:分析技术(销售额的17%);专业诊断产品(10%);生命科学解决方案(23%);以及实验室产品和服务,其中包括CRO服务(54%)。

Following our analysis of the options activities associated with Thermo Fisher Scientific, we pivot to a closer look at the company's own performance.

在对赛默飞世尔相关期权活动进行分析后,我们转而更近距离地观察公司自身的表现。

Where Is Thermo Fisher Scientific Standing Right Now?

赛默飞世尔当前处于什么位置?

- Trading volume stands at 593,628, with TMO's price down by -0.01%, positioned at $611.84.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 48 days.

- 交易成交量为593,628,TMO的价格下跌-0.01%,定位在611.84美元。

- RSI指标显示该股票可能接近超买。

- 预计在48天内公布盈利。

Professional Analyst Ratings for Thermo Fisher Scientific

赛默飞世尔的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $670.0.

过去30天,共有1位专业分析师对该股票给出了评级,设定了平均目标价格为$670.0。

- An analyst from Wells Fargo downgraded its action to Overweight with a price target of $670.

- 富国银行的分析师将其评级下调为超重,目标价格为$670。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。