Whales with a lot of money to spend have taken a noticeably bullish stance on Unity Software.

Looking at options history for Unity Software (NYSE:U) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $108,369 and 9, calls, for a total amount of $477,110.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $31.0 for Unity Software over the last 3 months.

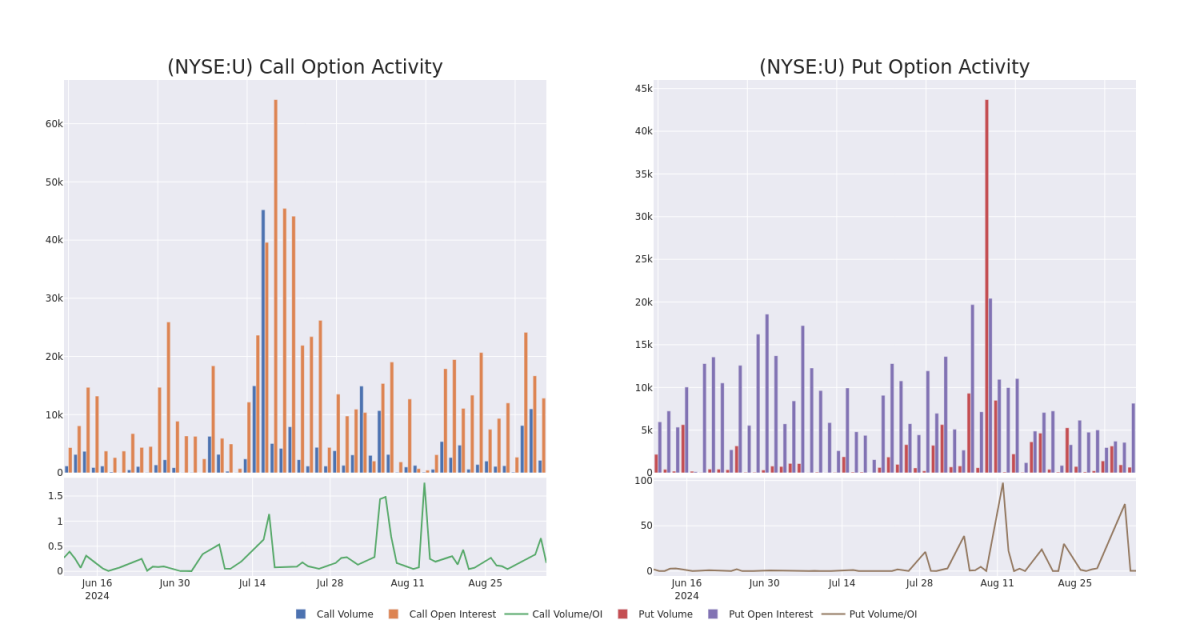

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Unity Software's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Unity Software's substantial trades, within a strike price spectrum from $10.0 to $31.0 over the preceding 30 days.

Unity Software Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | CALL | SWEEP | BULLISH | 01/17/25 | $2.47 | $2.43 | $2.46 | $17.50 | $95.0K | 3.6K | 464 |

| U | CALL | SWEEP | BEARISH | 01/16/26 | $5.95 | $5.8 | $5.8 | $15.00 | $80.7K | 2.8K | 147 |

| U | CALL | TRADE | BEARISH | 11/15/24 | $6.7 | $6.65 | $6.65 | $10.00 | $66.5K | 619 | 100 |

| U | CALL | SWEEP | BULLISH | 01/17/25 | $2.57 | $2.55 | $2.57 | $17.50 | $51.4K | 3.6K | 772 |

| U | CALL | SWEEP | BULLISH | 11/15/24 | $1.8 | $1.77 | $1.8 | $17.00 | $45.0K | 1.6K | 12 |

About Unity Software

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Following our analysis of the options activities associated with Unity Software, we pivot to a closer look at the company's own performance.

Unity Software's Current Market Status

- With a volume of 10,373,253, the price of U is up 6.65% at $17.0.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 63 days.

Professional Analyst Ratings for Unity Software

5 market experts have recently issued ratings for this stock, with a consensus target price of $16.9.

- An analyst from Benchmark persists with their Sell rating on Unity Software, maintaining a target price of $10.

- An analyst from Needham persists with their Buy rating on Unity Software, maintaining a target price of $23.

- An analyst from Goldman Sachs has decided to maintain their Neutral rating on Unity Software, which currently sits at a price target of $22.

- Maintaining their stance, an analyst from Macquarie continues to hold a Underperform rating for Unity Software, targeting a price of $12.

- Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $17.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Unity Software with Benzinga Pro for real-time alerts.