Bank of America Merrill Lynch believes that the key catalyst for the fundamental recovery of Nvidia may be the supply chain data in the coming weeks, confirming that Blackwell's new chip is ready for shipment. Bank of America Merrill Lynch's target price for Nvidia suggests that the stock price is expected to rise 55% from this Wednesday.

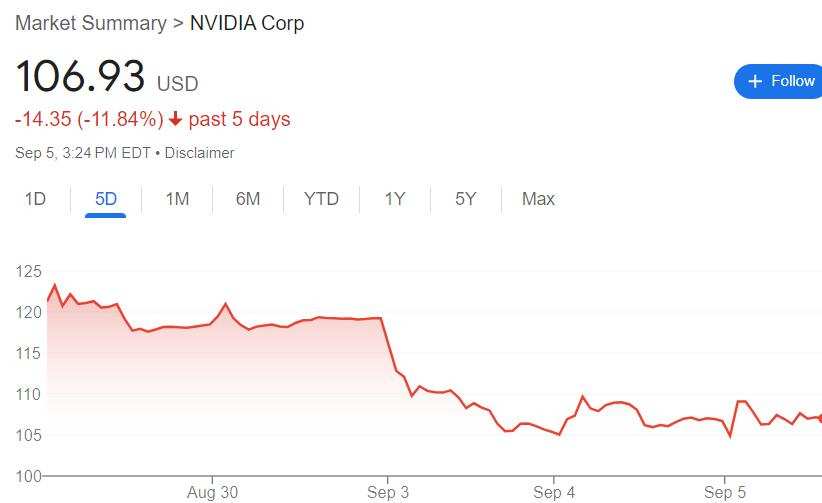

Last week's financial report failed to boost Nvidia, the 'darling' of the AI industry in the past two years, but instead suffered a 9% drop in the first two trading days of September, hit hard by the September stock market 'curse'. However, a recent report from Bank of America argues that the unfavorable environment Nvidia has recently faced has made its valuation look attractive, providing investors with an enticing buying opportunity.

On the first trading day of September this Tuesday, Nvidia's stock price fell 9.5%, causing its market cap to shrink by nearly $280 billion in one day, marking the largest single-day decline in market cap of any individual US stock. Afterwards, Wall Street Journal mentioned that Nvidia's stock price fell after the release of its financial report, highlighting investors' concerns about the stock's overvaluation, slowing revenue growth, and the sustainability of the overall AI chip investment frenzy. Nvidia's third-quarter revenue guidance shows that revenue growth, which had been in the triple digits for the past five quarters, is expected to slow to around 80%, raising concerns about a cooling demand for its AI chips. The financial report has cast doubt on the sustainability of massive investments in AI hardware.

In addition, after the market closed on Tuesday, there was news that the US Department of Justice had issued a subpoena to Nvidia for an antitrust investigation, further intensifying regulatory risks and preventing Nvidia from successfully rebounding on Wednesday.

In short, the financial report falling short of Wall Street's highest expectations, production issues with Nvidia's highly anticipated Blackwell chip, recent reports of regulatory scrutiny, cautious investor sentiment towards AI trades, and overall market volatility have all contributed to this steep decline in Nvidia's stock. A recent report by Bank of America analyst Vivek Arya suggests that these factors, combined, create a 'compelling' buying opportunity for investors, as Nvidia's stock price has fallen to the lower quartile of valuation in the past five years.

The report states:

'The key fundamental catalyst for Nvidia could be future supply chain data in the coming weeks that confirm the readiness of Blackwell, its new product.'

Although Nvidia's stock price lacks positive catalysts in the short term, the use of Nvidia chips, including the Hopper and Blackwell series, by enterprise customers to build AI capabilities is expected to support its stock price in the coming years. A report from Bank of America stated:

"The technology industry will spend at least another one or two years intensively building Nvidia's Blackwell chips, which will increase AI training capability by 4 times, and inference capability by over 25 times. So far, it is still part of the first wave of large language model (LLM) frenzy, and the use of Nvidia Hopper (chips) is just the beginning."

Bank of America reiterated Nvidia as the bank's top pick in the industry and gave the stock a buy rating with a target price of $165. This target price implies that Bank of America expects Nvidia's stock price to rise by approximately 55% from Wednesday's closing.

In addition to Bank of America, some market participants believe that this is a good time to bottom fish Nvidia. Piper Sandler analyst Harsh Kumar still bullish on Nvidia, pointing out strong market demand for Nvidia's Hopper chips, expected to further grow in the second half of the fiscal year. At the same time, revenue from Blackwell chips is basically on track. Wedbush Securities analyst Daniel Ives stated that Nvidia's chips have become the new oil and gold in the IT field, driving the AI revolution and are currently the only choice available.

On Thursday this week, Nvidia's stock price initially fell by nearly 1.4%, then quickly rebounded, reaching a new daily high in early trading, with an intraday increase of over 3.2%. It later gave back most of its gains, with less than a 1% increase at midday, rebounding after two consecutive days of decline, surpassing the closing low since August 9th that was set out over the previous two days.