Financial giants have made a conspicuous bearish move on Progressive. Our analysis of options history for Progressive (NYSE:PGR) revealed 10 unusual trades.

Delving into the details, we found 0% of traders were bullish, while 90% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $240,885, and 6 were calls, valued at $514,532.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $300.0 for Progressive, spanning the last three months.

Analyzing Volume & Open Interest

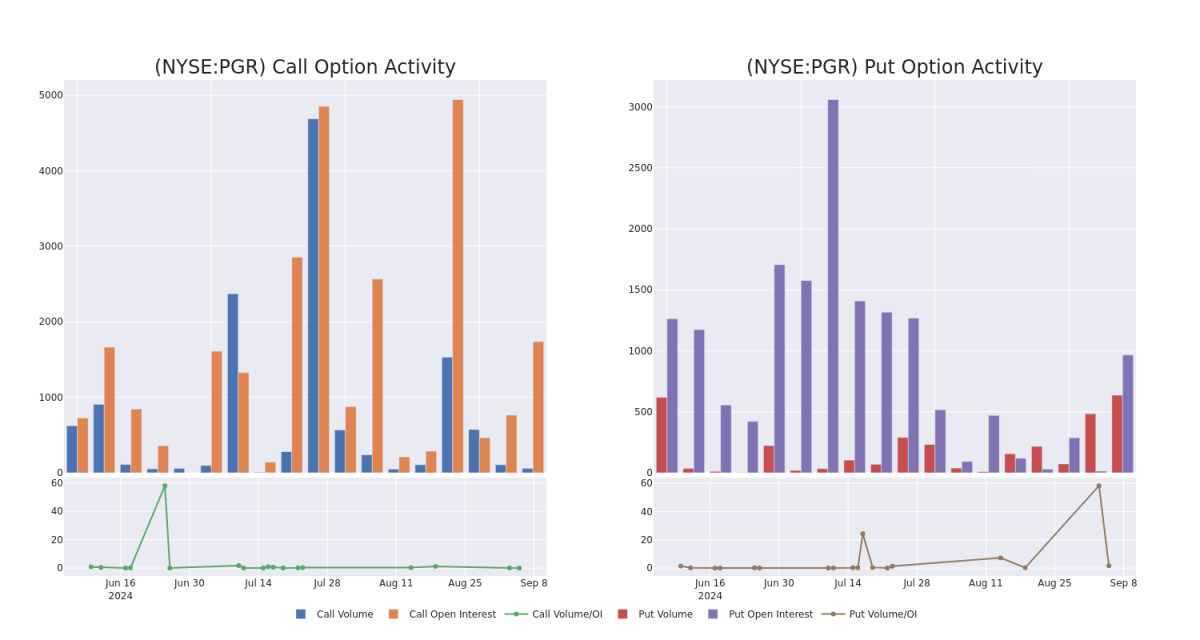

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Progressive 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| PGR | CALL | TRADE | BEARISH | 01/16/26 | $37.0 | $36.3 | $36.3 | $250.00 | $214.1K | 173 | 0 |

| PGR | PUT | SWEEP | BEARISH | 06/20/25 | $20.4 | $19.9 | $20.37 | $250.00 | $120.1K | 55 | 60 |

| PGR | CALL | SWEEP | BEARISH | 01/16/26 | $47.2 | $46.5 | $46.71 | $230.00 | $116.5K | 76 | 2 |

| PGR | CALL | SWEEP | BEARISH | 01/17/25 | $30.1 | $28.6 | $28.98 | $230.00 | $71.7K | 246 | 25 |

| PGR | PUT | TRADE | NEUTRAL | 11/15/24 | $51.3 | $47.4 | $49.05 | $300.00 | $49.0K | 10 | 0 |

About Progressive

Progressive underwrites private and commercial auto insurance and specialty lines; it has almost 20 million personal auto policies in force and is one of the largest auto insurers in the United States. Progressive markets its policies through independent insurance agencies in the US and Canada and directly via the internet and telephone. Its premiums are split roughly equally between the agent and the direct channel. The company also offers commercial auto policies and entered homeowners insurance through an acquisition in 2015.

After a thorough review of the options trading surrounding Progressive, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Progressive

- Currently trading with a volume of 2,309,712, the PGR's price is down by -1.72%, now at $249.54.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 36 days.

What Analysts Are Saying About Progressive

5 market experts have recently issued ratings for this stock, with a consensus target price of $295.6.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Progressive, targeting a price of $252.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Progressive, targeting a price of $294.

- An analyst from HSBC has elevated its stance to Buy, setting a new price target at $253.

- In a cautious move, an analyst from Barclays downgraded its rating to Equal-Weight, setting a price target of $367.

- An analyst from B of A Securities persists with their Buy rating on Progressive, maintaining a target price of $312.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Financial giants have made a conspicuous bearish move on Progressive. Our analysis of options history for Progressive (NYSE:PGR) revealed 10 unusual trades.

Delving into the details, we found 0% of traders were bullish, while 90% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $240,885, and 6 were calls, valued at $514,532.

予想される価格の変動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $300.0 for Progressive, spanning the last three months.

出来高と建玉を分析すること

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Progressive 30-Day Option Volume & Interest Snapshot

注目すべきオプション活動:

| シンボル | プット/コール | 取引タイプ | センチメント | 権利行使日 | 売気配 | 買気配 | 価格 | 権利行使価格 | トータル取引価格 | 建玉 | 出来高 |

|---|

| PGR | コール | 取引 | 弱気 | 01/16/26 | $37.0 | $36.3 | $36.3 | $250.00 | 214.1千ドル | 24,708,975 / (13.9%) | 0 |

| PGR | プット | スイープ | 弱気 | 06/20/25 | $20.4 | $19.9 | N/A | $250.00 | 120.1千ドル | 55 | 60 |

| PGR | コール | スイープ | 弱気 | 01/16/26 | $47.2 | $46.5 | $46.71 | $230.00 | 116.5千ドル | 76 | 2 |

| PGR | コール | スイープ | 弱気 | 01/17/25 | $30.1 | $28.6 | 28.98ドル | $230.00 | $71.7K | 246 | 25 |

| PGR | プット | 取引 | ニュートラル | 24年11月15日 | TRADE | 47.4ドル | 49.05ドル | $300.00 | 49.0千ドル | 10 | 0 |

プログレッシブについて

プログレッシブは私用および商用自動車保険および専門ラインを扱っており、米国で最も大きな自動車保険会社の1つであり、有効な個人用自動車保険契約は約2,000万件です。プログレッシブは、米国およびカナダの独立系保険代理店、インターネット、および電話を通じて保険契約を販売しています。プレミアムはエージェントと直接チャネルの間でほぼ半分ずつ分割されています。同社は商用自動車保険も提供し、2015年の買収を通じて住宅保険に参入しました。

プログレッシブを取り巻くオプション取引を十分に調査した後、より詳細に企業を調査します。これには、現在の市場状況とパフォーマンスの評価が含まれます。

プログレッシブの現在の市場状況

- 出来高2,309,712で取引されているPGRの価格は-1.72%下落し、現在$249.54です。

- 予想される決算発表は21日後です。

- 予想される決算発表は36日後です。

プログレッシブについてのアナリストの意見

5人の市場の専門家が最近この株に対して評価を出しており、目標株価は295.6ドルとなっています。

- Piper Sandlerのアナリストは引き続きプログレッシブにオーバーウェイトの評価を維持し、価格を252ドルと目標にしています。

- b of A Securitiesのアナリストは引き続きプログレッシブを買い評価を維持し、価格を294ドルと目標にしています。

- HSBCのアナリストは買い評価に引き上げ、新たな価格目標を253ドルと設定しました。

- バークレイズのアナリストは慎重な動きとして、評価をオーバーウェイトから等倍(中立)にダウングレードし、価格目標を367ドルに設定しました。

- b of A Securitiesのアナリストはプログレッシブに対する買い評価を維持し、価格を312ドルと目標にしています。

オプションは、株式だけを取引するよりもリスキーな資産ですが、より高い利益ポテンシャルがあります。真剣なオプショントレーダーは、毎日自己教育を行い、トレードをスケーリングイン・スケーリングアウトし、2つ以上のインジケーターをフォローし、市場を密接に追いかけることでこのリスクを管理します。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.