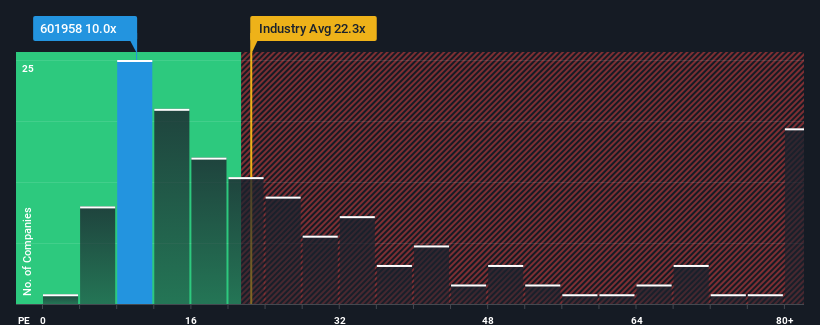

Jinduicheng Molybdenum Co., Ltd.'s (SHSE:601958) price-to-earnings (or "P/E") ratio of 10x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 52x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been pleasing for Jinduicheng Molybdenum as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Jinduicheng Molybdenum's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 45% gain to the company's bottom line. The latest three year period has also seen an excellent 882% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Retrospectively, the last year delivered an exceptional 45% gain to the company's bottom line. The latest three year period has also seen an excellent 882% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 2.7% per annum during the coming three years according to the four analysts following the company. With the market predicted to deliver 20% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Jinduicheng Molybdenum's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Jinduicheng Molybdenum's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jinduicheng Molybdenum maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Jinduicheng Molybdenum that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.