The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Shandong Xinchao Energy Corporation Limited (SHSE:600777) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Shandong Xinchao Energy's Debt?

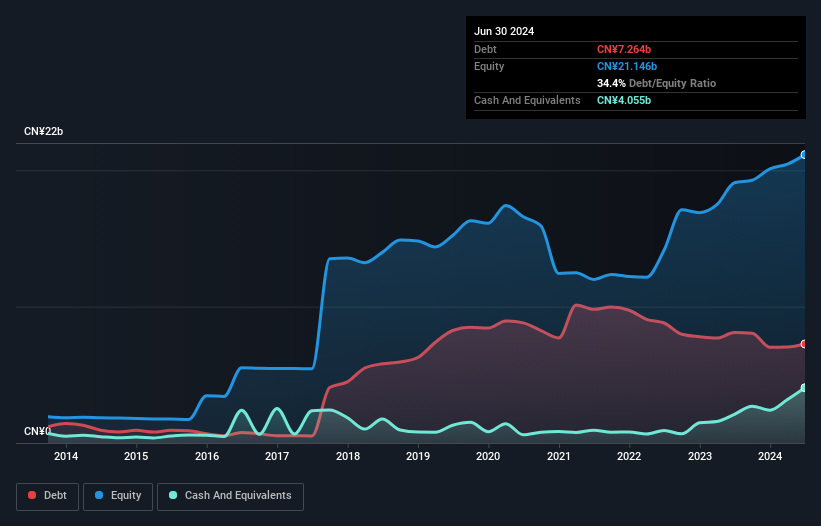

As you can see below, Shandong Xinchao Energy had CN¥7.26b of debt at June 2024, down from CN¥8.09b a year prior. However, it also had CN¥4.05b in cash, and so its net debt is CN¥3.21b.

How Strong Is Shandong Xinchao Energy's Balance Sheet?

The latest balance sheet data shows that Shandong Xinchao Energy had liabilities of CN¥2.83b due within a year, and liabilities of CN¥11.5b falling due after that. Offsetting these obligations, it had cash of CN¥4.05b as well as receivables valued at CN¥1.35b due within 12 months. So it has liabilities totalling CN¥8.88b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of CN¥12.4b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Shandong Xinchao Energy's net debt is only 0.46 times its EBITDA. And its EBIT covers its interest expense a whopping 10.4 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On the other hand, Shandong Xinchao Energy's EBIT dived 18%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Shandong Xinchao Energy will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Shandong Xinchao Energy produced sturdy free cash flow equating to 79% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Shandong Xinchao Energy's conversion of EBIT to free cash flow was a real positive on this analysis, as was its interest cover. But truth be told its EBIT growth rate had us nibbling our nails. Looking at all this data makes us feel a little cautious about Shandong Xinchao Energy's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Shandong Xinchao Energy's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.