When considering stocks to buy and hold for the next decade, it's crucial to select companies with robust profit generation, strong balance sheets, and promising growth trajectories. Here are three top TSX stocks that offer exceptional long-term value – provided you buy at the right price. Timing is everything, so look to purchase these gems during market dips for optimal returns.

Brookfield Asset Management stock: A foundation for long-term wealth creation

Brookfield Asset Management (TSX:BAM) is a cornerstone of the financial services sector that you'll want in your portfolio. This global giant has spent 25 years delivering impressive, risk-adjusted returns across a diversified portfolio of assets including renewable power, infrastructure, private equity, real estate, and credit.

With nearly US$1 trillion in assets under management – over half of which are fee-bearing capital – Brookfield boasts a reliable revenue stream from management fees and lucrative performance fees tied to its stellar investment outcomes.

Currently, the stock is fairly valued with a dividend yield of approximately 3.8%. The company's growth potential is substantial, as evidenced by its recent 18% dividend increase in February 2024. This combination of high growth potential and solid dividends makes Brookfield a prime candidate for long-term holding.

RBC: A reliable blue chip stock in any portfolio

Royal Bank of Canada (TSX:RY) stands as one of the oldest and most lucrative institutions in Canada. Its diversified operations span personal and commercial banking, wealth management, capital markets, and insurance.

Over the past decade, RBC has consistently delivered impressive results, with revenue per share growing at a compound annual growth rate (CAGR) of over 12% and diluted earnings per share rising at a CAGR of 6.6%. The bank has more than doubled its dividend over the same period, reflecting a CAGR of approximately 7.8%.

However, priced at $165 per share, RBC is currently trading at the high end of its historical valuation range. For those looking to invest in this stellar bank, it would be wise to wait for a market pullback. For instance, in 2023, RBC shares fell 19% from peak to trough, which was a spectacular buying opportunity.

Loblaw: A defensive retail giant you don't want to miss

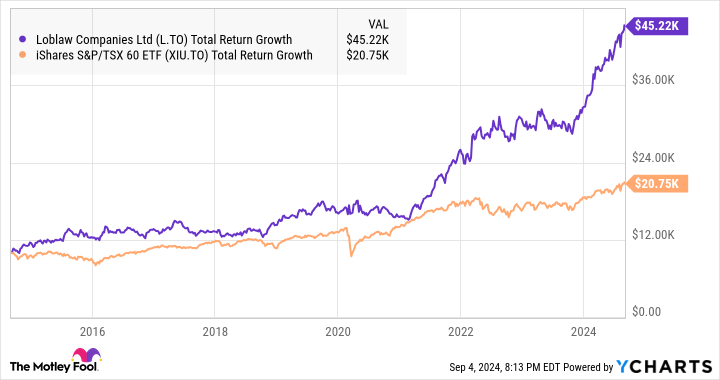

Loblaw (TSX:L) was once overlooked due to its modest dividend yield, but that was a significant oversight. Over the past decade, Loblaw stock has outperformed the Canadian stock market by a factor of three, turning an initial $10,000 investment into a remarkable $45,220.

L and XIU Total Return Level data by YCharts

Loblaw dominates the Canadian retail landscape with its strong banners, including Real Canadian Superstore, No Frills, Shoppers Drug Mart, and T&T Supermarket. Its flagship brands, President's Choice and No Name, are household names across Canada.

The stock has surged 37% year to date, and analysts suggest it remains reasonably valued. For long-term investors, this stock offers a compelling opportunity. Consider acquiring shares now and adding more during market corrections or periods of consolidation.

The Foolish investor takeaway

In summary, these three stocks – Brookfield Asset Management, Royal Bank of Canada, and Loblaw – offer strong potential for long-term growth. Keep an eye out for market dips to ensure you buy at advantageous prices and maximize your returns over the next decade.