Financial giants have made a conspicuous bearish move on Amazon.com. Our analysis of options history for Amazon.com (NASDAQ:AMZN) revealed 11 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $248,634, and 5 were calls, valued at $646,190.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $200.0 for Amazon.com during the past quarter.

Insights into Volume & Open Interest

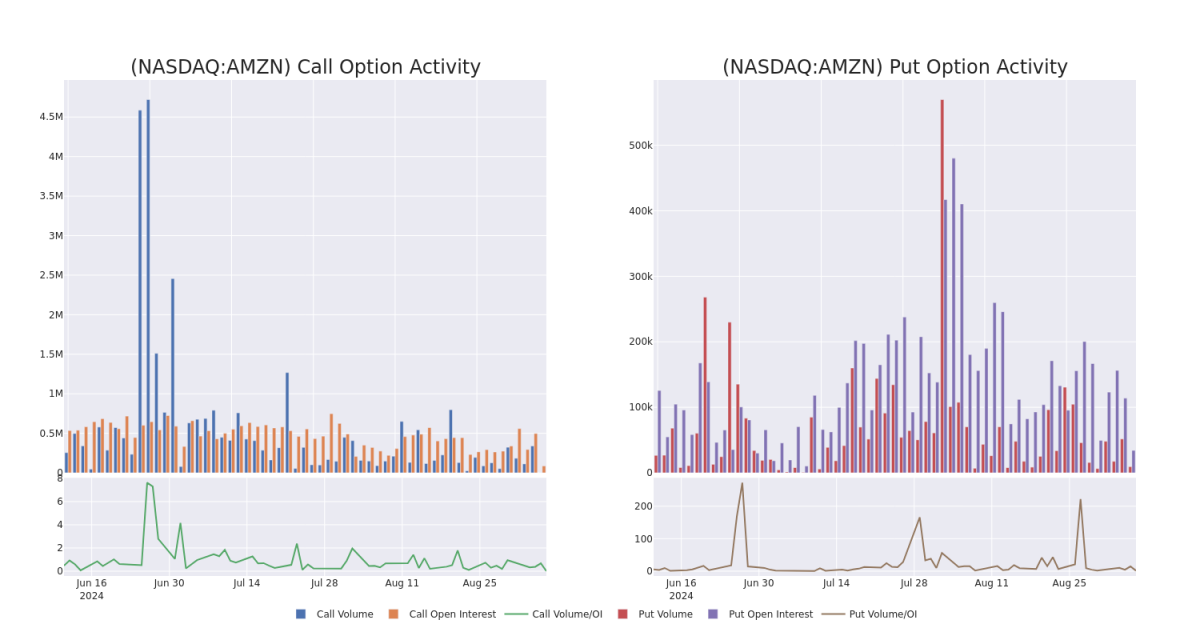

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Amazon.com's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Amazon.com's significant trades, within a strike price range of $140.0 to $200.0, over the past month.

Amazon.com Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | NEUTRAL | 09/13/24 | $16.75 | $15.85 | $16.1 | $160.00 | $478.1K | 1.9K | 710 |

| AMZN | PUT | SWEEP | BULLISH | 12/20/24 | $1.7 | $1.64 | $1.64 | $140.00 | $73.6K | 7.4K | 1.1K |

| AMZN | CALL | TRADE | BEARISH | 09/13/24 | $1.95 | $1.87 | $1.88 | $180.00 | $56.4K | 13.5K | 150 |

| AMZN | PUT | SWEEP | BULLISH | 09/20/24 | $2.69 | $2.65 | $2.66 | $172.50 | $47.2K | 8.5K | 552 |

| AMZN | CALL | TRADE | BEARISH | 12/18/26 | $31.65 | $31.3 | $31.3 | $200.00 | $43.8K | 3.4K | 15 |

About Amazon.com

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

Having examined the options trading patterns of Amazon.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Amazon.com Standing Right Now?

- With a volume of 4,244,653, the price of AMZN is down -1.29% at $175.6.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 48 days.

What Analysts Are Saying About Amazon.com

4 market experts have recently issued ratings for this stock, with a consensus target price of $237.5.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $230.

- Consistent in their evaluation, an analyst from JMP Securities keeps a Market Outperform rating on Amazon.com with a target price of $265.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $230.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Amazon.com with a target price of $225.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amazon.com options trades with real-time alerts from Benzinga Pro.