What the Options Market Tells Us About CrowdStrike Holdings

What the Options Market Tells Us About CrowdStrike Holdings

Whales with a lot of money to spend have taken a noticeably bearish stance on CrowdStrike Holdings.

有很多资金的鲸鱼对crowdstrike采取了明显的看淡态度。

Looking at options history for CrowdStrike Holdings (NASDAQ:CRWD) we detected 44 trades.

查看CrowdStrike控股(纳斯达克:CRWD)期权历史,我们发现了44笔交易。

If we consider the specifics of each trade, it is accurate to state that 22% of the investors opened trades with bullish expectations and 54% with bearish.

如果考虑每笔交易的具体情况,准确地说,22%的投资者带着看涨的期望开展交易,54%选择看跌。

From the overall spotted trades, 29 are puts, for a total amount of $3,966,138 and 15, calls, for a total amount of $745,972.

在所有观察到的交易中,有29笔看跌,总金额为3966138美元,有15笔看涨,总金额为745972美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $165.0 to $380.0 for CrowdStrike Holdings over the last 3 months.

考虑到这些合约的成交量和未平仓合约量,过去3个月中大型交易者似乎一直将CrowdStrike控股的目标价范围定在165.0至380.0美元之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for CrowdStrike Holdings's options for a given strike price.

这些数据可以帮助您追踪CrowdStrike Holdings特定行权价的期权的流动性和关注度。

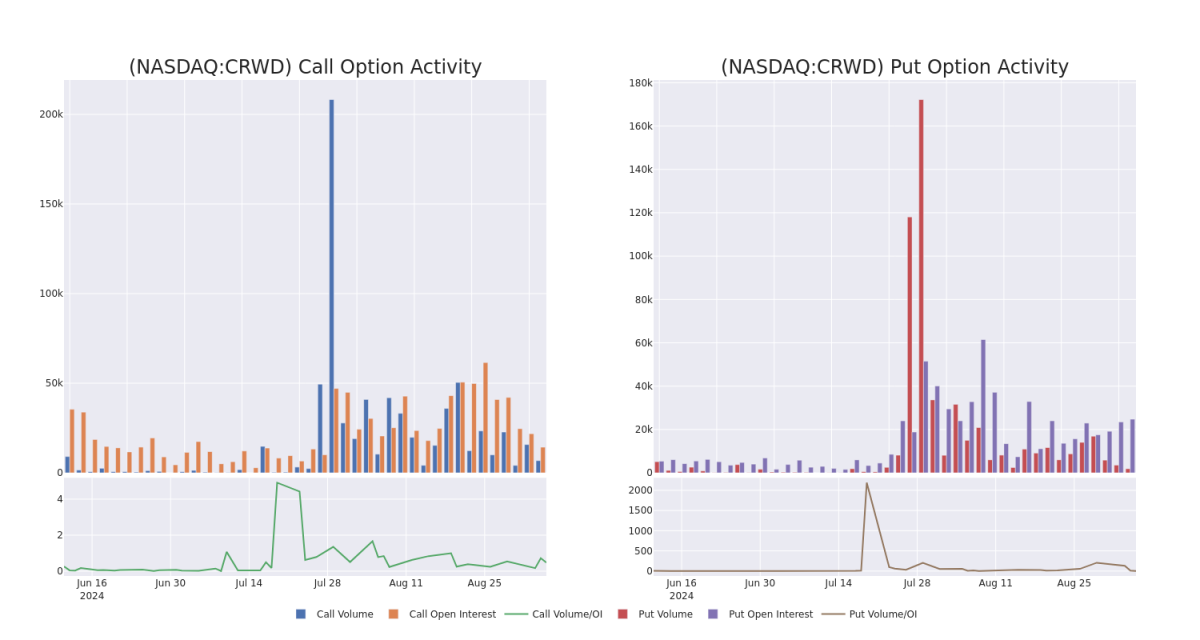

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CrowdStrike Holdings's whale activity within a strike price range from $165.0 to $380.0 in the last 30 days.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CrowdStrike Holdings's whale activity within a strike price range from $165.0 to $380.0 in the last 30 days.

CrowdStrike Holdings Option Volume And Open Interest Over Last 30 Days

CrowdStrike Holdings过去30天期权成交量和未平仓合约量

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | PUT | TRADE | BEARISH | 11/21/25 | $57.05 | $54.65 | $56.75 | $270.00 | $2.2M | 285 | 400 |

| CRWD | PUT | TRADE | NEUTRAL | 10/25/24 | $4.4 | $1.23 | $2.62 | $210.00 | $393.0K | 0 | 0 |

| CRWD | CALL | TRADE | BEARISH | 06/18/26 | $67.6 | $65.8 | $65.8 | $250.00 | $164.5K | 50 | 50 |

| CRWD | PUT | TRADE | BEARISH | 12/18/26 | $53.2 | $51.7 | $53.2 | $240.00 | $122.3K | 96 | 25 |

| CRWD | PUT | TRADE | NEUTRAL | 09/06/24 | $92.15 | $88.55 | $90.32 | $345.00 | $108.3K | 0 | 12 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | 看跌 | 交易 | 看淡 | 11/21/25 | $57.05 | $54.65 | $56.75 | $270.00 | $2.2M | 285 | 400 |

| CRWD | 看跌 | 交易 | 中立 | 10/25/24 | $4.4 | $1.23 | $2.62 | 目标股价为$210.00。 | $393.0K | 0 | 0 |

| CRWD | 看涨 | 交易 | 看淡 | 06/18/26 | $67.6 | $65.8 | $65.8 | $250.00 | 164.5千美元 | 50 | 50 |

| CRWD | 看跌 | 交易 | 看淡 | 12/18/26 | $53.2 | $51.7 | $53.2 | $240.00 | $122.3K | 96 | 25 |

| CRWD | 看跌 | 交易 | 中立 | 09/06/24 | $92.15 | $88.55 | 90.32美元 | $345.00 | $108.3K | 0 | 12 |

About CrowdStrike Holdings

关于CrowdStrike控股公司

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

CrowdStrike是一家基于云的网络安全公司,专门提供下一代安全垂直领域,如端点、云工作负载、身份和安全运营。CrowdStrike的主要产品是其Falcon平台,为企业提供一种类似单一的视图,以便检测和响应攻击其IT基础设施的安全威胁。这家总部位于德克萨斯州的公司成立于2011年,并于2019年上市。

Following our analysis of the options activities associated with CrowdStrike Holdings, we pivot to a closer look at the company's own performance.

在我们分析与CrowdStrike Holdings相关的期权业务之后,我们转而更加关注公司自身的表现。

Where Is CrowdStrike Holdings Standing Right Now?

CrowdStrike Holdings现在处于什么位置?

- With a volume of 2,451,448, the price of CRWD is down -4.21% at $245.64.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 81 days.

- CRWD的交易量为2,451,448,价格下跌了-4.21%,报245.64美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 预计下一季度财报将在81天后发布。

Expert Opinions on CrowdStrike Holdings

有关CrowdStrike Holdings的专家意见

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $301.8.

过去一个月,5位行业分析师分享了对这支股票的见解,提出了平均目标价301.8美元。

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $315.

- Maintaining their stance, an analyst from Bernstein continues to hold a Outperform rating for CrowdStrike Holdings, targeting a price of $315.

- Consistent in their evaluation, an analyst from Deutsche Bank keeps a Hold rating on CrowdStrike Holdings with a target price of $275.

- Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Perform rating for CrowdStrike Holdings, targeting a price of $265.

- An analyst from HSBC has elevated its stance to Buy, setting a new price target at $339.

- 受到担忧的影响,Wedbush的分析师将评级调降为增持,并设置了新的目标价315美元。

- Bernstein的分析师维持对CrowdStrike Holdings的看法,并继续给予增持评级,目标价为315美元。

- 德意志银行的分析师一贯以来对CrowdStrike Holdings持有持有评级,目标价为275美元。

- Scotiabank的分析师继续持有CrowdStrike Holdings的板块表现评级,目标价为265美元。

- HSBC的分析师将其立场提升至买入,将目标价设定为339美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 29 are puts, for a total amount of $3,966,138 and 15, calls, for a total amount of $745,972.

From the overall spotted trades, 29 are puts, for a total amount of $3,966,138 and 15, calls, for a total amount of $745,972.