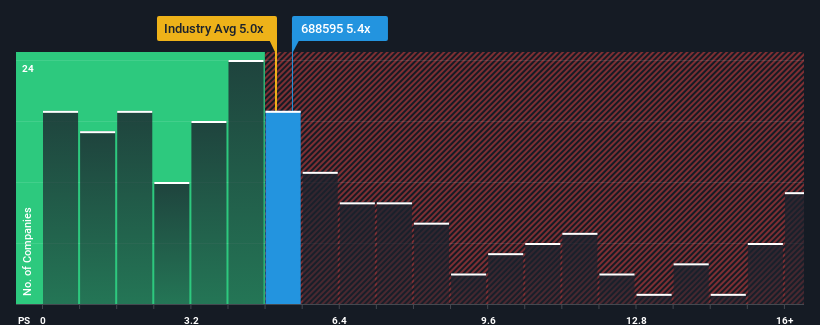

There wouldn't be many who think Chipsea Technologies (shenzhen) Corp.'s (SHSE:688595) price-to-sales (or "P/S") ratio of 5.4x is worth a mention when the median P/S for the Semiconductor industry in China is similar at about 5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Chipsea Technologies (shenzhen)'s P/S Mean For Shareholders?

Chipsea Technologies (shenzhen) certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Chipsea Technologies (shenzhen)'s future stacks up against the industry? In that case, our free report is a great place to start.How Is Chipsea Technologies (shenzhen)'s Revenue Growth Trending?

Chipsea Technologies (shenzhen)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 43% gain to the company's top line. The latest three year period has also seen an excellent 31% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Retrospectively, the last year delivered an exceptional 43% gain to the company's top line. The latest three year period has also seen an excellent 31% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 46% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 36% growth forecast for the broader industry.

With this information, we find it interesting that Chipsea Technologies (shenzhen) is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Chipsea Technologies (shenzhen)'s P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Chipsea Technologies (shenzhen)'s analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 1 warning sign for Chipsea Technologies (shenzhen) you should be aware of.

If these risks are making you reconsider your opinion on Chipsea Technologies (shenzhen), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.