Market Still Lacking Some Conviction On Fujian Aonong Biological Technology Group Incorporation Limited (SHSE:603363)

Market Still Lacking Some Conviction On Fujian Aonong Biological Technology Group Incorporation Limited (SHSE:603363)

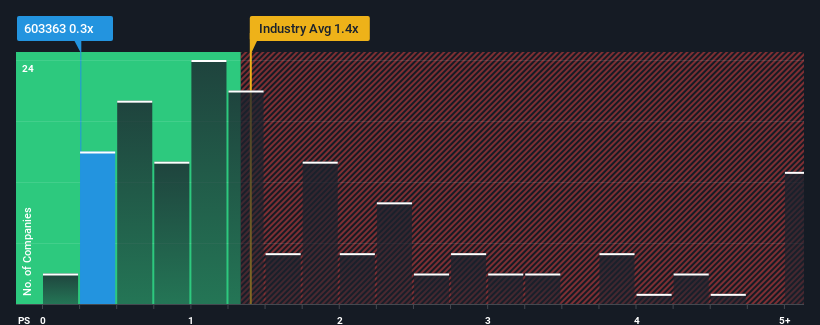

Fujian Aonong Biological Technology Group Incorporation Limited's (SHSE:603363) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Food industry in China have P/S ratios greater than 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Fujian Aonong Biological Technology Group Incorporation's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Fujian Aonong Biological Technology Group Incorporation's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Fujian Aonong Biological Technology Group Incorporation's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Fujian Aonong Biological Technology Group Incorporation's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 39%. This means it has also seen a slide in revenue over the longer-term as revenue is down 10% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 39%. This means it has also seen a slide in revenue over the longer-term as revenue is down 10% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 137% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Fujian Aonong Biological Technology Group Incorporation is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Fujian Aonong Biological Technology Group Incorporation currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Fujian Aonong Biological Technology Group Incorporation is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.