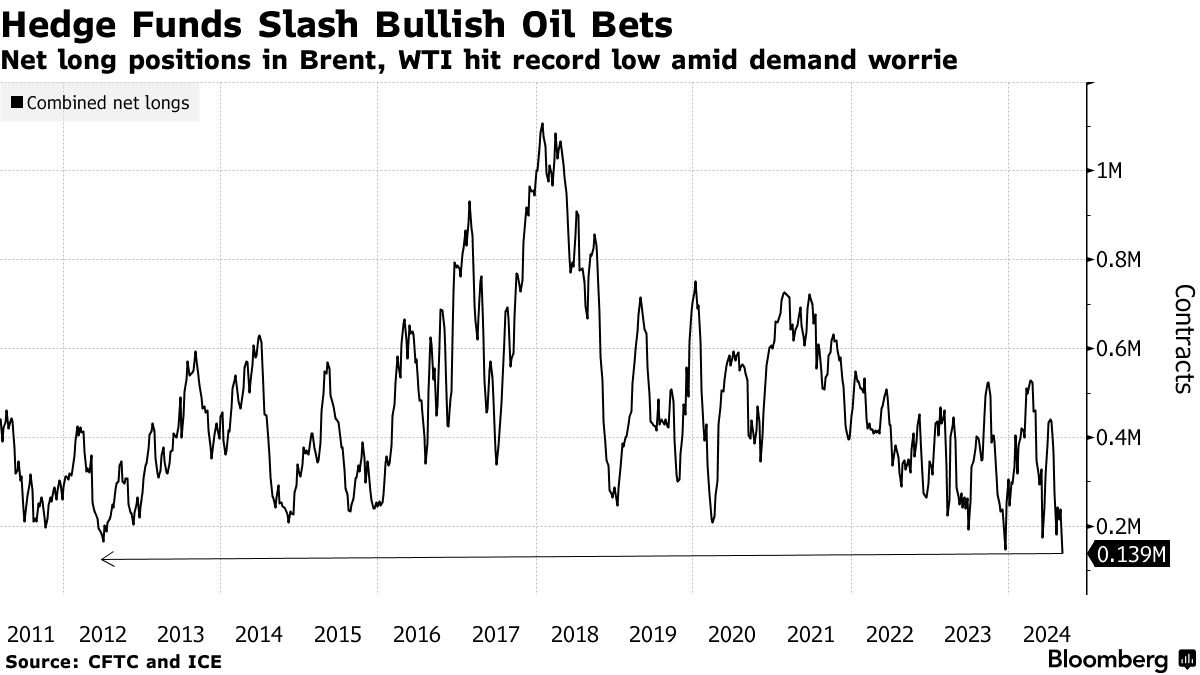

Hedge funds have reduced their bullish bets on crude oil to historically low levels.

According to the information from the Laohu Finacial APP, the bullish degree of hedge funds for crude oil prices has reached the lowest level since 2013, and also the lowest level recorded by ICE Futures Europe and CFTC for crude oil positions. The main logic may lie in the increasingly strong expectation of oversupply of crude oil by hedge funds, as well as multiple signs indicating a continuous weakening outlook for crude oil demand.

According to the weekly statistical data as of September 3 from ICE Futures Europe and CFTC, hedge fund managers have significantly reduced the overall bullish positions of Brent crude oil and WTI crude oil by 99,889 lots. As of that week, the "total net long position" measuring the bullishness of hedge funds on crude oil prices was 139,242 lots - the lowest position statistics since the summary statistics began in March 2011.

In recent weeks, due to the continuous deterioration of global PMI indicators, market concerns about crude oil demand in the USA and Asia have intensified. As a result of algorithm-based hedge funds selling off a large number of crude oil futures contracts, crude oil prices have plummeted, causing a sharp deterioration in the sentiment of the commodity market. The global benchmark for crude oil prices - Brent crude oil prices have continued to plummet since August 30, with a drop of up to 10%. The decision by OPEC+ to extend voluntary production cuts until the end of November has also failed to boost oil price trends.

In recent weeks, due to the continuous deterioration of global PMI indicators, market concerns about crude oil demand in the USA and Asia have intensified. As a result of algorithm-based hedge funds selling off a large number of crude oil futures contracts, crude oil prices have plummeted, causing a sharp deterioration in the sentiment of the commodity market. The global benchmark for crude oil prices - Brent crude oil prices have continued to plummet since August 30, with a drop of up to 10%. The decision by OPEC+ to extend voluntary production cuts until the end of November has also failed to boost oil price trends.

The catalyst for the negative sentiment is the strong expectation of oversupply, the potential agreement to restore Libyan production, and the possibility of an increase in crude oil production by OPEC+ in the near future. For a long time, the oil-producing countries led by Saudi Arabia and Russia in OPEC+ have chosen to reduce crude oil production. However, this reduction has not been able to raise crude oil trading prices at least this year.

Goldman Sachs, a top Wall Street investment bank, has recently lowered its expectations for the international crude oil benchmark - Brent crude oil. It is currently expected that the price of Brent crude oil in 2025 will fluctuate between $70 and $85 per barrel, with an average price of approximately $77. This range is $5 lower than Goldman Sachs' previous forecast. In comparison, the current Brent crude oil futures price is trading around $71. Goldman Sachs' latest expectations imply that the potential price increase of Brent crude oil in 2025 is very limited, and there is a possibility of a low performance throughout the year.

One crucial factor behind Goldman Sachs' revised oil price forecast is the unexpectedly low demand for crude oil from major consumers such as China, Japan, South Korea, and India, who are the main drivers of global oil consumption.

Goldman Sachs believes that by 2025, the entire crude oil market may shift from a slightly tight supply-demand balance to a potential surplus. This expectation from Goldman Sachs is derived from the overall expectation of OPEC and non-OPEC oil-producing countries for continuous increase in crude oil supply. Goldman Sachs predicts that if OPEC member countries completely reverse their production cuts, Brent crude oil trading prices could fall to a temporary low point of $61 per barrel. This situation will intensify the competitive situation among crude oil producers and may lead to price reduction in order to maintain their respective crude oil supply shares.

In a recent report, Goldman Sachs stated, "Given high excess capacity, as well as weak demand from major Asian consuming countries and downward demand risks from potential trade tensions, we still believe that the risk bias for the price range of $70-85 per barrel is inclined to continue downward rather than upward."

Morgan Stanley's upper price expectation for Brent crude oil in 2025 is lower than Goldman Sachs' expectation. Morgan Stanley predicts that the price of Brent crude oil will decline in 2025, and it is expected to be between $75 and $78 per barrel by the end of 2025. Morgan Stanley also predicts that by the end of 2024, the market will transition from tight to balanced, and there may be an excess supply of crude oil by 2025 due to the increased supply from OPEC and non-OPEC oil-producing countries.

最近几周,由于全球PMI指标持续恶化,市场对美国和亚洲地区的原油需求的担忧情绪加剧,以及基于算法的对冲基金大量抛售原油期货合约,导致原油价格暴跌,大宗商品市场情绪急剧恶化。全球原油价格基准——布伦特原油价格自8月30日以来持续暴跌,自那以来的跌幅高达10%,欧佩克+将自愿减产措施延长至11月底的决定也未能提振油价走势。

最近几周,由于全球PMI指标持续恶化,市场对美国和亚洲地区的原油需求的担忧情绪加剧,以及基于算法的对冲基金大量抛售原油期货合约,导致原油价格暴跌,大宗商品市场情绪急剧恶化。全球原油价格基准——布伦特原油价格自8月30日以来持续暴跌,自那以来的跌幅高达10%,欧佩克+将自愿减产措施延长至11月底的决定也未能提振油价走势。