The expected number of interest rate cuts for derivative products during the year is 4.5 times (25bp each time), and the number of interest rate cuts before June next year is 9 times. This radical expectation of interest rate cuts contributes to achieving the effect of early interest rate cuts, which may be welcomed by the current Federal Reserve.

The Huaxi Securities research team released a research report commenting on the US non-farm payroll data. The team believes that the labor market has cooled significantly and may need to accelerate the pace of interest rate cuts. While wage growth has accelerated, it is mainly due to structural increases, and the impact on inflation is relatively controllable. In this case, the remaining three Federal Reserve meetings this year may cut interest rates by at least 25bp each time, and the total interest rate cut for the year may be at least 75bp. How fast the Federal Reserve reaches the end of the interest rate cut cycle may be more important.

The following is the summary of the research report:

On September 6, the US Department of Labor released the August non-farm payroll survey data for enterprises and households. The number of new non-farm employment in August was 0.142 million, weaker than the market's expectation of 0.16 million, and 0.089 million (revised) in July. The unemployment rate in August fell as expected by 0.1 percentage point to 4.2%, compared to the previous level of 4.3%.

After the data was released, the 10-year US Treasury yield fell by about 10bp in the short term, but then turned upward, essentially recovering the previous decline; US stocks fell, with the Nasdaq Composite Index, S&P 500, and Dow Jones Industrial Average declining by 2.47%, 1.70%, and 0.95% respectively; the US dollar index fell to a intraday low of 100.58 and then rebounded to 101.27; COMEX gold rose by about 0.5% in the short term and then turned downward, closing down by 0.64%. Concerns about the cooling of the US economy outweighed the interest rate cut trades. How to view the August non-farm payroll data?

First, the unemployment rate slightly declined. The U3 unemployment rate in August dropped from 4.25% to 4.22%, which seems to be a decrease of 0.1 percentage point when rounded, but actually only a slight decrease of 0.03 percentage point, significantly higher than the unemployment rate of 4.05% in June. The number of unemployed in August was 7.115 million, slightly lower than the previous month's 7.163 million. The number of temporarily unemployed (seasonally adjusted) decreased from 1.062 million to 0.872 million, possibly reflecting the retreat of the impact of severe weather. The number of permanently unemployed increased slightly from 1.682 million to 1.688 million. The labor force participation rate remained at 62.7%, and the transfer of non-labor force population to the labor market temporarily slowed down.

The overall unemployment rate is higher than 2018-2019. The U6 unemployment rate in August was 7.9% (an increase of 0.1 percentage point compared to the previous month), which is between the average of 7.45% in 2019 and 8.1% in 2018. The U3 unemployment rate was 4.22%, significantly higher than the 3.9% in 2018 and 3.7% in 2019.

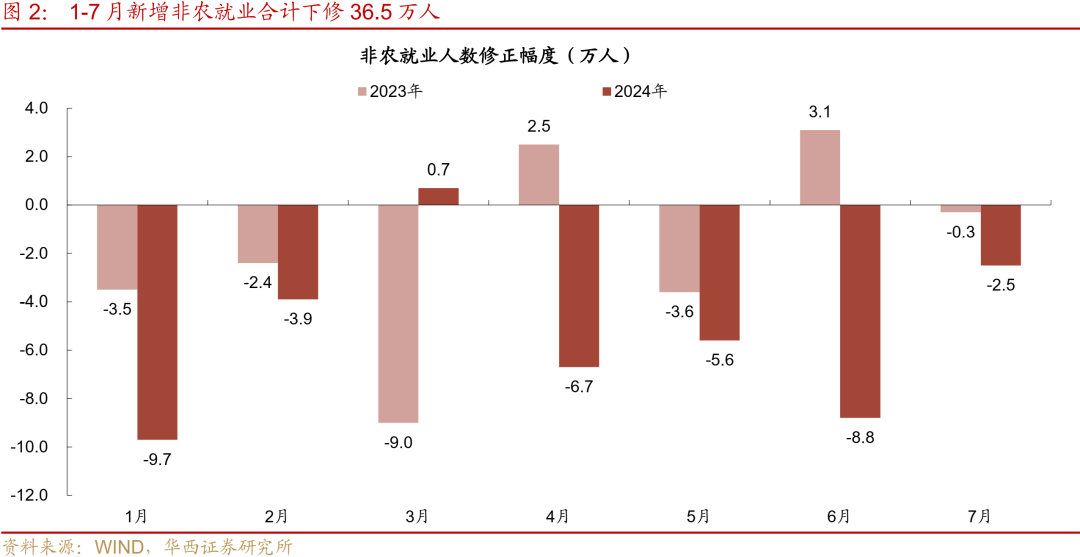

Second, the new employment is still relatively weak, and continues to be revised down. In August, the new employment increased by 0.142 million, down from 0.114 million in July to 0.089 million, and from 0.179 million in June to 0.118 million. A total of 0.086 million people were revised down in June and July. The new non-agricultural employment from January to July this year was revised down by 21.5%, totaling 0.365 million people, compared to only 6.4% and 0.132 million people for the same period last year.

In August, the private sector added 0.118 million new jobs, with an average of 0.152 million from January to August this year, and an average of only 0.096 million in the last 3 months. Compared to 2018-2019, the annual averages were 0.18 million and 0.148 million respectively. This reflects a significant slowdown in the employment opportunities provided by the private sector, which may be difficult to meet the supply growth brought by immigrants and may lead to continuous increase in the unemployment rate in the future.

The non-agricultural recovery rate is relatively low, also reflecting a cooling labor market in the USA. Since the beginning of this year, the average first-month recovery rate for non-agricultural employment has been 59.9%, significantly lower than the average of 67.5% for the same period in the past three years, a decrease of 7.6 percentage points. The recovery rates for the second and third months were also 3.7 and 6.1 percentage points lower, respectively. The monthly data for non-agricultural employment is frequently revised downwards. Generally speaking, small and medium-sized enterprises account for a high proportion of the recovery in the second and third months, giving greater weight to non-agricultural employment calculated based on the first-month data. Smaller and medium-sized enterprises are more susceptible to the negative impact of interest rate hikes, leading to a faster decline in the number of new jobs they provide. Therefore, the frequent and substantial downward revisions of the new non-agricultural employment this year reflect a labor market that is relatively 'cool' compared to the non-agricultural initial value.

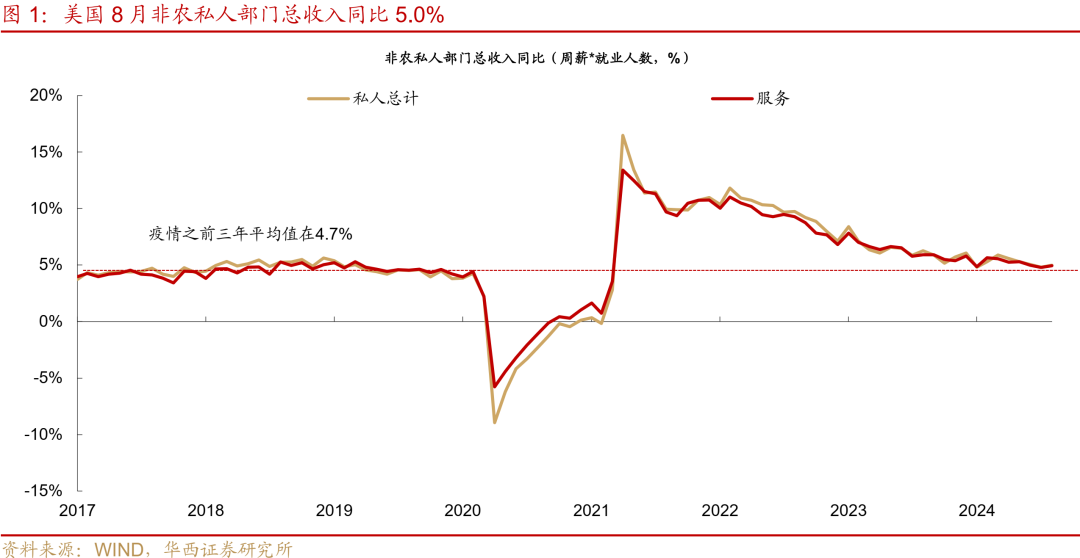

Third, wage growth is accelerating. In August, the seasonally adjusted month-on-month non-agricultural wage growth was 0.40%, reaching a high point since February this year. The corresponding annualized growth rate is about 4.9%, although the growth rate is higher, it is not enough to significantly boost inflation. Both goods and services saw an increase, rising by 0.06 and 0.20 percentage points to 0.33% and 0.43% respectively. The industries with the largest wage increases are information, utilities, retail, and finance, with growth rates ranging from 0.64% to 0.96%. These industries often require certain professional skills, making it difficult for immigrants to enter directly. In contrast, the wage growth in leisure and hotel, as well as education and medical services, has slowed down or remained basically the same. This wage distribution reflects the presence of structural labor shortages in the labor market. The year-on-year total income of the non-agricultural private sector (weekly salary * number of employees) rose slightly from 4.8% to 5.0%, which is close to the average value of 4.7% from 2017 to 2019 before the epidemic. The growth rate of total non-agricultural income is close to the pre-epidemic normal level.

Fourth, in terms of the pace of interest rate cuts, the Fed meetings in September, November, and December will each see a minimum of 25bp rate cuts. The August U.S. employment data presented a picture of weak new job additions, a slight decrease in the unemployment rate, and a structural rise in wages. We believe that based on the 3-month moving average of the number of new employees in the private sector being only 0.096 million, and the substantial downward revisions of non-agricultural employment this year, the labor market has cooled significantly, possibly requiring a faster pace of interest rate cuts. The accelerated wage growth is mainly due to structural reasons, and its role in boosting inflation is relatively controllable. In this scenario, the Fed's three remaining meetings this year may see at least 25bp rate cuts each, with a total rate cut of at least 75bp for the year.

In terms of market expectations, according to Bloomberg data, the derivative market is expecting 4.5 rate cuts this year (25bp each time), and 9 rate cuts before June next year. This kind of aggressive rate cut expectation may help achieve the effect of cutting rates in advance, which may be welcomed by the current Fed.

As for whether a single 50bp rate cut is needed, the Fed may need more data to make an assessment. After the release of the August employment data, Fed officials emphasized the urgency of rate cuts in September. New York Fed President Williams stated, 'It is appropriate to lower the federal funds rate now', but did not comment on the magnitude of the rate cut. Fed Governor Wall still slightly leans hawkish in his stance, believing that the data is still relatively solid, so rate cuts should be cautious, but he is also open to the possibility of a larger rate cut. Whether the Fed will cut rates by 50bp in the September meeting (to be released in the early morning of September 19th, Beijing time) is still undecided, with the market's expected probability only at 30%. We expect a high probability of a 25bp rate cut in September.

Compared to whether a 25bp or 50bp rate cut is needed, we may need to focus more on the dot plot that the Fed will provide at the September meeting, which represents the rate cut pace acknowledged by the Fed. The dot plot in June this year predicted a 25bp rate cut this year, and 100bp rate cuts over the next two years, tending towards a 25bp rate cut every quarter. We need to observe the dot plot in September, to see if they will switch from a 25bp rate cut per quarter to a 25bp rate cut per meeting (8 meetings per year). The longer run interest rate given by the Fed is 2.8%, which can be seen as the endpoint of the rate cut, corresponding to an overall reduction of about 250bp in this rate cut cycle. How fast the Fed reaches the end point of the rate cut cycle may be more important.

The fifth is that interest rate cuts have been fairly sufficient, and the market is more concerned about the risk of a US economic downturn. The market expects that the Federal Reserve will cut interest rates nine times by June next year, totaling 225 basis points. This is already pricing in a recession, with only the internet bubble in 2001 and the subprime crisis in 2007 having such a rapid pace of rate cuts. Therefore, there is relatively limited room for further expansion of the rate-cut expectations. The market's concerns about a US economic slowdown are increasing, resulting in increased volatility in US stocks. Going forward, important data may continue to impact the sentiment of the US stock market.