On August 23, Urabayashi Naruyama (1809.HK) announced the 2024 interim results. According to financial reports, Pulin Chengshan achieved revenue of about 5.363 billion yuan, an increase of 23.7% year on year; gross profit of 1.32 billion yuan, up 60.4% year on year; profit attributable to shareholders of 0.811 billion yuan, a sharp increase of 148.0% year on year, and a net profit margin of 15%. Furthermore, Pulin Chengshan declared an interim dividend of HK$0.15 per share.

Since last year, downstream demand in the tire industry has continued to be strong. At the same time, tire companies have accelerated the expansion of production capacity and innovative products. The Matthew effect has become more prominent. Pulin Chengshan has stood out and handed over a “questionnaire” with a high score. The company's operations have also been recognized by the market, and the stock price has increased by more than 20% this year as of the closing date. Why did Naruyama Urabayashi do the right thing?

Take advantage of the manufacturing industry to expand overseas and continue to unleash room for performance growth

China's manufacturing industry has become a general trend. In 2023, Thailand attracted 663.239 billion baht of foreign direct investment, of which China accounts for 20%, making it Thailand's largest source of investment. By industry, the total amount of NEVs was 82.2 billion baht, accounting for 12.39%. Chinese tire companies are also a core force in the manufacturing industry going overseas.

China's manufacturing industry has become a general trend. In 2023, Thailand attracted 663.239 billion baht of foreign direct investment, of which China accounts for 20%, making it Thailand's largest source of investment. By industry, the total amount of NEVs was 82.2 billion baht, accounting for 12.39%. Chinese tire companies are also a core force in the manufacturing industry going overseas.

Judging from Pulin Chengshan's financial report, revenue from the Shandong tire production base and the Thai tire production base in the first half of the year accounted for about 64.9% and 35.1% of tire revenue, respectively, compared to 72.0% and 28.0% for the same period last year. Behind the increase in revenue and profit, the Thai factory is becoming an increasingly important profit engine.

It is worth noting that in May of this year, the US announced the preliminary findings of the anti-dumping duty investigation against truck and bus tires imported from Thailand. Pulin Thailand's anti-dumping duty rate was 0%, Bridgestone was 2.35%, and the average tax rate for the remaining participating companies was 2.35%. According to the preliminary ruling of the second administrative review of the anti-dumping duty rate against Thai passenger car and light truck tires issued by the US in early August 2024 (the investigation period is July 1, 2022 to June 30, 2023), Pulin Thailand's anti-dumping duty rate is 4.95%. The final ruling is expected to be announced in early 2025. The decline in the US anti-dumping duty rate on tires imported from Thailand is expected to drive up the volume of orders exported from Pulin Chengshan to the US, and the competitiveness and profits of the Thai manufacturing base are expected to further increase.

The Matthew effect in the industry was highlighted, and Pulin Chengshan achieved both quantitative and profit increases

Tires are an important automotive safety part, which significantly affects vehicle performance, supporting new cars and replacing old tires to ensure tire market demand.

From a global perspective, demand in the tire market rose steadily in the first half of this year. According to Michelin financial reports, in the first half of 2024, global tire sales (semi-steel+all-steel) were 0.9 billion, up 2.69% year on year. Among them, sales of semi-steel tires were 0.794 billion, up 2.70% year on year, and sales of all steel tires were 0.106 billion, up 2.61% year on year.

Specifically, in the Chinese market, consumer demand continues to be strong. According to data from the National Bureau of Statistics, in January-June, China's rubber tire production was about 0.526 billion pieces, an increase of 10.5% over the previous year; China's tire export volume increased by about 5.3%, and the export value increased by about 6.5%.

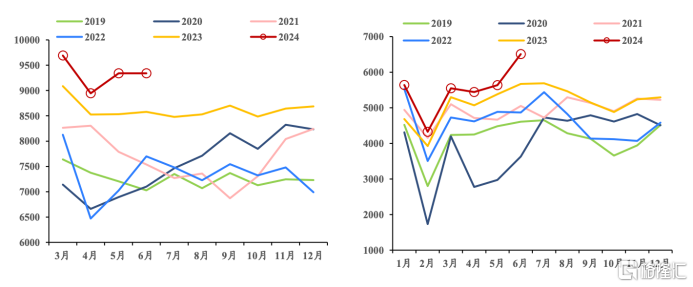

(Left: China's rubber tire outer tube production; right: number of new inflatable rubber tires exported from China, unit: 10,000 pieces)

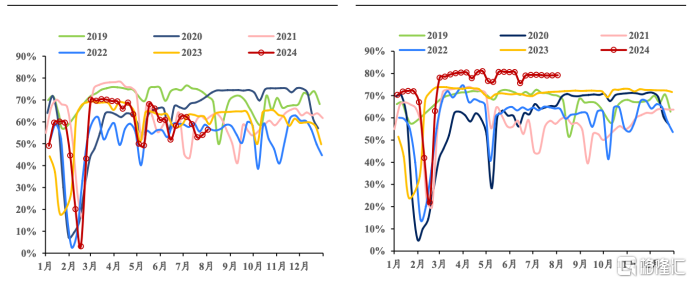

According to the further classification of products, the performance of semi-steel tires is stronger than that of all-steel tires. The operating rate of semi-steel tires remained high in the first half of the year, while the operating rate of all-steel tires declined. For example, in June, the operating rate of steel tires was 79.21%, an increase of 7.77 percentage points over the previous year, and the operating rate of all-steel tires was 57.03%, a decrease of 5.79 percentage points over the previous year.

(Left: operating rate of all-steel tires in China; right: operating rate of semi-steel tires in China)

Looking back at Pulin Chengshan himself, the sales revenue of semi-steel and all-steel radial tires both increased. In terms of revenue, the year-on-year growth rate of half-steel radial tires was 47.6%, and the year-on-year growth rate of all-steel radial tires was 10.4%. At the same time, against the backdrop of strong demand in the passenger car tire market and weak overall demand in the commercial vehicle tire market, domestic and international markets have achieved considerable revenue growth.

(Data source: The company's financial report for the first half of 2024)

(Data source: The company's financial report for the first half of 2024)

This means that Pulin Chengshan not only enjoys beta in the passenger car market, but also outperforms the industry's alpha growth with its own advantages, while long-term deep cultivation in the commercial vehicle sector has enabled its related revenue to maintain contrarian growth. The continued growth of international business also shows that its tire products have been recognized by more overseas customers and have shown strong product strength in global competition. The author believes that the reason for achieving overall growth is reflected in the following aspects:

First, on the product side, Pulin Chengshan is actively promoting research and development of new products. In the first half of 2024, a total of 300 products were developed and launched, including 14 all-steel tires and 286 semi-steel tires. This is in line with the trend of expanding demand in the NEV passenger vehicle market, enriching product lines and strengthening market competitiveness, and continuously increasing market segment share. In addition, in response to overseas market demand, the company has also planned and stocked 13 all-steel tires and 9 semi-steel patterns and products. In recent years, Purin Chengshan has drastically optimized the product structure, relied on R&D and technology to evolve product performance, and built a product matrix integrating high value and deep content. Among them, all-steel radial tires accurately focus on key market segments and strive to create a new generation of green and environmentally friendly products with low rolling resistance and high wear resistance to meet the market's demand for efficient, energy-efficient and environmentally friendly tires. Representative products include the “H Heavy Duty Series” commercial tires and the “PRO Boutique Series”, a high-end commercial tire product. In the field of semi-steel radial tires, Pulin Chengshan creates a new generation of high-performance tires and new energy tires. Representative products include the first urban SUV tire in the Chengshan Huayue series — “Huayue SUV”, the first ultra-high performance tire “Huaren PLUS”, and the new energy tires — PRINX “XLAB EV” and “XNET EV”, which have received high praise from customers. The launch of the Pulin and Naruyama series of North American 4S products, European Chengshan 4S Van products, and a full range of new Chengshan winter tire products in the international market have further enriched the seasonal product line of Half Steel, reflecting the strategic management and flexible response capabilities of Pulin Chengshan.

Second, on the channel side, Purin Chengshan empowers sales through innovative business models and digitalization. Currently, there are 6,915 stores at Dengta e Station, with a cumulative contribution of about 65% of the total sales volume of domestic commercial vehicle tire replacement channels, an increase of 8 percentage points over the previous year. Through digital transformation, stores have improved their comprehensive operation capabilities. At the same time, Urabayashi Naruyama continued to optimize the “Koura Cloud Store” and “Koura Manager” system functions, and launched “Koura Takara 2.0” to provide passenger car customers with a “tire care five-part series”, including bulk/crash claims, a 799-day extended warranty period, free lifetime tire repair, trade-in and repurchase tires, and a worry-free five-year warranty to enable the passenger car replacement tire business.

In the first half of the year, Pulin Naruyama developed 37 overseas distributors and launched a Secondary Supply project in the US market to increase the sales coverage of second-level dealers, including retailers, across the US through first-level dealer warehouse resources.

Finally, on the production capacity side, the semi-steel radial production line at the Shandong tire production base in Chengshan, Pulin completed capacity optimization and upgrading in the second quarter of this year; at the same time, production capacity of the Phase III project (2 million semi-steel radial tires per year) of the Thai tire production base continued to be released and is expected to reach production in the fourth quarter of this year, which lays a solid foundation for the company's future production capacity growth.

Therefore, under the influence of multiple positive factors such as innovative products, sales channels, and production capacity reserves, Pulin Chengshan will also have the strength to continuously unleash growth momentum in the passenger car and commercial vehicle markets.

Profit quality continues to rise, global tire consumer demand remains strong

In the first half of 2024, Pulin Chengshan's profit indicators were further improved compared to the same period last year, including EBITDA profit margin of 22.3%, gross profit margin of 24.6%, net profit margin of 15.1%, and half-year ROE of 14.1%.

Looking ahead to the subsequent performance of the market, the latest forecast data shows that retail sales of new energy vehicles are expected to reach about 0.98 million units in August, a sharp increase of 36.6% year over year and up to 11.6% month on month. Driven by multiple factors such as policy support, technological progress and market demand, the NEV market is showing a rapid development trend. In addition, by the end of June, the number of motor vehicles in the country reached 0.44 billion, which is in response to the potentially huge demand for tire replacement.

The domestic commercial vehicle market is still under heavy pressure, as evidenced by insufficient growth momentum and inventory backlog. However, many parties have given more optimistic expectations for the whole year, and the industry will show a restorative growth trend. Industry insiders pointed out that after 3 years of cyclical adjustments, the commercial vehicle market will stabilize in 2024 and is expected to grow by around 5%. With the implementation of favorable policies such as trade-in, it provides strong support for the growth of commercial vehicle sales and drives a recovery in demand for tire accessories.

Meanwhile, demand for tire consumption in overseas markets is expected to continue to be strong. In fact, since 2024, the number of tires imported into the US market from China and the three Southeast Asian countries increased 38% year on year. Compared with the 28% growth rate in 2023, the US import market returned to the normal inventory replenishment stage in early 2023. Furthermore, Europe continues to show steady growth in replacement demand.

(U.S. passenger car tire demand and import share, unit: 10,000 pieces,%)

Furthermore, the prices of raw materials for tires did not fluctuate much in the first half of the year. However, the prices of rubber and carbon black are currently showing signs of rising. The agency predicts that the long-term price center of natural rubber is expected to rise. Prices in the carbon black market will rise narrowly in the early stages and then decline after stabilizing later. However, for Pulin Chengshan, with product premiums and product structure optimization, it gradually gained more share in the middle and high-end market, and was less affected by the cost side.

(Left: tire raw material price index, early 2016 = 100; right: tire raw material price, unit: yuan/ton)

(July tire raw material price index, source: Cinda Securities)

In summary, the external environment has had more positive effects on Chinese tire manufacturers this year. Pulin Chengshan currently has two major manufacturing bases in China and Thailand. Its subsidiaries include Pulin, Chengshan, Aotong, and Fushen to form a multi-brand matrix. They have a competitive advantage in the industry, and product sales have increased, further unleashing scale effects. As can be seen, the logic of increasing the scale and profitability of Pulin Chengshan's business is quite smooth, and it is expected that the good results of the past will continue in the future.

summed

Being in the current macro environment, investors have excellent defensive advantages with good fundamentals and the ability to pay dividends continuously. Long-term capital is very favored by this type of asset. Many institutions, such as CICC and CITIC Construction Investment, have published research reports, and they are optimistic that the above investment strategies are still relatively superior.

From 201-2023, Pulin Chengshan's revenue CAGR was 15.5%, and the net profit CAGR attributable to shareholders was 21.12%. The performance showed significant growth. In terms of dividends, the annual dividend rate is expected to reach 5%-6%.

As the world's leading tire manufacturer, Purin Naruyama has achieved high-quality performance growth through a multi-dimensional layout at the product and market levels. At the same time, since its listing, Pulin Chengshan has continued to bring returns and value to shareholders and investors with annual profits and annual dividends. The reason behind this also stems from the motivation provided by performance. Continued growth in performance combined with continuous dividends, Pulin Chengshan already has the dual advantages of high dividends and high growth.

(Photo: Comparing the profitability of Pulin Chengshan and eight comparable companies in the first half of 2024)

From the perspective of long-term investors, eight tire companies were selected as comparable companies. Pulin Chengshan had a market capitalization of HK$5.227 billion. In the first half of the year, ROE ranked first, gross margin and net margin ranked second, and EBITDA ranked third. The data performance is superior to that of peers, showing that Pulin Chengshan has strong profitability and market competitiveness.

(Picture: Comparison of PE and PB between Narayama and 8 comparable companies)

Further comparing the PE and PB performance of eight comparable companies, Pulin Chengshan's intrinsic value is likely to be underestimated, making the allocation more attractive to investors. Therefore, based on Pulin Chengshan's clear strategic plan for the future, the company has a relatively reliable margin of safety and may be able to achieve profitability that exceeds expectations, bringing more value and return to investors.

中国制造业出海成为大势所趋,2023年,在泰国吸引的外商直接投资6632.39亿泰铢,其中中国占20%,为泰国最大的投资来源国。分行业来看,新能源汽车总金额822亿泰铢,占比12.39%。中国轮胎企业亦是制造业出海的核心力量。

中国制造业出海成为大势所趋,2023年,在泰国吸引的外商直接投资6632.39亿泰铢,其中中国占20%,为泰国最大的投资来源国。分行业来看,新能源汽车总金额822亿泰铢,占比12.39%。中国轮胎企业亦是制造业出海的核心力量。