Recently, China Reinsurance (1508.HK) held its mid-year performance conference for 2024. The attendees of this meeting include: China Reinsurance CEO Zhuang Qianzhi, China Reinsurance Vice President and Secretary of the Board Zhu Xiaoyun, China Reinsurance Assistant CEO, Chief Actuary, and China Re Life Insurance General Manager Tian Meipan, China Re Property Insurance General Manager Wang Zhongyao, China Continent Property & Casualty Insurance President Li Xiaomin, and China Re Asset General Manager Li Wei.

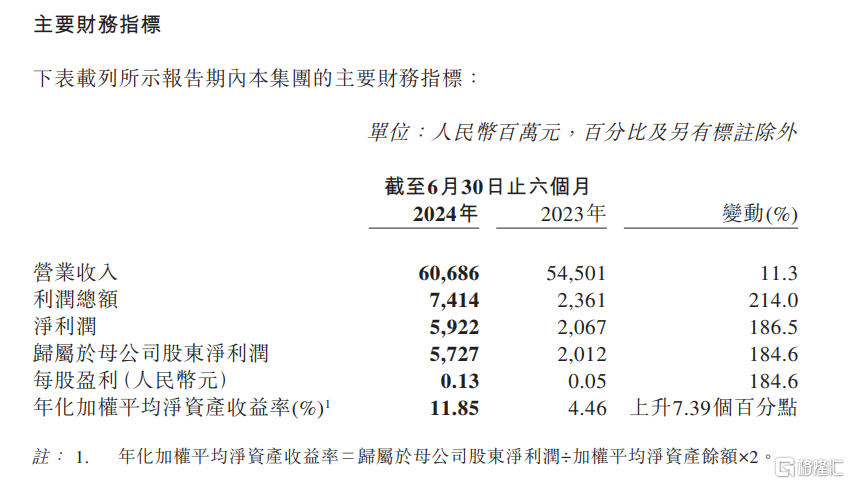

1. Overview of core performance data for the first half of 2024

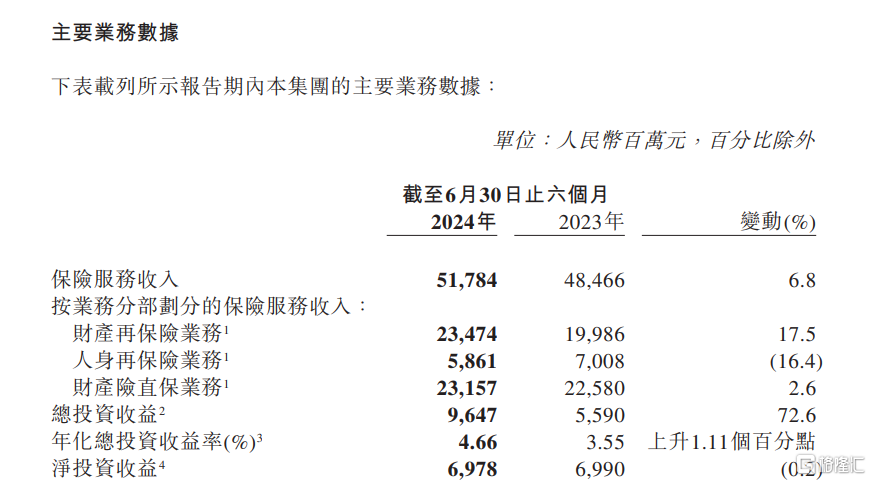

In the first half of the year, China Reinsurance achieved outstanding results in the complex domestic and international economic environment, demonstrating strong financial performance. Looking at the core financial indicators, the company's consolidated insurance service revenue reached 51.784 billion yuan, a year-on-year increase of 6.8%; net profit attributable to the parent company's shareholders reached 5.727 billion yuan, a significant year-on-year increase of 184.6%; the annualized return on equity (ROE) reached 11.85%, an increase of 7.39 percentage points compared to the same period last year, further enhancing profitability.

2. Dual improvement in underwriting performance and investment performance

2. Dual improvement in underwriting performance and investment performance

The company's overall operating performance has improved comprehensively in the first half of the year, benefiting from a significant improvement in underwriting performance and a further increase in investment income, optimizing the profit structure. In terms of insurance business, the company achieved a record high underwriting profit. The latest financial report data shows that the company's consolidated underwriting profit in the first half of the year continued to improve on the basis of reaching a record high last year, with a year-on-year increase of over 30%, and all insurance business sectors achieved underwriting profitability.

Among them, the comprehensive cost ratio of domestic and overseas property reinsurance remained stable at 99.64% and 89.09% respectively; the comprehensive cost ratio of life reinsurance's protection-type business decreased by 0.75 percentage points to 96.60% year-on-year; the comprehensive cost ratio of property direct insurance business also decreased by 1 percentage point to 99.86% year-on-year.

In the field of investment, China Reinsurance has always adhered to a prudent and cautious investment philosophy, and investment income has increased significantly. The latest financial report data shows that in the first half of the year, the company's total investment income soared to 9.647 billion yuan, achieving a growth rate of 72.6% compared to the same period last year; the annualized total investment return rate of the company rose to 4.66%, an increase of 1.11 percentage points compared to the same period last year. In terms of stock investment, the comprehensive investment return rate of domestic stocks exceeded the CSI 300 Index benchmark by more than 1600 basis points, and the comprehensive investment return rate of overseas stocks exceeded the Hang Seng Index benchmark by more than 800 basis points, showing significant excess returns.

The following is a partial record of the Q&A session between market investors and the management of this earnings conference.

Q1: What are the reasons for the significant increase in the company's operating performance and net profit in the first half of 2024? What are the prospects for the profit performance of the full year under the new regulations?

A1: In the first half of 2024, the company adhered to the operating philosophy of 'developing on a scale, underwriting for increased efficiency, and stable and prudent investment'. Both underwriting and investment were coordinated to achieve a significant increase in net income attributable to shareholders. In the second half of the year, the company still faces uncertainties such as extreme catastrophes and volatility in the capital markets. The company will strive to fully achieve its annual operational objectives, enhance the quality and effectiveness of serving national strategies, highlight strategic leadership and reform and innovation, enhance risk control and compliance levels comprehensively, and strive to create sustainable and stable investment returns for shareholders.

Q2: How does the company deal with the catastrophic risks brought by global climate change?

A2: The company closely monitors market trends, further refines the management of accumulated catastrophe risks, fully considers the impact factors of climate change trends in business strategies and pricing, strengthens risk management and control in underwriting conditions and clause management through technical means, and makes arrangements for reinsurance.

Q3: Is the international reinsurance market still in a hard cycle? What are the company's plans for Bridge Insurance?

A3: Overall, the supply and demand in the market are currently in a balanced state. If there are no particularly significant losses that affect the market during the year, it is expected that major reinsurance lines will be at the end of the hard market cycle. As for the planning of Bridge Insurance, the company will provide long-term support for its development and support its operations in various aspects through an international governance authorization system. Bridge Insurance will actively respond to new market cycle changes and formulate better development plans to cope with market changes based on past successful experiences.

Q4: In a low interest rate environment, what is the company's asset allocation strategy?

A4: Faced with the trend of low interest rates, the company adheres to the concept of long-term investment, value investment, emphasizes prudence, emphasizes risk control, emphasizes seizing opportunities with relative certainty, and focuses on promoting the construction of an integrated domestic and overseas, cross-market diversified allocation investment system to enhance portfolio resilience with diversified strategies. In the face of market fluctuations and challenges, the company aims to navigate through cycles as much as possible, achieve stable and sustainable investment returns, in order to better support and ensure the development of insurance and reinsurance core business.

Q5: What are the company's thoughts on innovation for protection-type business products in the future?

A5: For the innovation of protection-type business products, the company fully utilizes the advantages of data, product development, and industrial integration to develop protection-type business. It will enhance pricing competitiveness and risk prediction accuracy through data advantages, develop new products to meet market demand, and improve competitiveness by integrating resources such as medical insurance, medical care, and pharmaceuticals.

Q6: How did Da Di Insurance achieve underwriting profits in the first half of the year?

A6: Da Di Insurance achieved underwriting profits in the first half of the year, mainly benefiting from the company's efforts in professional management and refined operations in recent years. Specific measures include strengthening budget assessment guidance, enhancing business structure adjustments, and deepening quality and efficiency improvement management. As of the first half of 2024, the company's comprehensive cost ratio trend continues to improve. At present, the company is confident and capable of achieving its annual operating targets.