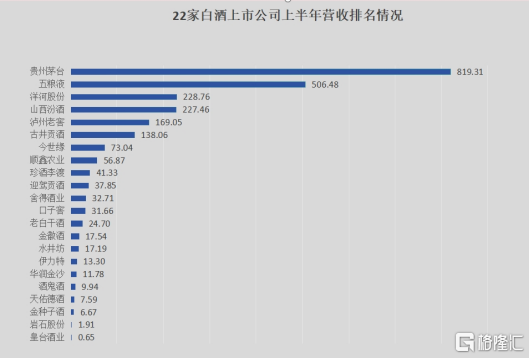

Recently, with the disclosure of the mid-term performance of the 22 listed baijiu companies in the "A+H" share market in 2024, the baijiu industry has ushered in an annual feast.

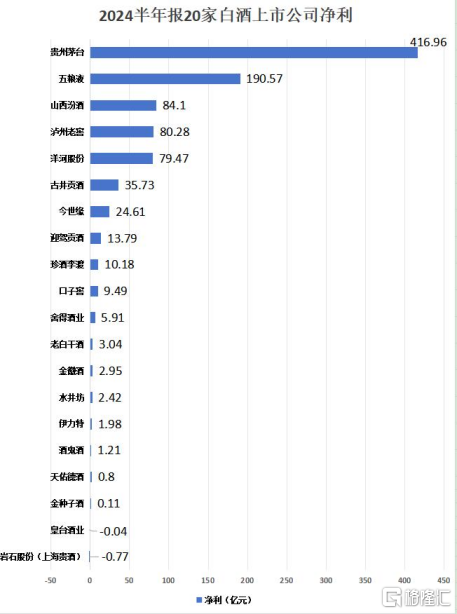

The data shows that the 22 liquor companies generated revenue of 246.396 billion yuan in the first half of the year, a year-on-year growth of 13.21%, and a net profit of 96.279 billion yuan, a year-on-year growth of 13.82%. Overall, although the revenue and net profit of the 22 liquor companies have grown year-on-year, there is a further polarization within the industry. Top liquor companies and well-known brands have shown strong adaptability in response to industry adjustments, while brands lacking in strength are gradually falling behind.

Among them, Zhenjiu Lidu (6979.HK) stood out from the crowd with outstanding performance, with a year-on-year revenue growth of 17.5% and an adjusted net profit growth of 26.9%, demonstrating not only its strong driving force as a "growth stock", but also its profound value as a "value stock".

The characteristics of "growth stocks" are significant, combining high growth and potential.

The characteristics of "growth stocks" are significant, combining high growth and potential.

In the investment community, growth stocks are always eye-catching. They often have high growth potential, continuously break through themselves, expand market share through proactive market positioning, and maintain strong competitiveness.

The data shows that in the first half of the year, out of the 22 listed baijiu companies, 5 had a year-on-year decline in revenue, and 5 had a year-on-year decline in net profit. Only 11 companies achieved double-digit growth in revenue and adjusted net profit, and Zhenjiu Lidu is one of them.

Caption: Shunxin Agriculture and CR Jingsha have not disclosed the net profit of the baijiu sector.

Specifically, Zhenjiu Lidu's revenue ranks 9th among the listed baijiu companies in China, with revenue growth ranking 7th; after adjusted, the net profit ranks 9th, with growth ranking 4th. In addition, Zhenjiu Lidu's gross margin is 58.8% (calculated under A-share accounting standards as 75.5%), and the adjusted net margin is 24.6%, with increases of 0.9% and 1.8% respectively compared to the same period last year, showing continued enhanced profitability and significant growth potential.

Caption: Some baijiu companies have missing data for 2023.

Looking at the data from 2020 to 2023, Zhenjiu Lidu's compound annual growth rate of revenue is 43.1%, and the adjusted net income has a compound annual growth rate of 46.1%, both higher than the industry average level.

Industry observers pointed out that in the context of the overall slowdown in the industry, Zhenjiu Lidu's ability to maintain high-speed growth is not easy, and is also related to its helmsman Wu Xiangdong's rich industry experience.

It is reported that Wu Xiangdong, as an industry veteran, has a firm grasp of both the production and distribution channels, can accurately grasp market trends, and quickly make strategic adjustments. In the first half of the year, Zhenjiu Lidu was able to thrive despite the challenges, by upgrading the "dual-channel" strategy and experiential marketing, optimizing the distribution network and product portfolio, and continuously improving the product, channel, and experiential attractiveness, accelerating market expansion against the trend.

The above-mentioned industry observers stated that the strong resilience and robust performance of Zhenjiu Lidu's operations, whether based on its endogenous advantages or the overall challenging market environment, are consistent with the growth logic of growth stocks.

Value stocks have deep background and are still underestimated by the market.

The high performance of Zhenjiu Laidu has attracted industry attention. However, the charm of Zhenjiu Laidu goes beyond this and also has the characteristics of "value stock".

Value stocks generally refer to companies with relatively mature markets and products, and have formed a certain competitive position, but due to macroeconomic factors or changes in market sentiment, their stock prices are undervalued.

Zhenjiu Laidu has three subsidiaries.

As the only listed liquor company in the industry in the past 8 years, Zhenjiu Laidu has four major brands: Zhenjiu, Lidu, Xiangjiao, and Kaikou Smiling. The product matrix covers all price ranges. In 2023, the revenue reached 7.03 billion yuan, making it the third largest private liquor company in China and the ninth largest listed liquor company in China.

In the first half of this year, Zhenjiu Laidu continued to maintain significant growth in high base, significantly improved cash flow, maintained positive growth in advance payments, and continuously improved its competitiveness, further enhancing its industry leadership.

According to the financial report, Zhenjiu Laidu's net cash flow from operating activities reached nearly 0.575 billion yuan, a year-on-year increase of 166%, driving the end-of-period balance of cash and cash equivalents to increase to 6.01 billion yuan. At the same time, the balance of advance payments exceeded 1.79 billion yuan, continuing to grow positively compared to 1.777 billion yuan in the same period last year.

This series of data changes not only demonstrates the excellent financial health of Zhenjiu Lidu, but also reflects its strong competitiveness and attractiveness in the market.

After high growth, Zhenjiu Lidu is still undervalued. Currently, the average PE ratio of A-share liquor companies is around 16 times, while the PE ratio of Zhenjiu Lidu is only 11 times.

Partial product images of Zhenjiu Lidu

In the view of the internationally renowned investment bank Morgan Stanley, Zhenjiu Lidu is undoubtedly a highly valuable investment gem. On August 14th, it first gave Zhenjiu Lidu a "shareholding" rating, believing that during the industry adjustment period, Zhenjiu Lidu's advantages are obvious, predicting a compound annual revenue growth rate of 17% from 2023 to 2025, and a profit compound annual growth rate of 18%, with the potential to reach a market size of 20 billion yuan in the future.

Choice data also shows that after the mid-term performance release of Zhenjiu Lidu, 20 well-known brokerages such as China Securities Co., Ltd., Sinolink Securities, China Merchants Securities, Huachuang Securities, gtja, and Founder Securities all believe that Zhenjiu Lidu's mid-term performance meets expectations, and have given positive ratings such as shareholding and buy rating.

Many investors are curious about why Zhenjiu Lidu can embody both the characteristics of a "growth stock" and a "value stock", which can be traced back to Zhenjiu Lidu's long-termism.

In recent years, Zhenjiu Lidu has always focused on key elements such as production capacity, brand, channels, and team, continuously strengthened and enhanced its competitive advantage. While maintaining high-speed growth, it also focuses on risk control and value creation, ensuring the sustainability and stability of performance.

This core advantage is the moat for the sustainable development of Zhenjiu Lidu and also the solid foundation for resilient growth. It is the strong engine for its future breakthroughs.

Currently, in the face of macro changes and new industry dynamics, many enterprises are exploring viable paths for high-quality growth. Zhenjiu Lidu, with the characteristics of both growth stocks and value stocks, has just provided a beneficial benchmark for the healthy development of the industry.