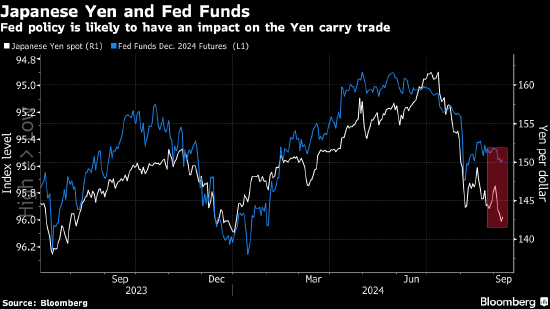

JPMorgan strategist Michael Wilson believes that if the Federal Reserve cuts interest rates significantly this month, the US stock market may face the risk of further unwinding of yen carry trade.

Wilson, who was still one of Wall Street's largest stock market bears until May of this year, pointed out that if the initial rate cut exceeds 25 basis points, it may support the yen. This will prompt yen traders to withdraw from US assets after domestic interest rates rise, causing a repeat of the pattern that led to global market turbulence last month.

"The unwinding of yen carry trades may still be a hidden risk factor," Wilson wrote in a report. "The rapid decline in US short-term interest rates may further strengthen the yen, thereby eliciting a negative reaction from US risk assets."

Due to increasing concerns about a hard landing of the US economy, US stocks have fallen since mid-July. The yen has also soared after the Bank of Japan raised interest rates in July, resulting in the unwinding of carry trades worth billions of dollars.

Due to increasing concerns about a hard landing of the US economy, US stocks have fallen since mid-July. The yen has also soared after the Bank of Japan raised interest rates in July, resulting in the unwinding of carry trades worth billions of dollars.

Shortly thereafter, JPMorgan strategists stated that three-quarters of the carry trades had been unwound.

Due to data showing a cooling labor market in the US, the benchmark S&P 500 index fell again last week. According to swap market data, traders have fully digested the scenario of the Federal Reserve cutting interest rates by more than 100 basis points before the end of the year.

由于对美国经济硬着陆的担忧日益升温,美股自7月中旬以来回落。日元也在日本央行7月加息后飙升,使得价值数十亿美元的套利交易平仓。

由于对美国经济硬着陆的担忧日益升温,美股自7月中旬以来回落。日元也在日本央行7月加息后飙升,使得价值数十亿美元的套利交易平仓。