Check Out What Whales Are Doing With NFLX

Check Out What Whales Are Doing With NFLX

Financial giants have made a conspicuous bullish move on Netflix. Our analysis of options history for Netflix (NASDAQ:NFLX) revealed 9 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $195,485, and 7 were calls, valued at $433,004.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $400.0 to $750.0 for Netflix over the recent three months.

Analyzing Volume & Open Interest

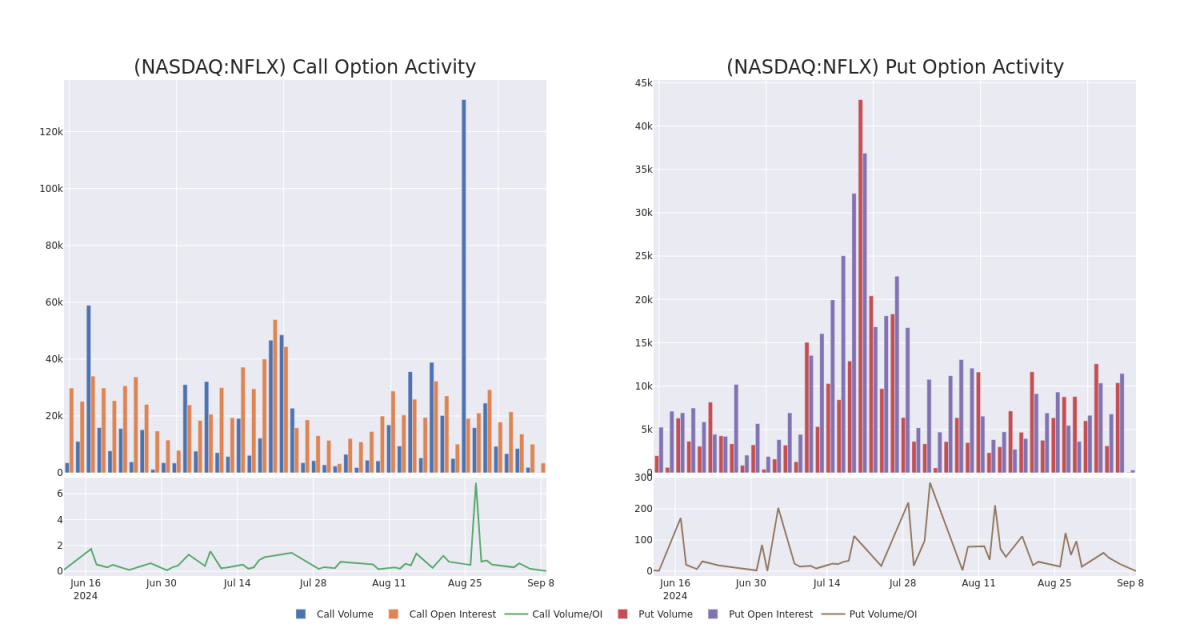

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Netflix's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Netflix's whale trades within a strike price range from $400.0 to $750.0 in the last 30 days.

Netflix Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFLX | PUT | SWEEP | BEARISH | 10/18/24 | $32.6 | $29.95 | $31.96 | $675.00 | $159.7K | 286 | 50 |

| NFLX | CALL | SWEEP | BEARISH | 09/20/24 | $12.85 | $12.5 | $12.55 | $685.00 | $112.6K | 1.0K | 17 |

| NFLX | CALL | TRADE | BULLISH | 12/20/24 | $88.45 | $84.1 | $87.0 | $625.00 | $87.0K | 98 | 20 |

| NFLX | CALL | TRADE | BULLISH | 12/20/24 | $86.0 | $83.85 | $86.0 | $625.00 | $77.4K | 98 | 10 |

| NFLX | CALL | SWEEP | BULLISH | 01/17/25 | $33.7 | $32.6 | $33.7 | $750.00 | $67.3K | 1.7K | 21 |

About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 275 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

In light of the recent options history for Netflix, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Netflix

- With a volume of 60,448, the price of NFLX is up 1.18% at $673.6.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 37 days.

Professional Analyst Ratings for Netflix

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $825.0.

- Consistent in their evaluation, an analyst from Pivotal Research keeps a Buy rating on Netflix with a target price of $900.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Netflix, targeting a price of $750.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Netflix with Benzinga Pro for real-time alerts.