Advanced Micro Devices's Options: A Look at What the Big Money Is Thinking

Advanced Micro Devices's Options: A Look at What the Big Money Is Thinking

Deep-pocketed investors have adopted a bullish approach towards Advanced Micro Devices (NASDAQ:AMD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMD usually suggests something big is about to happen.

資深投資者相對美國超微公司(NASDAQ:AMD)採取看好的態度,這是市場人士不應忽視的。Benzinga公共期權記錄的跟蹤今天揭示了這個重要的行動。這些投資者的身份尚不可知,但AMD的如此重大舉措通常意味着重大事件即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Advanced Micro Devices. This level of activity is out of the ordinary.

我們從今天的觀察中獲取了這些信息,當貝寧格的期權掃描器突出了美國超微公司的13個非同尋常的期權交易。這種活躍程度是不尋常的。

The general mood among these heavyweight investors is divided, with 23% leaning bullish and 23% bearish. Among these notable options, 4 are puts, totaling $159,069, and 9 are calls, amounting to $615,969.

這些重量級投資者的總體情緒是分歧的,有23%看好,23%看淡。在這些值得注意的期權中,有4個看跌,總額爲159,069美元,9個看漲,總額爲615,969美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $160.0 for Advanced Micro Devices during the past quarter.

通過分析這些合同的成交量和持倉量,似乎大戶們在過去一個季度裏一直密切關注美國超微公司在95.0美元至160.0美元的價格區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

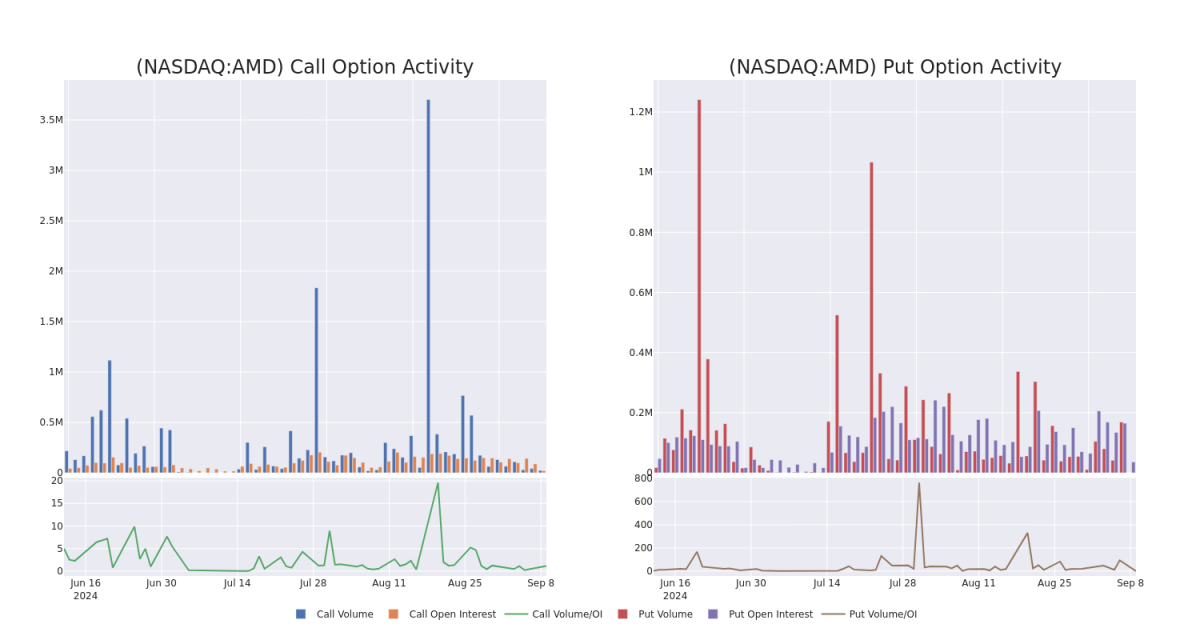

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Advanced Micro Devices's options for a given strike price.

這些數據可以幫助您跟蹤Advanced Micro Devices的某個行權價格的期權的流動性和關注度。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Advanced Micro Devices's whale activity within a strike price range from $95.0 to $160.0 in the last 30 days.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Advanced Micro Devices's whale activity within a strike price range from $95.0 to $160.0 in the last 30 days.

Advanced Micro Devices 30-Day Option Volume & Interest Snapshot

美國超微公司30天期權成交量和興趣快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | SWEEP | NEUTRAL | 09/13/24 | $1.89 | $1.86 | $1.88 | $140.00 | $211.4K | 6.9K | 1.9K |

| AMD | CALL | TRADE | BEARISH | 01/17/25 | $8.5 | $8.4 | $8.43 | $160.00 | $84.3K | 12.3K | 119 |

| AMD | CALL | SWEEP | NEUTRAL | 09/13/24 | $2.14 | $2.13 | $2.13 | $140.00 | $69.2K | 6.9K | 4.5K |

| AMD | PUT | SWEEP | NEUTRAL | 12/20/24 | $3.5 | $3.25 | $3.5 | $105.00 | $54.5K | 18.2K | 174 |

| AMD | CALL | SWEEP | BULLISH | 09/13/24 | $1.84 | $1.81 | $1.82 | $141.00 | $53.0K | 1.5K | 700 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD (納斯達克:AMD) | 看漲 | SWEEP | 中立 | 09/13/24 | $1.89 | $1.86 | $1.88 | $140.00 | $211.4K | 6.9K | 1.9K |

| AMD (納斯達克:AMD) | 看漲 | 交易 | 看淡 | 01/17/25 | $8.5 | $8.4 | $8.43 | $160.00 | $84.3K | 12.3K | 119 |

| AMD (納斯達克:AMD) | 看漲 | SWEEP | 中立 | 09/13/24 | $2.14 | $2.13 | $2.13 | $140.00 | $69.2K | 6.9K | 4.5K |

| AMD (納斯達克:AMD) | 看跌 | SWEEP | 中立 | 12/20/24 | $3.5 | $3.25 | $3.5 | $105.00 | 54.5K美元 | 18.2千 | 174 |

| AMD (納斯達克:AMD) | 看漲 | SWEEP | 看好 | 09/13/24 | $1.84 | $1.81 | $1.82 | $141.00 | 53.0千美元 | 1.5K | 700 |

About Advanced Micro Devices

關於Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

Advanced Micro Devices專門爲個人電腦、遊戲機、數據中心、工業和汽車應用等市場設計各種數字半導體。AMD傳統上擅長中央處理器(CPU)和圖形處理器(GPU)的生產,這些用於個人電腦和數據中心。此外,該公司還提供供應在索尼PlayStation和微軟Xbox等知名遊戲機中使用的芯片。在2022年,該公司收購了現場可編程門陣列(FPGA)領導者Xilinx,以多樣化其業務並增加其在數據中心和汽車等重要終端市場的機會。

Where Is Advanced Micro Devices Standing Right Now?

Advanced Micro Devices現在的表現如何?

- With a trading volume of 633,552, the price of AMD is up by 0.99%, reaching $135.68.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 50 days from now.

- AMD的交易量爲633,552,價格上漲0.99%,達到135.68美元。

- 目前的RSI值表明該股票目前處於超買和超賣之間的中立狀態。

- 下一份收益報告將在50天后發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Advanced Micro Devices with Benzinga Pro for real-time alerts.

交易期權涉及更高的風險,但也提供了更高的利潤可能性。精明的交易者通過持續教育、戰略性交易調整、利用各種因子以及保持對市場動態的敏感來減少這些風險。使用Benzinga Pro進行實時提醒,了解美國超微公司的最新期權交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $160.0 for Advanced Micro Devices during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $160.0 for Advanced Micro Devices during the past quarter.