① Yoshikami said that the Fed could cut interest rates by 50 basis points next week and noted that this move would not scare the market. ② "This can be seen as a very positive signal that the Fed is taking necessary measures to support employment growth."

Caixin News on September 9th (Editor Zhao Hao) On Monday local time (September 9th), Michael Yoshikami, founder and CEO of Destination Wealth Management in the United States, said that the Fed could cut interest rates by 50 basis points next week and pointed out that this move would not scare the market.

Yoshikami told the media that a larger interest rate cut would indicate that the Fed is ready to take action, but it does not mean that the central bank is releasing a signal of deeper concern about the recession. "If they directly cut interest rates by 50 basis points, I would not be surprised."

"This can be seen as a very positive signal that the Fed is taking necessary measures to support employment growth," he said. "I believe that the Fed is already prepared to take an earlier step to deal with this situation."

"This can be seen as a very positive signal that the Fed is taking necessary measures to support employment growth," he said. "I believe that the Fed is already prepared to take an earlier step to deal with this situation."

Yoshikami's statement echoes Nobel laureate in economics Joseph Stiglitz. Last Friday, Stiglitz said that given the previous monetary policy was tightened "too quickly and excessively", a 50 basis point adjustment should be implemented next week.

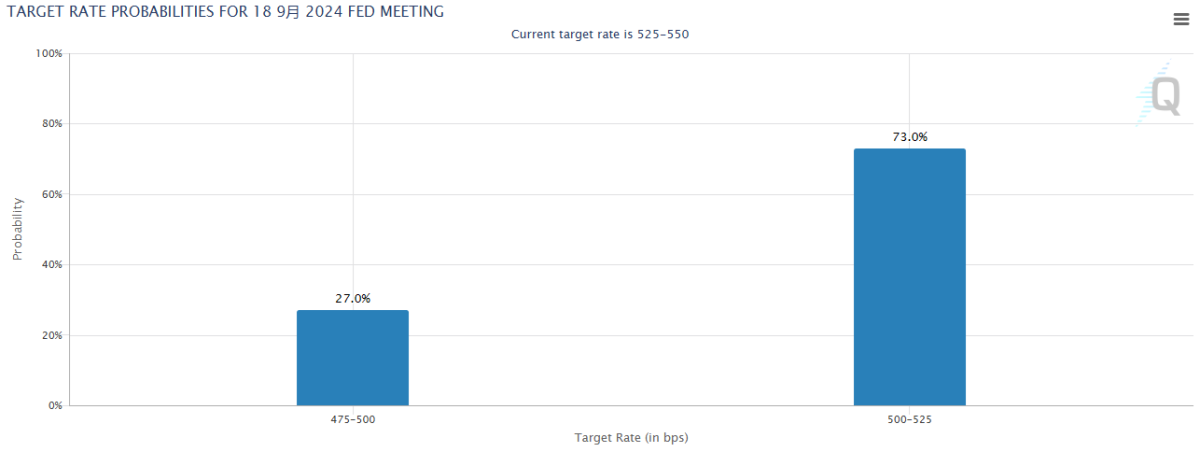

As of now, there is still a significant divide in the market regarding the extent of the interest rate cut next week. After the release of weak job data in the United States last week, the camp supporting a "50 basis point cut" was once on par with the camp supporting a "25 basis point cut", but the latter has gradually gained the upper hand.

Yoshikami admitted that a larger interest rate cut could exacerbate concerns about an impending recession, but he insisted that this view was exaggerated. He pointed out that the unemployment population and unemployment rate are still at historically low levels and corporate profits remain strong.

He said that the recent market sell-off - the worst week since March 2023 for the s&p 500 index - was due to the "huge profits" from the previous month. Despite the volatility in early August, the major indices still saw gains, while September is typically a weaker trading period.

Thanos Papasavvas, founder and chief investment officer of ABP Invest, also acknowledged that concerns about an economic downturn have "increased". The company recently raised the probability of a US economic recession from a "moderate" 25% in June to a "relatively limited" 30%.

However, Papasavvas said that the underlying factors of the economy - manufacturing and unemployment rate - still have resilience, and "we are not particularly worried about the US entering an economic recession."

Nevertheless, there are still many cautious observers in the market. George Lagarias, Chief Economist of Forvis Mazars, told the media that a significant rate cut is "very dangerous" as it could "send the wrong message to the market and the economy."

"I don't see the urgency for a 50-basis-point rate cut," said Lagarias. Instead, it could create a sense of urgency, which increases the likelihood of it becoming a reality."

“这可以被视为一个非常积极的信号,表明美联储正在采取必要措施支持就业增长,”他说道,“我认为,美联储当前已准备好,更早一步地应对这种情况。”

“这可以被视为一个非常积极的信号,表明美联储正在采取必要措施支持就业增长,”他说道,“我认为,美联储当前已准备好,更早一步地应对这种情况。”