Investors with a lot of money to spend have taken a bullish stance on SoFi Techs (NASDAQ:SOFI).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SOFI, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for SoFi Techs.

This isn't normal.

The overall sentiment of these big-money traders is split between 54% bullish and 18%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $87,640, and 10, calls, for a total amount of $442,739.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $4.0 to $10.0 for SoFi Techs over the recent three months.

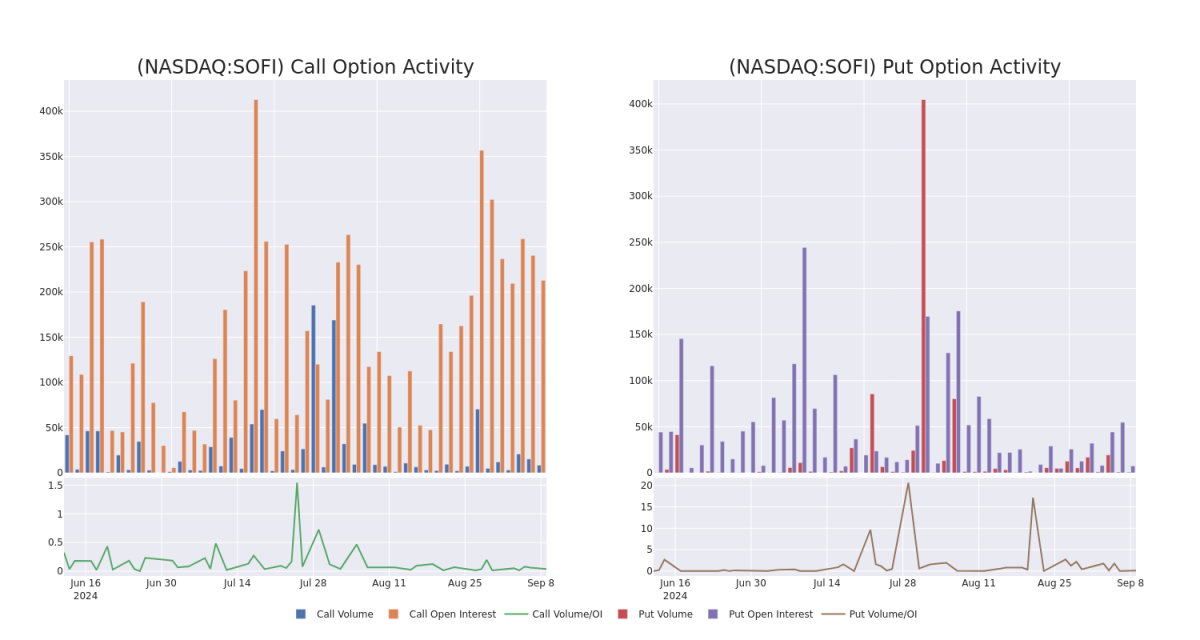

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for SoFi Techs's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across SoFi Techs's significant trades, within a strike price range of $4.0 to $10.0, over the past month.

SoFi Techs Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SOFI | PUT | SWEEP | BEARISH | 01/17/25 | $1.4 | $1.38 | $1.4 | $8.00 | $87.6K | 7.4K | 750 |

| SOFI | CALL | SWEEP | NEUTRAL | 11/15/24 | $0.47 | $0.46 | $0.46 | $8.00 | $65.7K | 21.5K | 1.9K |

| SOFI | CALL | SWEEP | BULLISH | 01/17/25 | $1.05 | $1.03 | $1.05 | $7.00 | $52.5K | 75.5K | 1.0K |

| SOFI | CALL | SWEEP | BULLISH | 01/16/26 | $2.24 | $2.19 | $2.24 | $7.00 | $44.7K | 52.9K | 881 |

| SOFI | CALL | SWEEP | BULLISH | 01/16/26 | $2.23 | $2.19 | $2.23 | $7.00 | $44.6K | 52.9K | 1.0K |

About SoFi Techs

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

In light of the recent options history for SoFi Techs, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of SoFi Techs

- With a volume of 17,913,621, the price of SOFI is up 2.14% at $7.16.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 49 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for SoFi Techs with Benzinga Pro for real-time alerts.