Deep-pocketed investors have adopted a bearish approach towards Procter & Gamble (NYSE:PG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Procter & Gamble. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 58% bearish. Among these notable options, 3 are puts, totaling $580,953, and 9 are calls, amounting to $325,538.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $165.0 and $185.0 for Procter & Gamble, spanning the last three months.

Volume & Open Interest Trends

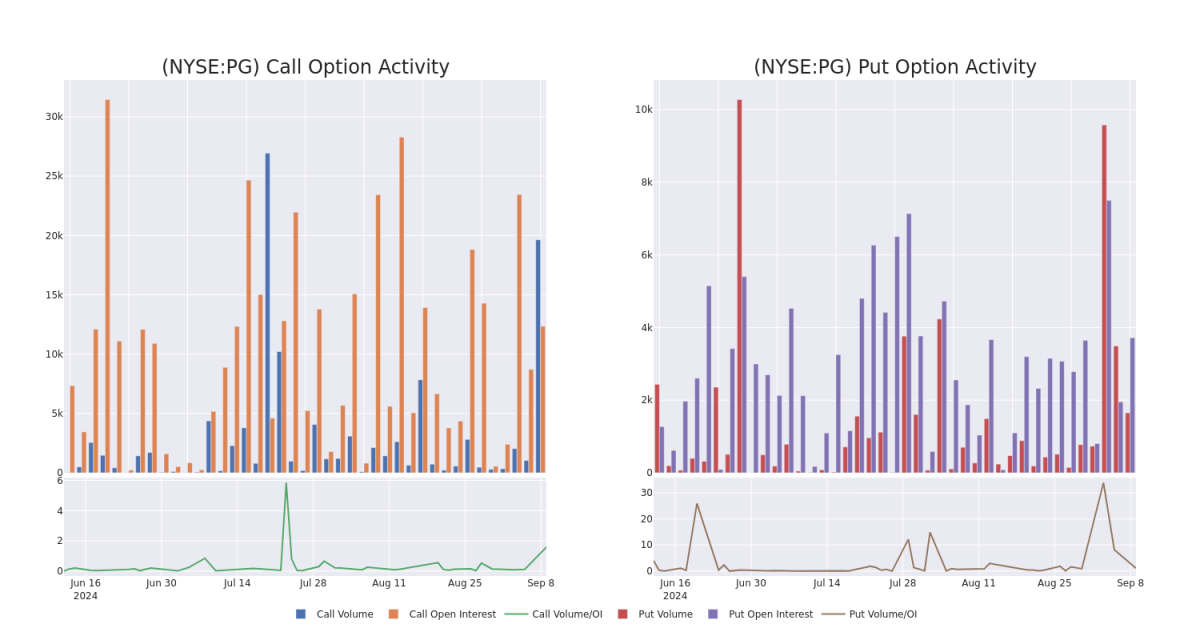

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Procter & Gamble's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Procter & Gamble's whale activity within a strike price range from $165.0 to $185.0 in the last 30 days.

Procter & Gamble Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | PUT | TRADE | BULLISH | 12/20/24 | $3.3 | $3.2 | $3.23 | $170.00 | $484.5K | 2.2K | 1.5K |

| PG | PUT | SWEEP | BULLISH | 10/04/24 | $1.9 | $1.88 | $1.89 | $175.00 | $52.9K | 98 | 32 |

| PG | CALL | SWEEP | BEARISH | 09/27/24 | $0.91 | $0.9 | $0.9 | $180.00 | $50.4K | 237 | 2.1K |

| PG | CALL | TRADE | BEARISH | 03/21/25 | $5.5 | $5.25 | $5.3 | $185.00 | $47.7K | 401 | 90 |

| PG | PUT | SWEEP | BEARISH | 03/21/25 | $3.85 | $3.8 | $3.85 | $165.00 | $43.5K | 1.3K | 117 |

About Procter & Gamble

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm's consolidated total.

Current Position of Procter & Gamble

- Trading volume stands at 2,945,814, with PG's price up by 0.26%, positioned at $176.05.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 37 days.

What Analysts Are Saying About Procter & Gamble

In the last month, 1 experts released ratings on this stock with an average target price of $190.0.

- An analyst from DZ Bank has elevated its stance to Buy, setting a new price target at $190.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.